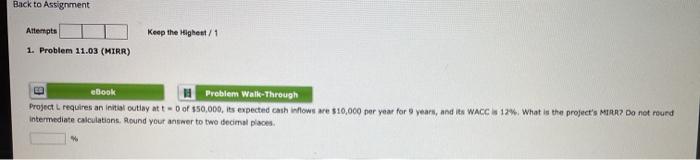

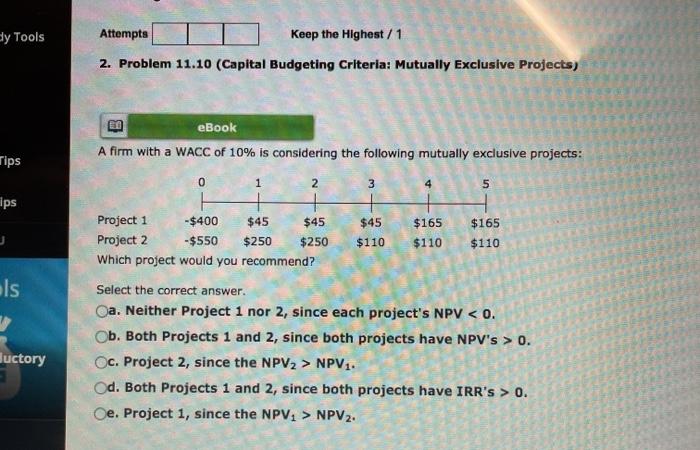

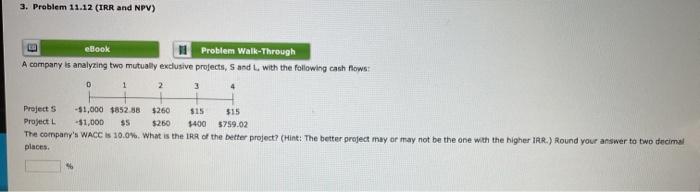

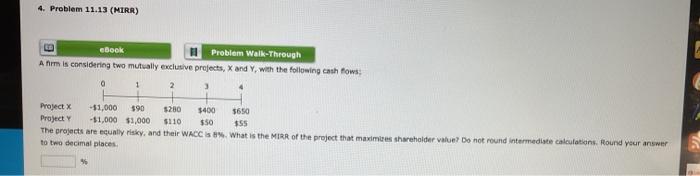

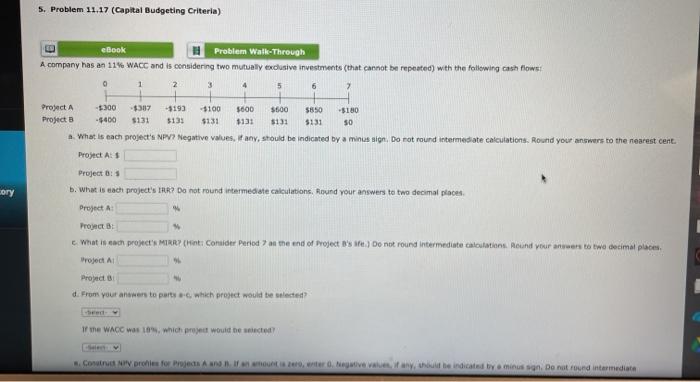

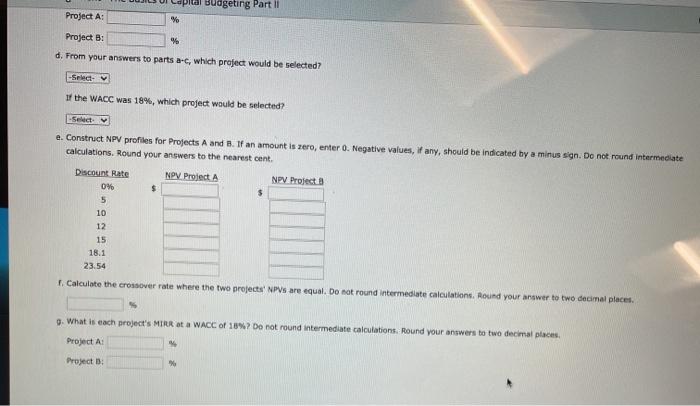

Back to Assignment Keep the Highest/1 Attempts 1. Problem 11.03 (MIRR) ebook Problem Walk-Through Project requires an initial outlay at t-of $50.000, its expected cash flows are $10,000 per year for years, and its WACC 12% What is the project's MIR? Do not round intermediate calculations. Round your answer to two decimal places Bly Tools Attempts Keep the Highest/1 2. Problem 11.10 (Capital Budgeting Criteria: Mutually Exclusive Projects) B Tips 0 ips eBook A firm with a WACC of 10% is considering the following mutually exclusive projects: 1 2 3 5 + Project 1 -$400 $45 $45 $45 $165 $165 Project 2 -$550 $250 $250 $110 $110 $110 Which project would you recommend? Select the correct answer. Oa. Neither Project 1 nor 2, since each project's NPV 0. c. Project 2, since the NPV2 > NPV1. Od. Both Projects 1 and 2, since both projects have IRR's > 0. Oe. Project 1, since the NPV, > NPV2. als Buctory 3. Problem 11.12 (IRR and NPV) eBook Problem Walk-Through A company is analyzing two mutually exclusive projects, and with the following cash now 0 2 3 Projects -$1,000 $852.88 $260 $15 555 Project -$1,000 35 $260 $400 5759.02 The company's WACC is 100%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR) Round your answer to two decimal places, 4. Problem 11.13 (MIRR) ebook Problem Walk-Through Am is considering two mutually exclusive projects, X and Y, with the following cash flows: a 1 Project x -$1,000 $90 5280 3400 5650 Project -$1,000 $3,000 $110 $50 $55 The projects are equally risky, and their WACC 58%. What is the MIRR of the project that maximizes shareholder value? Do not round intermediate calculations. Round your answer to two decimal places S. Problem 11.17 (Capital Budgeting Criteria) ebook Problem Walk-Through A company has an 11% WACC and is considering two mutually exclusive investments that cannot be repeated) with the following cash flows 0 1 2 3 4 5 6 7 Project A -5300 $387 -5193 -$100 3600 $500 $850 -$180 Project B -$400 5131 $135 $131 $133 5131 5131 so What is each project's NPV? Negative values, any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. Project AS ory Project : b. What is each project's TAR? Do not round Intermediate calculations, Round your answers to two decimal places Project Project : What is each proses MIRRY CHint: Consider Period the end of Project B) Do not round Intermediate calculations Round your answers to two decimal places Project AI Project d. From your answers to part which prosect would be selected If the WACC was 10, which project would be selected Com proles for Projects and fonti e Neve van hulle indicated to minus son. Do not found intermediate Budgeting Part 1 Project A: yo Project B: % d. From your answers to parts a-c, which project would be selected? -Select- 1 the WACC was 18%, which project would be selected? -Selety e. Construct NPV profiles for Projects A and B. If an amount is zero, enter 0. Negative values, Wany, should be indicated by a minus sign. Do not found intermediate calculations. Round your answers to the nearest cent. Discount Rate NPV Project A NPV Project 0% $ 5 10 12 15 18.1 23.54 1. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calculations. Round your answer to two decimal places. Q. What is each project's MIRR at a WACC of 18%? Do not round Intermediate calculations. Round your answers to two decimal places Project A: Project