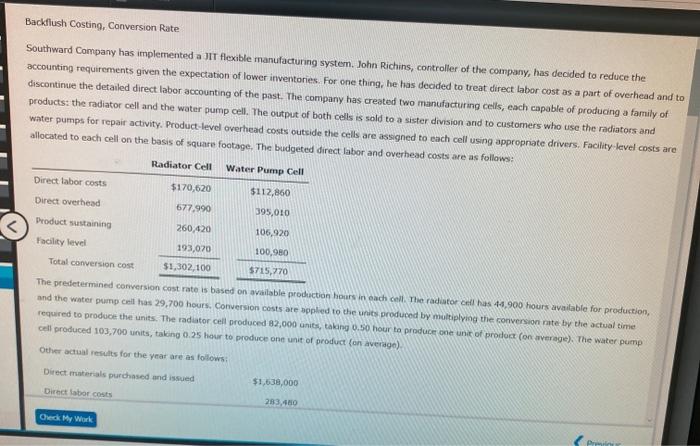

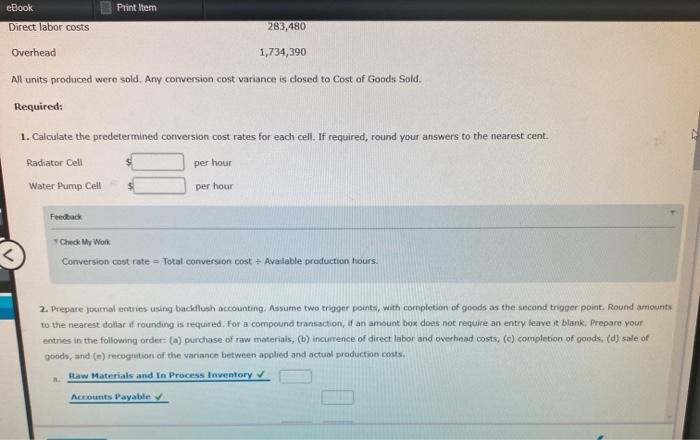

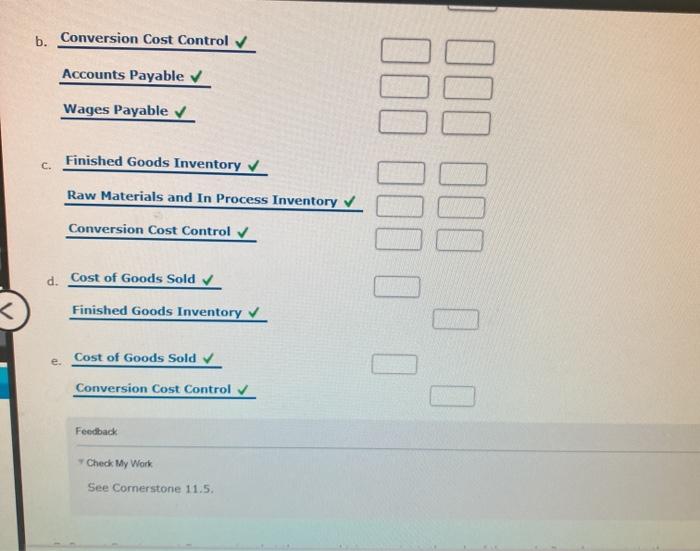

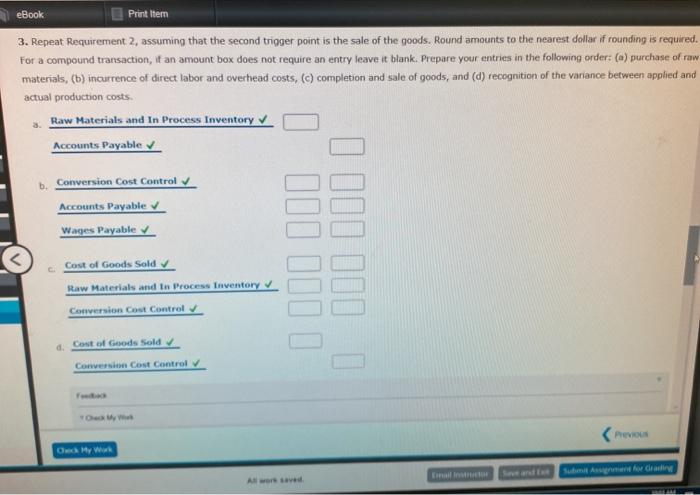

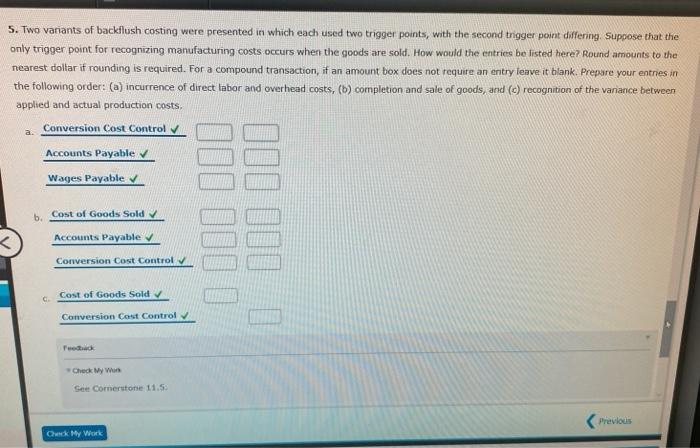

Backflush Costing, Conversion Rate Southward Company has implemented a JIT flexible manufacturing system. John Richins, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories For one thing, he has decided to treat direct labor cost as a part of overhead and to discontinue the detailed direct labor accounting of the past. The company has created two manufacturing cells, each capable of producing a family of products: the radiator cell and the water pump cell. The output of both cells is sold to a sister division and to customers who use the radiators and water pumps for repair activity. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility level costs are allocated to each cell on the basis of square footage. The budgeted direct labor and overhead costs are as follows: Radiator Cell Water Pump Cell Direct labor costs Direct overhead $170,620 677.990 $112,860 395,010 Product sustaining Facility level 260.420 106,920 Total conversion cost 193,070 $1,302,100 100,980 $715,770 The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 45.900 hours available for production, and the water pump has 29,700 hours. Conversion costs are applied to the units produced by multiplying the conversion rate by the actual time required to produce the units. The radiator cell produced 82,000 units, taking 0.50 hour to producer one unit of prodot (on average). The water pump cell produced 103,700 units, taking 0.25 hour to produce one unit of product on average) Other actual results for the year are as follows: Direct materials purchased and issued $1,638,000 Direct labor costs 283.480 Oled My Work Print Item eBook Direct labor costs 283,480 Overhead 1,734,390 All units produced were sold. Any conversion cost variance is cosed to cost of Goods Sold. Required: 1. Calculate the predetermined conversion cost rates for each cell. If required, round your answers to the nearest cent. Radiator Cell per hour Water Pump Cell per hour Feedback Check My Work Conversion cost rate - Total conversion cost + Avatable production hours. 2. Prepare youma entries using backflush accounting. Assume two trigger points, with completion of goods as the second trigger point. Round amounts to the nearest dollar of rounding is required. For a compound transaction, if an amount box does not require an entry leave it blank. Prepare your entries in the following order: (1) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) completion of goods, (d) sale of goods, and (e) recognition of the variance between applied and actual production costs Raw Materials and In Process Inventory Accounts Payable b. Conversion Cost Control Accounts Payable Wages Payable Finished Goods Inventory C. Raw Materials and In Process Inventory 1 111 111 100 101 10 Conversion Cost Control d. Cost of Goods Sold Finished Goods Inventory Cost of Goods Sold Conversion Cost Control Feedback Check My Work See Cornerstone 11.5. eBook Print Item 3. Repeat Requirement 2, assuming that the second trigger point is the sale of the goods. Round amounts to the nearest dollar if rounding is required. For a compound transaction, if an amount box does not require an entry leave it blank. Prepare your entries in the following order: (a) purchase of raw materials, (b) incurrence of direct labor and overhead costs, (c) completion and sale of goods, and (d) recognition of the variance between applied and actual production costs. Raw Materials and In Process Inventory Accounts Payable Conversion Cost Control Accounts Payable Wages Payable Cost of Goods Sold Raw Materials and in Process Inventory Conversion Cost Control 1 III II. D 1 III III Cost of Goods Sold Conversion Cost Control Previous Ow My Wor Sun Augen for dating 5. Two variants of backflush costing were presented in which each used two trigger points, with the second trigger point differing. Suppose that the only trigger point for recognizing manufacturing costs occurs when the goods are sold. How would the entries be listed here? Round amounts to the nearest dollar if rounding is required. For a compound transaction, if an amount box does not require an entry leave it blank. Prepare your entries in the following order: (a) incurrence of direct labor and overhead costs, (b) completion and sale of goods, and (c) recognition of the variance between applied and actual production costs. Conversion Cost Control Accounts Payable Wages Payable b. Cost of Goods Sold 10 II10 100 011 Accounts Payable Conversion Cost Control Cost of Goods Sold Conversion Cost Control Check My Won See Cornerstone 11.50 (previous Ok My Work