Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background: A married couple (calendar year taxpayers) comes to you for tax advice. They have a 20-year old daughter whom took some time off

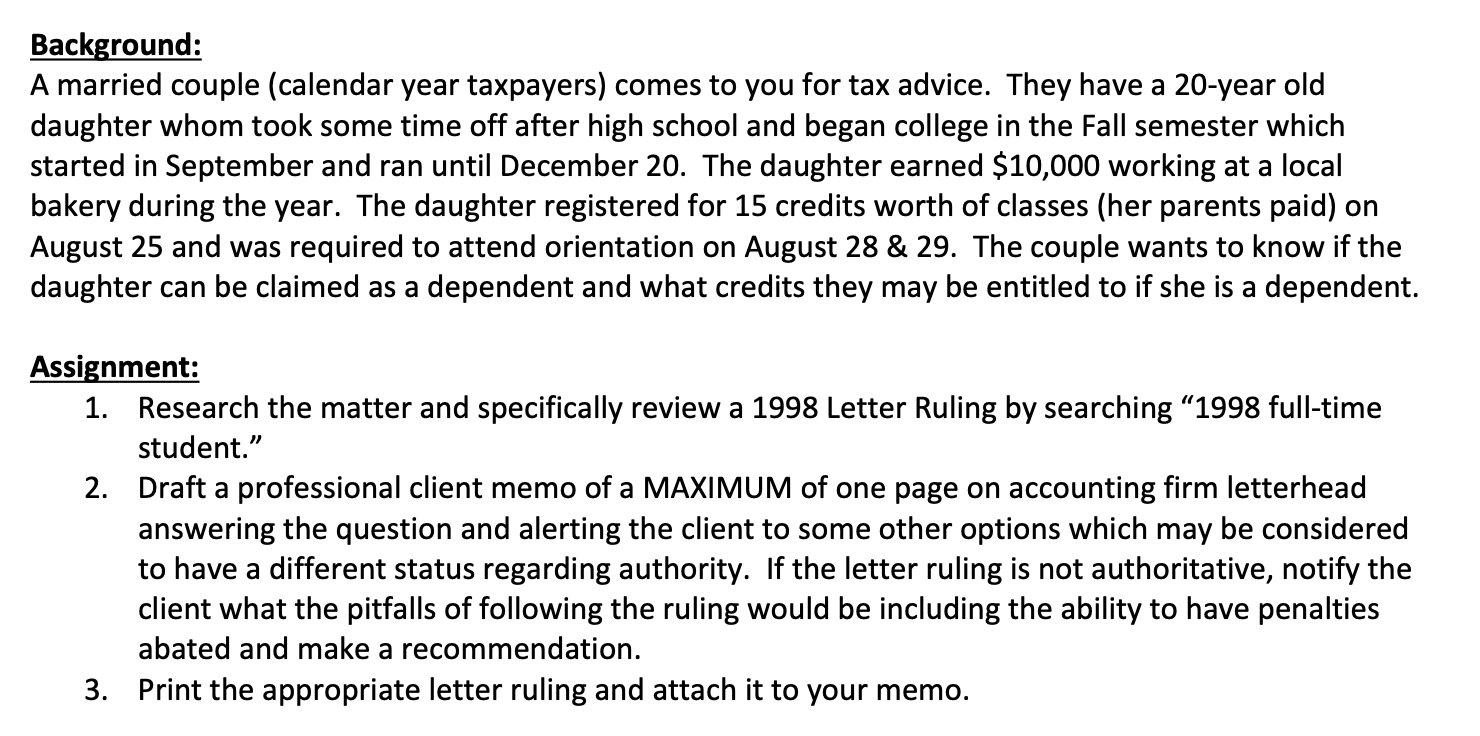

Background: A married couple (calendar year taxpayers) comes to you for tax advice. They have a 20-year old daughter whom took some time off after high school and began college in the Fall semester which started in September and ran until December 20. The daughter earned $10,000 working at a local bakery during the year. The daughter registered for 15 credits worth of classes (her parents paid) on August 25 and was required to attend orientation on August 28 & 29. The couple wants to know if the daughter can be claimed as a dependent and what credits they may be entitled to if she is a dependent. Assignment: 1. Research the matter and specifically review a 1998 Letter Ruling by searching 1998 full-time student." 2. Draft a professional client memo of a MAXIMUM of one page on accounting firm letterhead answering the question and alerting the client to some other options which may be considered to have a different status regarding authority. If the letter ruling is not authoritative, notify the client what the pitfalls of following the ruling would be including the ability to have penalties abated and make a recommendation. 3. Print the appropriate letter ruling and attach it to your memo.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started