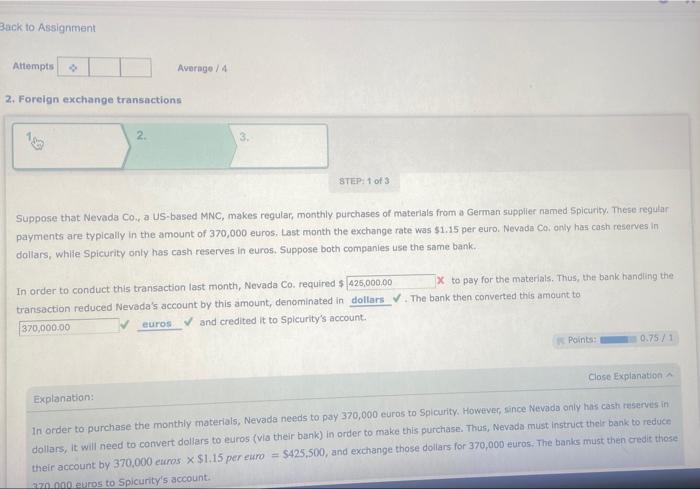

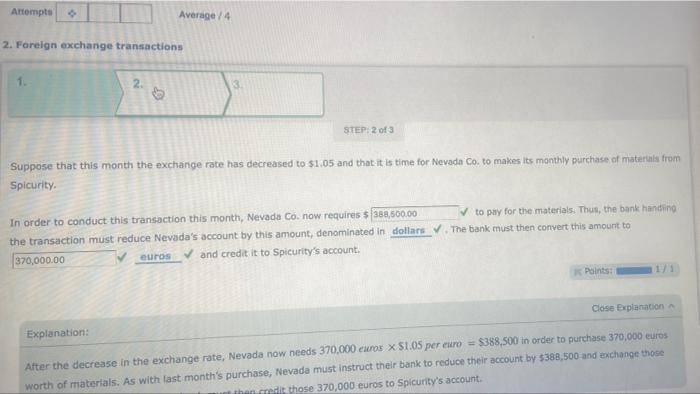

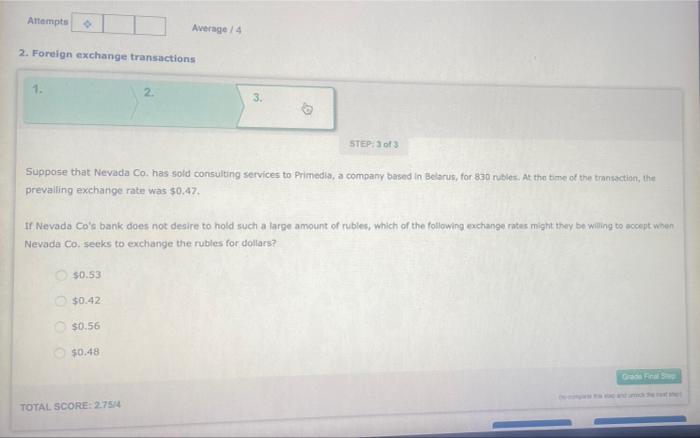

Back to Assignment Attempts Averago / 4 2. Foreign exchange transactions 2. STEP: 1 of 3 Suppose that Nevada Co.a US-based MNO, makes regular, monthly purchases of materials from a German supplier named Spicurity. These regular payments are typically in the amount of 370,000 euros. Last month the exchange rate was $1.15 per euro. Nevada Co, only has cash reserves in dollars, while Spicurity only has cash reserves in euros. Suppose both companies use the same bank. X to pay for the materials. Thus, the bank handling the The bank then converted this amount to In order to conduct this transaction last month, Nevada Co. required $ 425,000.00 transaction reduced Nevada's account by this amount, denominated in dollars 370,000.00 euros and credited it to Spleurity's account. Points 0.75 / 1 Close Explanation Explanation: In order to purchase the monthly materials, Nevada needs to pay 370,000 euros to Spicurity. However, since Nevada only has cash reserves in dollars, it will need to convert dollars to euros (via their bank) in order to make this purchase. Thus, Nevada must instruct their bank to reduce their account by 370,000 euros x $1.15 per euro = $425,500, and exchange those dollars for 370,000 euros. The banks must then credit those 0.000s to Spicurity's account. Attempts Average / 4 2. Foreign exchange transactions 1. 2 . STEP 2 of 3 Suppose that this month the exchange rate has decreased to $1.05 and that it is time for Nevada Co. to makes its monthly purchase of materials from Spicurity In order to conduct this transaction this month, Nevada Co. now requires 5 388,500.00 to pay for the materials. Thus, the bank handing the transaction must reduce Nevada's account by this amount, denominated in dollars. The bank must then convert this amount to 370,000.00 euros and credit it to Spicurity's account. i Polnts: 11 Close Explanation Explanation: After the decrease in the exchange rate, Nevada now needs 370.000 euros x 51.05 per euro = $388,500 in order to purchase 370,000 euros worth of materials. As with last month's purchase, Nevada must instruct their bank to reduce their account by $388,500 and exchange those When credit those 370.000 euros to Spicurity's account. Altempts Average / 4 2. Foreign exchange transactions 1 2. 3. STEP 3 of 3 Suppose that Nevada Co has sold consulting services to Primedia, a company based in Belarus, for 830 rubles. At the time of the transaction, the prevalling exchange rate was $0.47 ir Nevada Co's bank does not desire to hold such a large amount of rubles, which of the following exchange rates might they be willing to accept when Nevada Co. seeks to exchange the rubles for dollars? $0.53 $0.42 $0.56 $0.48 G TOTAL SCORE: 275/4 Back to Assignment Attempts Averago / 4 2. Foreign exchange transactions 2. STEP: 1 of 3 Suppose that Nevada Co.a US-based MNO, makes regular, monthly purchases of materials from a German supplier named Spicurity. These regular payments are typically in the amount of 370,000 euros. Last month the exchange rate was $1.15 per euro. Nevada Co, only has cash reserves in dollars, while Spicurity only has cash reserves in euros. Suppose both companies use the same bank. X to pay for the materials. Thus, the bank handling the The bank then converted this amount to In order to conduct this transaction last month, Nevada Co. required $ 425,000.00 transaction reduced Nevada's account by this amount, denominated in dollars 370,000.00 euros and credited it to Spleurity's account. Points 0.75 / 1 Close Explanation Explanation: In order to purchase the monthly materials, Nevada needs to pay 370,000 euros to Spicurity. However, since Nevada only has cash reserves in dollars, it will need to convert dollars to euros (via their bank) in order to make this purchase. Thus, Nevada must instruct their bank to reduce their account by 370,000 euros x $1.15 per euro = $425,500, and exchange those dollars for 370,000 euros. The banks must then credit those 0.000s to Spicurity's account. Attempts Average / 4 2. Foreign exchange transactions 1. 2 . STEP 2 of 3 Suppose that this month the exchange rate has decreased to $1.05 and that it is time for Nevada Co. to makes its monthly purchase of materials from Spicurity In order to conduct this transaction this month, Nevada Co. now requires 5 388,500.00 to pay for the materials. Thus, the bank handing the transaction must reduce Nevada's account by this amount, denominated in dollars. The bank must then convert this amount to 370,000.00 euros and credit it to Spicurity's account. i Polnts: 11 Close Explanation Explanation: After the decrease in the exchange rate, Nevada now needs 370.000 euros x 51.05 per euro = $388,500 in order to purchase 370,000 euros worth of materials. As with last month's purchase, Nevada must instruct their bank to reduce their account by $388,500 and exchange those When credit those 370.000 euros to Spicurity's account. Altempts Average / 4 2. Foreign exchange transactions 1 2. 3. STEP 3 of 3 Suppose that Nevada Co has sold consulting services to Primedia, a company based in Belarus, for 830 rubles. At the time of the transaction, the prevalling exchange rate was $0.47 ir Nevada Co's bank does not desire to hold such a large amount of rubles, which of the following exchange rates might they be willing to accept when Nevada Co. seeks to exchange the rubles for dollars? $0.53 $0.42 $0.56 $0.48 G TOTAL SCORE: 275/4