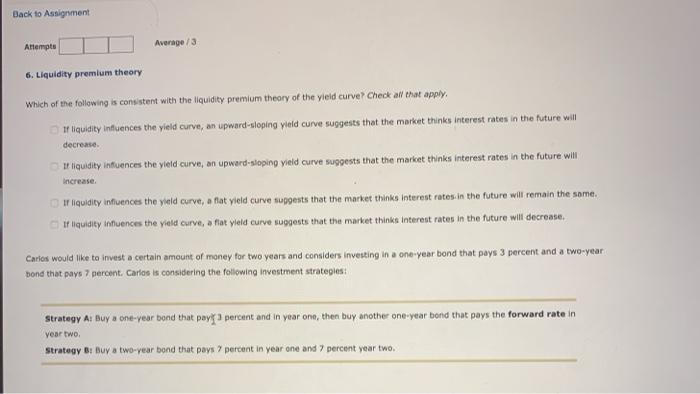

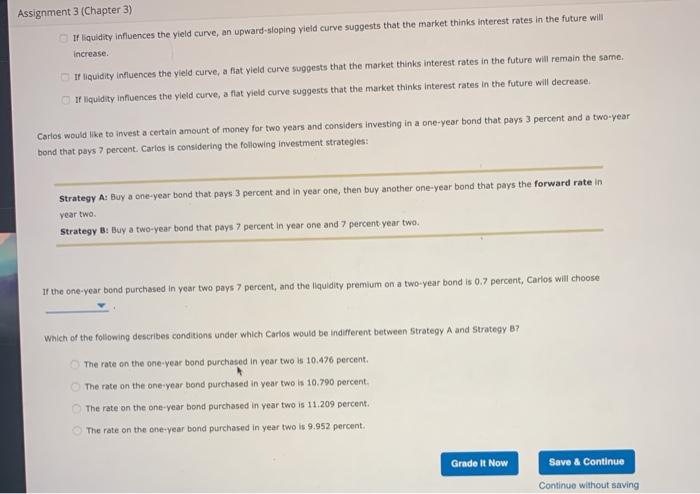

Back to Assignment Attempts Average / 6. Liquidity premium theory Which of the following is consistent with the liquidity premium theory of the yield curveCheck all that apply. If liquidity infuences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will decrease liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will Increase Il liquidity influences the yield curve, a flat yield curve suppests that the market thinks interest rates in the future will remain the same. of liquidity influences the yield curve, a flor yield curve suggests that the market thinks interest rates in the future will decrease. Carlos would like to invest a certain amount of money for two years and considers Investing in a one-year bond that pays 3 percent and a two-year bond that pays 7 percent. Carlos is considering the following investment strategies: Strategy A Buy a one-year bond that pay a percent and in year on, then buy another one-year bond that pays the forward rate in year two Strategy Bt Buy a two-year bond that pays 7 percent in year one and 7 percent year two Assignment 3 (Chapter 3) If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will Increase If liquidity influences the yield curve, a flat wield curve suggests that the market thinks interest rates in the future will remain the same If liquidity influences the yield curve, a flat yield curve suggests that the market thinks interest rates in the future will decrease Carlos would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays 3 percent and a two-year bond that pays 7 percent. Carlos is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 3 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 7 percent in year one and 7 percent year two. If the one-year bond purchased in year two pays 7 percent, and the liquidity premium on a two-year bond is 0.7 percent, Carlos will choose Which of the following describes conditions under which Carlos would be indifferent between Strategy A and Strategy B? The rate on the one year bond purchased in year two is 10.476 percent. The rate on the one year bond purchased in year two is 10.790 percent. The rate on the one-year bond purchased in year two is 11.209 percent. The rate on the one year bond purchased in year two is 9.952 percent. Grade it Now Save & Continue Continue without saving