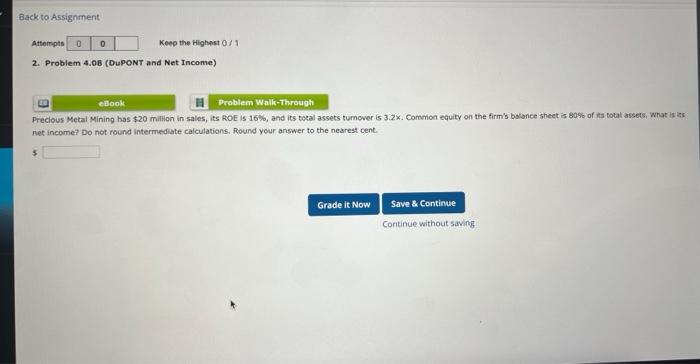

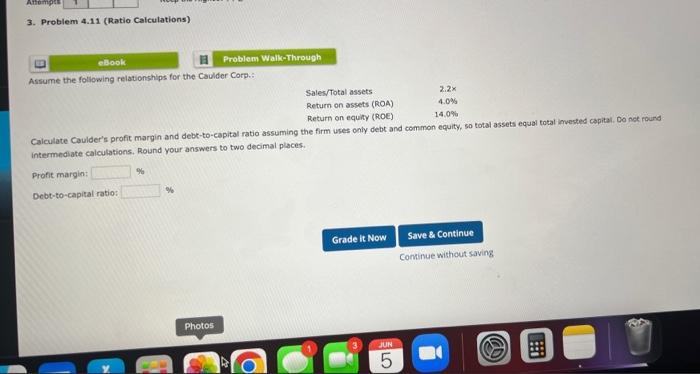

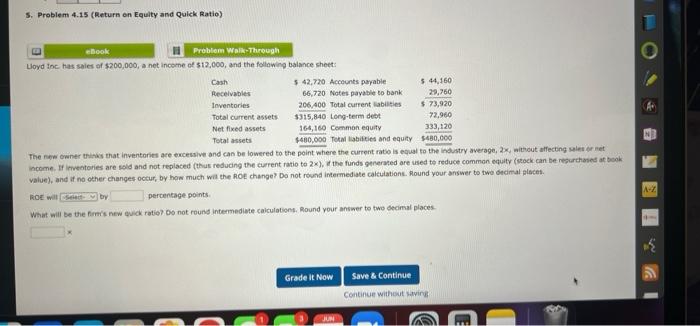

Back to Assignment Attempts 0 0 2. Problem 4.08 (DUPONT and Net Income) E eBook Problem Walk-Through Precious Metal Mining has $20 million in sales, its ROE is 16%, and its total assets turnover is 3.2x. Common equity on the firm's balance sheet is 80% of its total assets. What is its net income? Do not round intermediate calculations. Round your answer to the nearest cent. $ Grade it Now Save & Continue Continue without saving Keep the Highest 0/1 3. Problem 4.11 (Ratio Calculations) B eBook Assume the following relationships for the Caulder Corp. Sales/Total assets 2.2x 4.0% Return on assets (ROA) Return on equity (ROE) 14.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: Grade it Now Save & Continue Continue without saving Photos B Problem Walk-Through 47 O JUN 5 S. Problem 4.15 (Return on Equity and Quick Ratio) eBook Problem Walk-Through Lloyd Inc. has sales of $200,000, a net income of $12,000, and the following balance sheet: $44,160 29,760 Cash Receivables Inventories Total current assets Net fixed assets Total assets $ 42,720 Accounts payable 66,720 Notes payable to bank 206,400 Total current abilities $315,840 Long-term debt $73,920 72,960 164,160 Common equity 333,120 $480,000 Total liabilities and equity $480,000 The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2x, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 2x), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? Do not round intermediate calculations. Round your answer to two decimal places. A-Z ROE will d by percentage points. What will be the firm's new quick ratio? Do not round intermediate calculations. Round your answer to two decimal places. IN Grade it Now Save & Continue Continue without savings JUN