Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Green Tea 4 Life Ltd has requested your help in preparing their financial statements as they are unsure of the requirements of

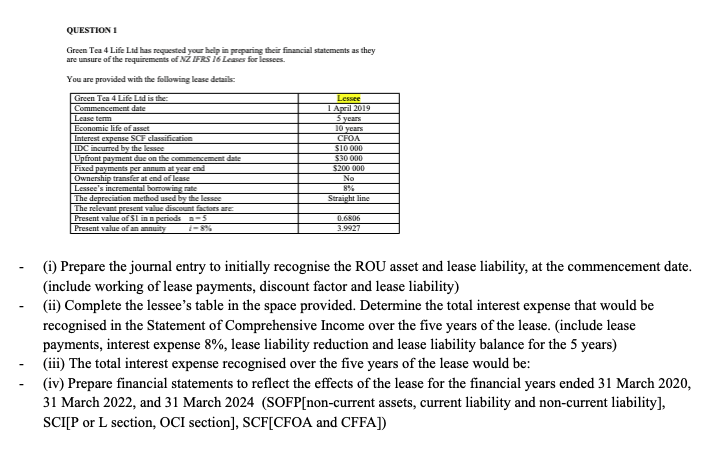

QUESTION 1 Green Tea 4 Life Ltd has requested your help in preparing their financial statements as they are unsure of the requirements of NZ IFRS 16 Leases for lessees. You are provided with the following lease details: Green Tea 4 Life Ltd is the: Commencement date Lease term Economic life of asset Interest expense SCF classification IDC incurred by the lessee Upfront payment due on the commencement date Fixed payments per annum at year end Ownership transfer at end of lease Lessee's incremental borrowing rate The depreciation method used by the lessee The relevant present value discount factors are: Present value of $1 in n periods -5 Present value of an annuity 1-8% Lessee 1 April 2019 5 years 10 years CFOA $10 000 $30 000 $200 000 No 8% Straight line 0.6806 3.9927 - - (i) Prepare the journal entry to initially recognise the ROU asset and lease liability, at the commencement date. (include working of lease payments, discount factor and lease liability) (ii) Complete the lessee's table in the space provided. Determine the total interest expense that would be recognised in the Statement of Comprehensive Income over the five years of the lease. (include lease payments, interest expense 8%, lease liability reduction and lease liability balance for the 5 years) (iii) The total interest expense recognised over the five years of the lease would be: (iv) Prepare financial statements to reflect the effects of the lease for the financial years ended 31 March 2020, 31 March 2022, and 31 March 2024 (SOFP[non-current assets, current liability and non-current liability], SCI[P or L section, OCI section], SCF[CFOA and CFFA])

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started