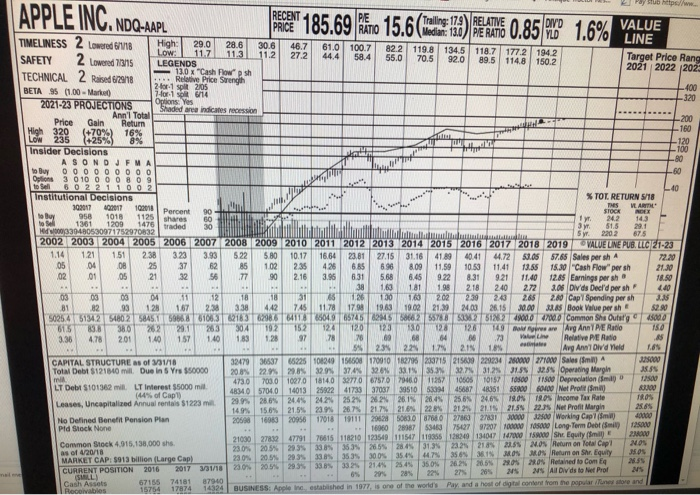

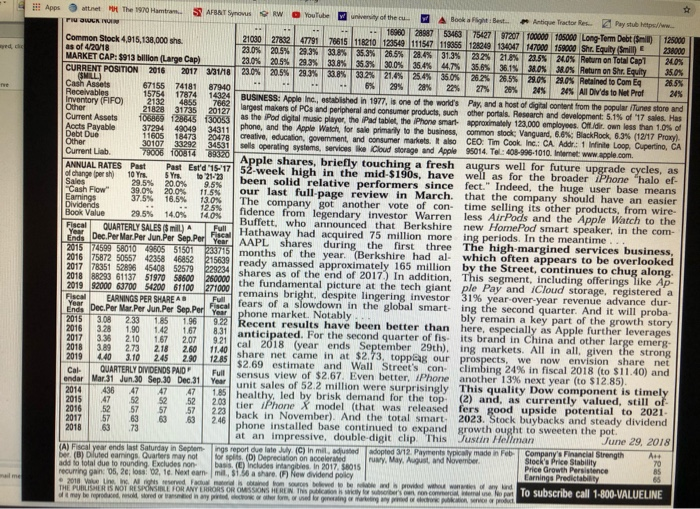

Back to Assignment Attempts: Keep the Highest: 8 2. Ch11 Financial Planning Exercise 7 eBook Chapter 11 Financial Planning Exercise 7 Interpreting stock report information Using the value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. a. What was the amount of revenues (i.e., sales) generated by the company in 2015? million b. What were the latest annual dividends per share and dividend yield in 2015? Round to two decimal places. a share c. What is the earnings per share (EPS) projection for 2019? a share d. How many shares of common stock were outstanding? e. What were the book value per share and EPS in 2015? book value per share earnings per share f. How much actual long-term debt did the company have in 2018? million Grade It Now Save & Continue Continue without saving Pay Hub Hips://www. APPLE INC. NDQ-AAPL NDQ-AAPL 185.69 RTO 15.6 (Hodor 1932) EL ATNE 0.85% 1.6% VALUE 61.0 100./ 44.4 58.4 822 119.8 134.5 118.7 56.0 70.5 92.0 89.5 177.2 1942 114,8 150-2 Target Price Rang 2021 2022 2023 TIMELINESS 2 Lowered 6/118 High: Low 20.0 28.6 30.61 46.7 117 11.3 11.2 27.2 SAFETY 2 Lowered 11315 LEGENDS 13.0 x "Cash Flowsh TECHNICAL 2 Raised 8/2018 1 . Relative Price Serength 2 for 1 split 2/05 BETA 95 (1.00 - Markal) 17 for 106/14 2021-23 PROJECTIONS Shaded area indicates recession Ann'l Total Price Gain Return 400 +320 Options: Yes +200 160 1.14 151 33 35 125 Insider Decisions AS ONDJFMA to Buy OOOOOOOOO Options 3 0 10 0 0 0 8 0 9 to sell 6 0 2 2 1 1 0 0 2 institutional Decisions % TOT RETURN 5/18 10 02011102018 to Buy 958 1018 1125 to shares 1361 1200 1476 330430530071752970832 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 VALUE UNE PUBLLO 1-23 27.15 31.1641.89 40 41 44.72 51.05 5765 Sales persh A 72.20 8.09 11.59 10.53 11.41 13.56 15.30 "Cash Flow" per sh 21.30 6.31 568 645 922 831921 11.40 12.85 Earnings per sho 10.50 38 1.98 218 240 2.72 300 Divds Decl'd per sh 0303 126 13016202239 243265 280 Cap Spending persh 81 82 745 11.78 179 1903 1902 21 20 2615 2000 Book Value per sh 2 0265794251802 5845686687 37063 2 0 049657458255625578832578248000 47000 Common She Outitg 45000 615383801 29.1 15222 1201 123 3020112019 Mawar Avg Ann PE Ratio 3.36 4.78 201 76 68 4 64 063 7 3 Relative PE Ratio 5% 2.34 22 1.7% 2.1 18% Avg AmlDivd Yield CAPITAL STRUCTURE as of 1/31/18 32479 36637 65225 108249 1850 17001082705233715 215009229234 2600 27100 Sales S A JUST Total Debt $121810 mi Due in 5 yrs $50000 20 22.9529532.94 374 328 33 15 3533271312 2 85 Operating Margin 4730 7000 1070 1814.0 327706757070460112710605105 10500 1500 Depreciation ( po LT Debt $101362 mil. LT Interest $5000 mil 48340 5704014013 25922 4173337037 30510 530945687 48351 3520 V Net Profit RU (44% of Capl) 0 29952862444 2424 25226226326425624619. 0 Income Tax Rate 105 Leases, Uncapitalized Annual rentals 51223 mil. 149% 15% 21.5623926 217 218 2284 212 213 21.5 22. Net Profit Margin No Defined Benefit Pension Plan 20698 160 20956 17018 1911 29628 50800 2 7863 2703120000 2500 Working Caplmi) Pld Stock None . . 18000 2888753463 750 97207 1000 Long Term Debt (S ) SAN 21030 278.32 47791 70615 118210 123549 111547 119355 128249 194047 00 15900 She Equity 23800 Convmon Stock 4.915,138,000 shs. 23 0% 20.5% 29 39 338 35 35 28 31 as of 4/20/18 NOS 232 218 2155 NON Return on lotal Capt 23 0% 20.5 29 35 MARKET CAP: 8013 billion (Large Cap) 3385 35 35 30 35.4% 47 356 361 0 N JON Return on Shr. Equity 2017 2 CURRENT POSITION 0 2016 23 0 2011 2655 29.35 338 332 2145 25:45 262 350 206 Retained to Com 2065 206 .. 20% 28% 22% 27 205 S 205 All Divds to Ne Prof Cash Assets 67155 74181 87940 Ro b les 15754 17874 14324 BUSINESS: Apple in established in 1977, is one of the world's Pay, and a host of digital content from the popularne store and 262 150 14 NS SULL) 9 Other 95% A pps et The 1970 Hamrom. AFONTW Antique Tractores Paystube . POUR UN 97207 100000 10000 Long Term Debt 2103027632 47791 70615 Common Stock 4,915,138,000 sh. 11R210 122549 111547 119056 12849 134047 147000 15000 Shr. Equity Small 234000 as of 4/20/18 35.3% 26.5 245 3131 232 21.8% 23.59 2008 Return on Total Cap1 24.0% MARKET CAP: $913 billion (Large Cap) 23.06 20.5 29. 3 338 353 300 16.4% 358 36.15 MOS MOS Return on Sh. Equity 35.0% CURRENT POSITION 2016 2017 31/18 230% 20.5 29 3 3 22 21 20 20. 5 0 230 Reained to Com EQ 25.5% X 295 28% Cash Assets 67155 74181 87940 27% 20% 20% 20% All Divds to Net Prof 24% Receivables 15754 17874 14324 BUSINESS: Apple Inc., established in 1977, is one of the world's Pay, and a host of digital content from the popular iTunes store and Inventory (FFO) 21828 31735 20127 largest makers of PCs and peripheral and consumer products, such other portals. Research and development 5.15 of 17 sales. Has Current Assets 13692813005 as the iPod digital music player the Pad tablet the Phone Smart Cromately 123.000 employees. O d own less than 10% of common stock Vanguard BlackRock 6.3% (12/17 Proxy phone, and the Apple Watch for sale primarily to the business Aocts Payable 37294 49049 34311 Debt Due 11605 18473 20478 creative, education, government, and consumer markets also CEO Tim Cook Inc.: CA Addr: 1 Infinite Loop Cupertino, CA 30107 30292 34531 sell operating systems services Cloud storage and Apple 95014. TeL: 408-996-1010. Internet www.apple.com 79005 0.14 Apple shares, briefly touching a fresh augurs well for future upgrade cycles, as 52 week high in the mid-$150s, have well as for the broader iPhone "halo ef of change per sh 1 0 Yrs. Yrs. 21-23 Sales 29.5% 200% been solid relative performers since fect." Indeed, the huge user base means "Cash Flow 39 09 2010 11:55 our last full page review in March, that the company should have an easier Earnings 375% 10% 100% The company got another vote of con time selling its other products, from wire Dividends 125% Book Value 29.5% 14.0% less AirPods and the Apple Watch to the fidence from legendary investor Warren 14.0% Buffett, who announced that Berkshire new HomePod smart speaker, in the com- Fiscal QUARTERLY SALES A Full Hathaway had acquired 75 million more ing periods. In the meantime... Jom Dec. Per var Per Jun Per Sea. Per AAPL shares during the first three The high-margined services business, 2015 74599 5801049605 5150133715 months of the year."(Berkshire had al which often appears to be overlooked 2016 175872 50557 42258 46852 215639 ready amassed approximately 165 million by the Street, continues to chug along. 2017 78951 52896 4540952579529234 shares as of the end of 2017.) In addition. This segment, including offerings like Ap- 2018 88299 51137 5197058600 250000 the fundamental picture at the tech giant ple Pay and iCloud storage, registered a 2019 92000 63700 54200 61100271000 remains bright, despite lingering investor 31% year-over-year revenue advance dur- Fiscal EARNINGS PER SHARE AS Full fears of a slowdown in the global smart ing the second quarter. And it will proba Sear Dee Per War.Per Jun. Per Sep. Per Year phone market. Notably ... Per Jun Per Sep Perler bly remain a key part of the growth story 20150820 185 196 192 Recent results have been better than here, especially as Apple further leverages 328 1.90 1.42 1678.31 anticipated. For the second quarter of fis its brand in China and other large emerg 2017 3.36 210 157207921 cal 2018 (year ends September 29th). ing markets. All in all, given the strong 218 250 11.40 share net came in at $2.73, toppbag our prospects, we now envision share net 245 290 $2.69 estimate and Wall Street's con climbing 24% in fiscal 2018 to $11.40) and Cal QUARTERLY DIVIDENDS PAIDF sensus view of $2.67 Even better, IPhone another 13% next year (to $12.85). endar Mar 31 Jun 30 Sep 30 Dec 31 Year unit sales of 52 2 million were surprisingly This quality Dow component is timely healthy, led by brisk demand for the top (2) and, as currently valued, still of tier iPhone X model that was released fers good upside potential to 2021- back in November). And the total smart 2023. Stock buybacks and steady dividend phone installed base continued to expand growth ought to sweeten the pot. at an impressive, double-digit clip. This Justin Hellman June 29, 2018 (A) Fiscal year endast Saturday in Sephemings report Belt W C) in meld p led 312 Payments made in Feb Company's Financial strength Art (B) Diluted earnings Quarters may not for splits. (D) Depreciation on accelerd a y, May, Augustand November Stock's Price Stability Price Growth Persistence d otal due to rounding Excludes non includes intag bis in 2017. 58015 recurring gan 05, 2 021. Nedumi. S aare widend policy Earnings Predictability . 2018 www Fas om w wwbedded with www ind on com e le port to subscribe call 1-800-VALUELINE THE PUBLISHER IS NOT RESPONSE FOR ANY ERRORS OR OMISSIONS HERENT of my stored in any form or bor d e t 15 203 223 2.46