Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Back 6 Part 2 of 3 This window shows your responses and what was marked correct and incorrect from your previous attempt. Required information

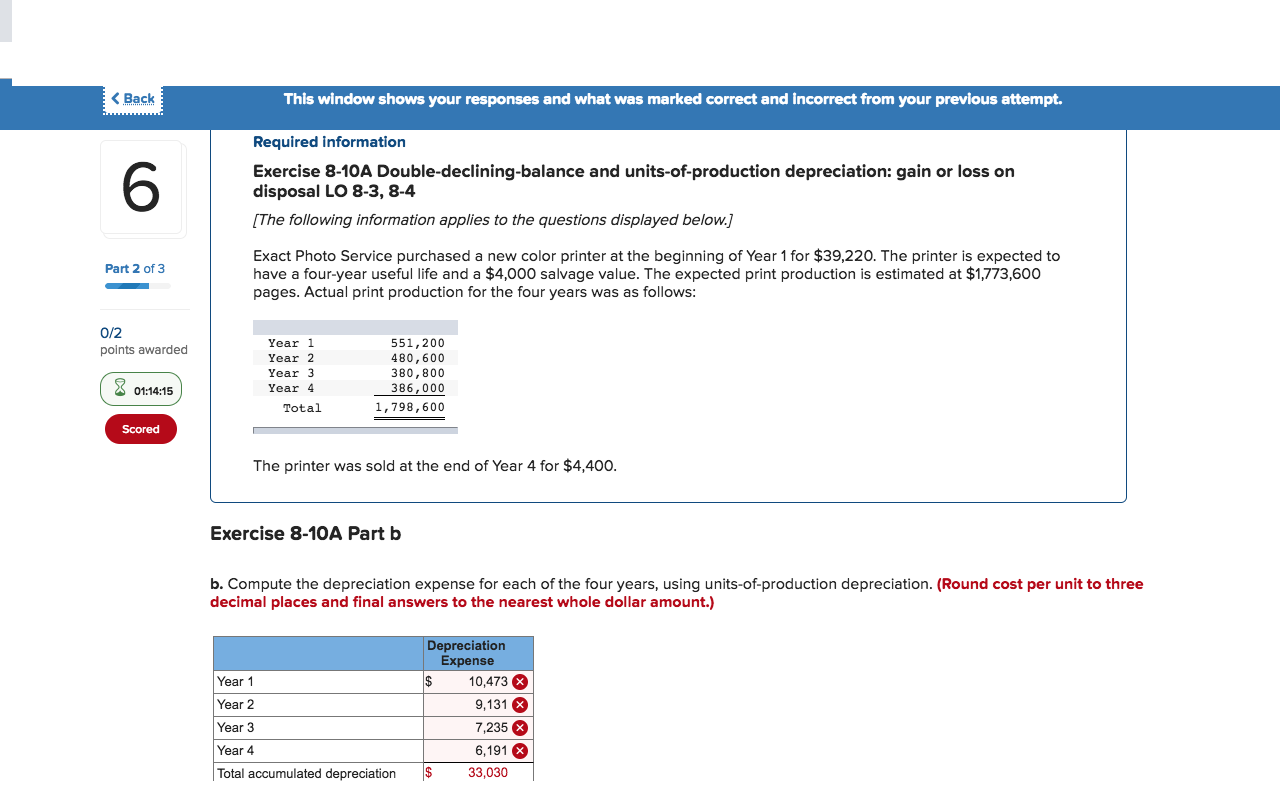

Back 6 Part 2 of 3 This window shows your responses and what was marked correct and incorrect from your previous attempt. Required information Exercise 8-10A Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 8-3, 8-4 [The following information applies to the questions displayed below.] Exact Photo Service purchased a new color printer at the beginning of Year 1 for $39,220. The printer is expected to have a four-year useful life and a $4,000 salvage value. The expected print production is estimated at $1,773,600 pages. Actual print production for the four years was as follows: 0/2 Year 1 points awarded Year 2 551,200 480,600 Year 3 380,800 01:14:15 Year 4 386,000 Total 1,798,600 Scored The printer was sold at the end of Year 4 for $4,400. Exercise 8-10A Part b b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. (Round cost per unit to three decimal places and final answers to the nearest whole dollar amount.) Depreciation Expense Year 1 $ 10,473 Year 2 9,131 Year 3 7,235 Year 4 6,191 Total accumulated depreciation 33,030

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started