Question

Background: 2. The IRS, unlike financial accounting, seeks to provide standardized formulas rather than providing users with subjective judgement. Therefore, instead of 5 years, MACRS

Background:

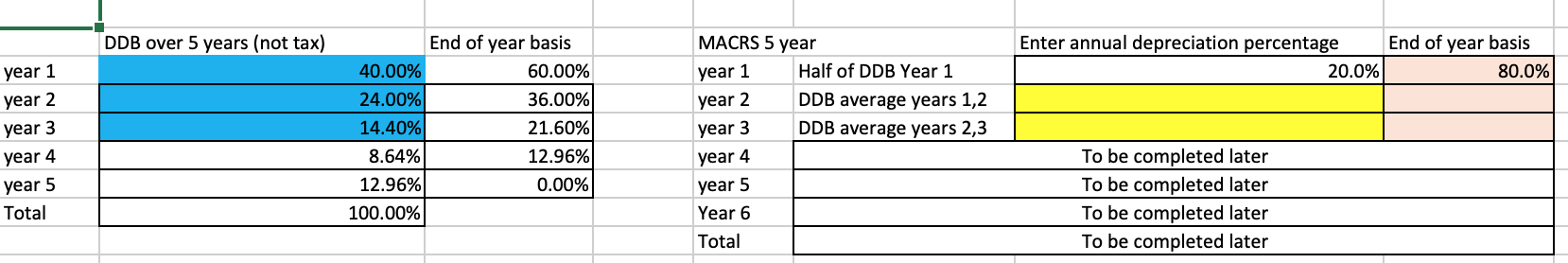

2. The IRS, unlike financial accounting, seeks to provide standardized formulas rather than providing users with subjective judgement. Therefore, instead of 5 years, MACRS depreciates over 6 years, with the first year representing half of the 40 percent under DDB (i.e. 20 percent). The idea is to prevent taxpayers from gaming the system and buying equipment on the last day of the year.

Required:

Prepare a table showing 6-year MACRS depreciation for years 1 through 3 based on the formula provided. Please prepare in Excel using formulas only. If you do not use formulas you will get half credit. Complete the yellow cells with formulas based on the blue cells. Complete the pink cells used formulas based on the yellow and pink cells.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started