Answered step by step

Verified Expert Solution

Question

1 Approved Answer

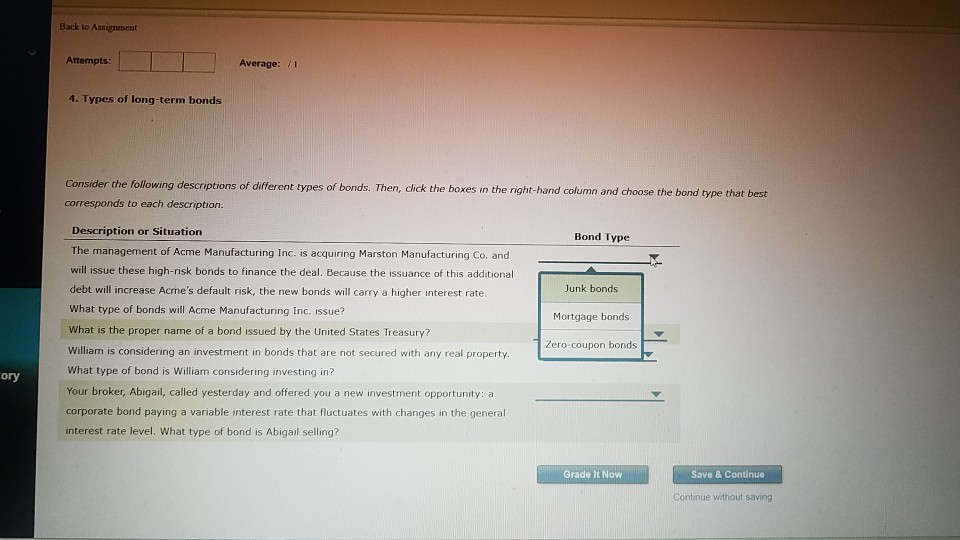

Back to Assignment Attempts: Average: 71 4. Types of long-term bonds Consider the following descriptions of different types of bonds. Then, click the boxes in

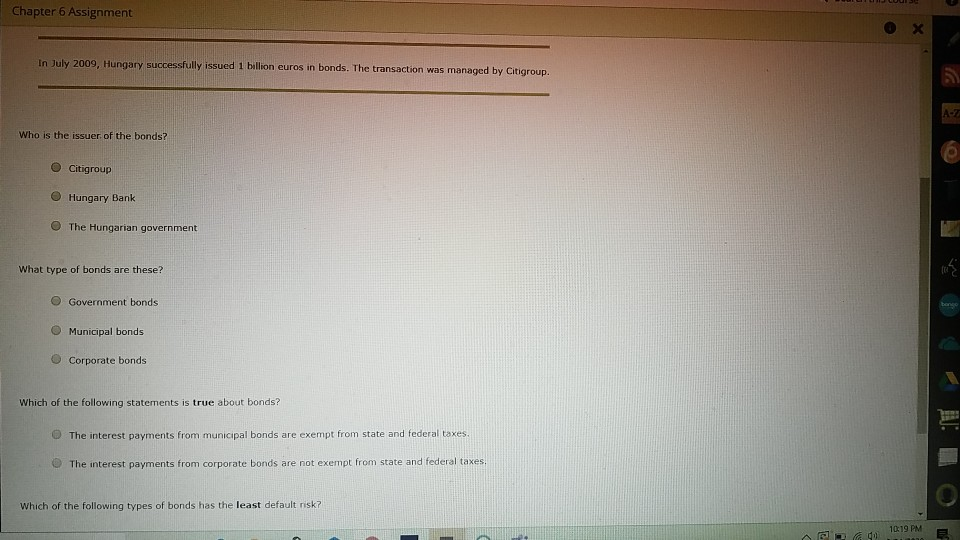

Back to Assignment Attempts: Average: 71 4. Types of long-term bonds Consider the following descriptions of different types of bonds. Then, click the boxes in the right-hand column and choose the bond type that best corresponds to each description. Description or Situation Bond Type The management of Acme Manufacturing Inc. is acquiring Marston Manufacturing Co, and will issue these high-risk bonds to finance the deal. Because the issuance of this additional debt will increase Acme's default risk, the new bonds will carry a higher interest rate. What type of bonds will Acme Manufacturing Inc. issue? Junk bonds Mortgage bonds What is the proper name of a bond issued by the United States Treasury? Zero-coupon bonds William is considering an investment in bonds that are not secured with any real property. What type of bond is William considering investing in? ory Your broker, Abigail, called yesterday and offered you a new investment opportunity: a corporate bond paying a variable interest rate that fluctuates with changes in the general interest rate level. What type of bond is Abigail selling? Grade It Now Save & Continue Continue without saving Chapter 6 Assignment In July 2009, Hungary successfully issued 1 billion euros in bonds. The transaction was managed by Citigroup Who is the issuer of the bonds? Citigroup Hungary Bank The Hungarian government What type of bonds are these? Government bonds Municipal bonds Corporate bonds Which of the following statements is true about bonds? The interest payments from municipal bonds are exempt from state and federal taxes The interest payments from corporate bonds are not exempt from state and federal taxes. Which of the following types of bonds has the least default risk? 10:19 PME

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started