Answered step by step

Verified Expert Solution

Question

1 Approved Answer

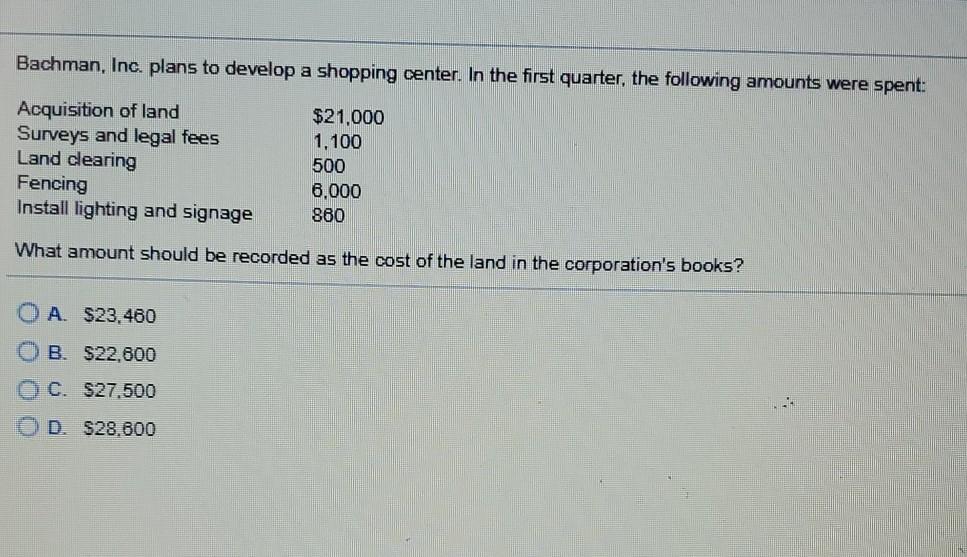

Bachman, Inc. plans to develop a shopping center. In the first quarter, the following amounts were spent: Acquisition of land Surveys and legal fees Land

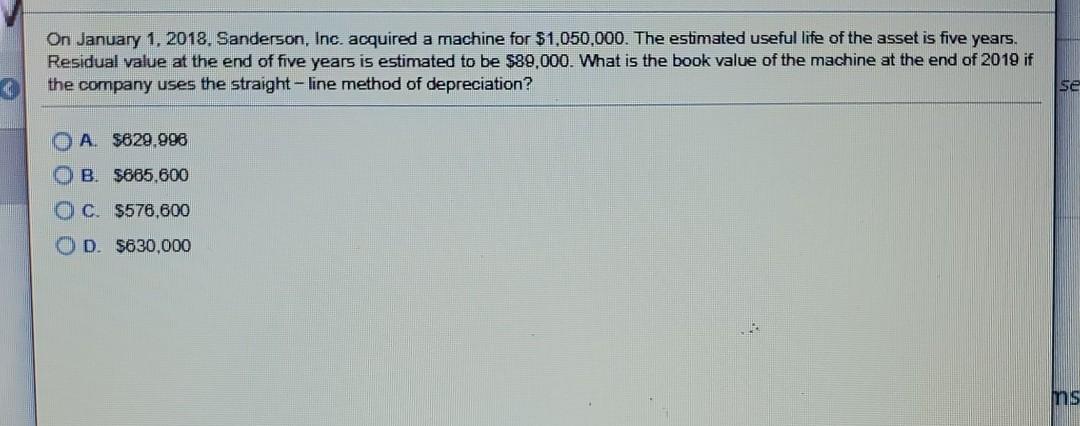

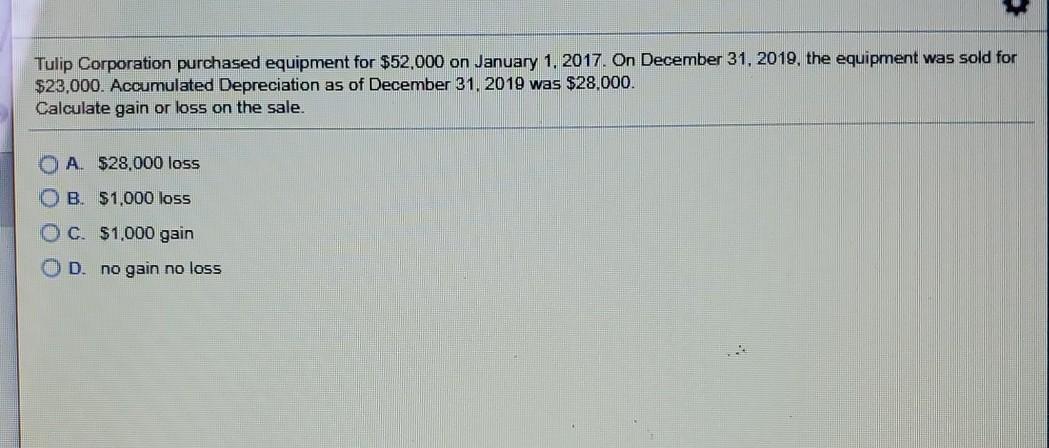

Bachman, Inc. plans to develop a shopping center. In the first quarter, the following amounts were spent: Acquisition of land Surveys and legal fees Land clearing Fencing Install lighting and signage $21,000 1.100 500 6.000 880 What amount should be recorded as the cost of the land in the corporation's books? A. $23,460 B. $22.600 C. $27.500 D. $28.800 On January 1, 2018. Sanderson, Inc. acquired a machine for $1,050,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $89.000. What is the book value of the machine at the end of 2019 if the company uses the straight-line method of depreciation? se O A $629.996 OB 5665.600 OC. $576,600 OD. $630,000 is Tulip Corporation purchased equipment for $52,000 on January 1, 2017. On December 31, 2019, the equipment was sold for $23,000. Accumulated Depreciation as of December 31, 2019 was $28.000. Calculate gain or loss on the sale. O A. $28,000 loss OB. $1,000 loss O c. $1,000 gain OD. no gain no loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started