Question

Back to Assignment Attempts 0 0 Keep the Highest (0)/(1) 4. Domestic valuation model Consider the valuation of a purely domestic firm that does

Back to Assignment\ Attempts\ 0\ 0\ Keep the Highest

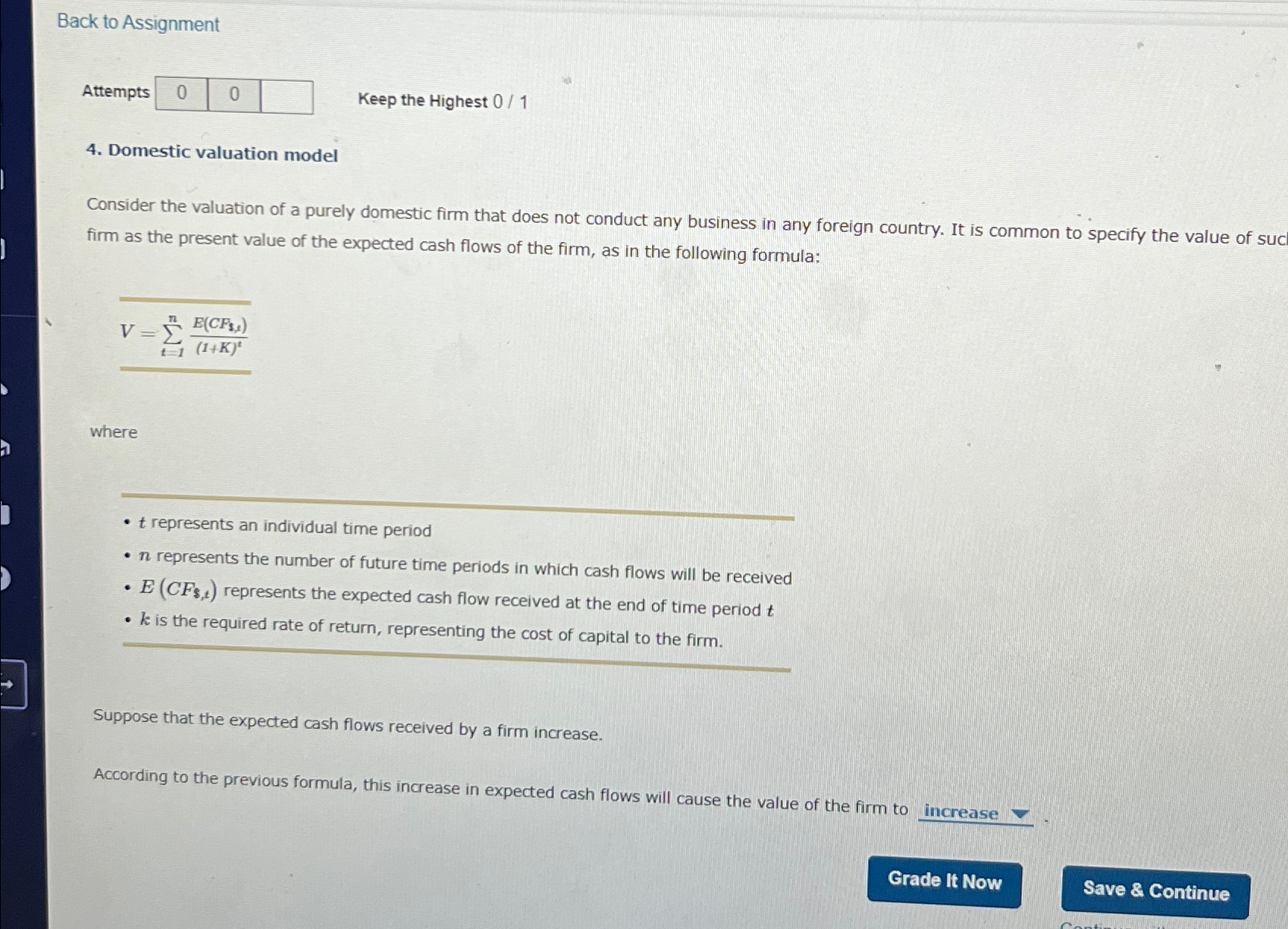

(0)/(1)\ 4. Domestic valuation model\ Consider the valuation of a purely domestic firm that does not conduct any business in any foreign country. It is common to specify the value of suc firm as the present value of the expected cash flows of the firm, as in the following formula:\

V=\\\\sum_(t=1)^n (E(CF_(3,t)))/((1+K)^(t))\ where\

trepresents an individual time period\

nrepresents the number of future time periods in which cash flows will be received\

E(CF_($,t))represents the expected cash flow received at the end of time period

t\

kis the required rate of return, representing the cost of capital to the firm.\ Suppose that the expected cash flows received by a firm increase.\ According to the previous formula, this increase in expected cash flows will cause the value of the firm to\ increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started