Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adjusting for Partial Ownerships. Below, we present an income statement and balance sheet for the MM Company. The company's debt and preferred stock are

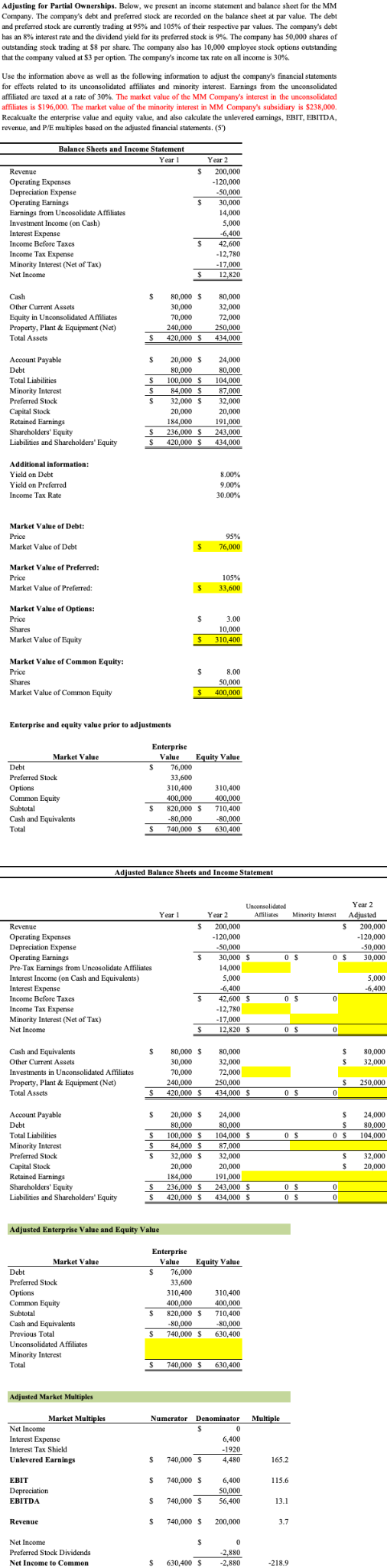

Adjusting for Partial Ownerships. Below, we present an income statement and balance sheet for the MM Company. The company's debt and preferred stock are recorded on the balance sheet at par value. The debt and preferred stock are currently trading at 95% and 105% of their respective par values. The company's debt has an 8% interest rate and the dividend yield for its preferred stock is 9%. The company has 50,000 shares of outstanding stock trading at $8 per share. The company also has 10,000 employee stock options outstanding that the company valued at $3 per option. The company's income tax rate on all income is 30%. Use the information above as well as the following information to adjust the company's financial statements for effects related to its unconsolidated affiliates and minority interest. Earnings from the unconsolidated affiliated are taxed at a rate of 30%. The market value of the MM Company's interest in the unconsolidated affiliates is $196,000. The market value of the minority interest in MM Company's subsidiary is $238,000. Recalcualte the enterprise value and equity value, and also calculate the unlevered earnings, EBIT, EBITDA, revenue, and P/E multiples based on the adjusted financial statements. (5) Balance Sheets and Income Statement Year 1 Year 2 Revenue $ 200,000 Operating Expenses -120,000 Depreciation Expense -50,000 Operating Earnings 30,000 Earnings from Uncosolidate Affiliates 14,000 Investment Income (on Cash) 5,000 Interest Expense -6,400 Income Before Taxes $ 42,600 Income Tax Expense -12,780 Minority Interest (Net of Tax) -17,000 Net Income $ 12,820 Cash 80,000 $ 80,000 Other Current Assets 30,000 32,000 Equity in Unconsolidated Affiliates 70,000 72,000 Property, Plant & Equipment (Net) 240,000 250,000 Total Assets $ 420,000 $ 434,000 Account Payable $ 20,000 $ 24,000 Debt 80,000 80,000 Total Liabilities $ 100,000 $ 104,000 Minority Interest $ 84,000 $ 87,000 Preferred Stock $ 32,000 $ 32,000 Capital Stock 20,000 20,000 Retained Earnings 184,000 191,000 Shareholders' Equity $ 236,000 $ 243,000 Liabilities and Shareholders' Equity $ 420,000 $ 434,000 Additional information: Yield on Debt Yield on Preferred Income Tax Rate 8.00% 9.00% 30.00% Market Value of Debt: Price Market Value of Debt Market Value of Preferred: Price Market Value of Preferred: 95% 76,000 105% 33,600 Market Value of Options: Price Shares Market Value of Equity $ 3.00 10,000 310,400 Market Value of Common Equity: Price $ 8.00 Shares 50,000 Market Value of Common Equity $ 400,000 Enterprise and equity value prior to adjustments Enterprise Market Value Value Equity Value Debt $ 76,000 Preferred Stock 33,600 Options 310,400 310,400 Common Equity 400,000 400,000 Subtotal $ 820,000 $ 710,400 Cash and Equivalents Total -80,000 -80,000 740,000 $ 630,400 Adjusted Balance Sheets and Income Statement Year 1 Revenue $ Year 2 200,000 Unconsolidated Affiliates Minority Interest Year 2 Adjusted S 200,000 Operating Expenses -120,000 -120,000 Depreciation Expense -50,000 -50,000 Operating Earnings $ 30,000 $ 0 S 0 $ 30,000 Pre-Tax Earnings from Uncosolidate Affiliates 14,000 Interest Income (on Cash and Equivalents) 5,000 5,000 Interest Expense -6,400 -6,400 Income Before Taxes 42,600 $ 0 S Income Tax Expense -12,780 Minority Interest (Net of Tax) -17,000 Net Income 12,820 S 0 S Cash and Equivalents $ 80,000 $ 80,000 $ 80,000 Other Current Assets 30,000 32,000 S 32,000 Investments in Unconsolidated Affiliates 70,000 72,000 Property, Plant & Equipment (Net) 240,000 250,000 S 250,000 Total Assets 420,000 $ 434,000 $ 0 $ 0 Account Payable $ Debt Total Liabilities $ 20,000 $ 80,000 100,000 $ 24,000 80,000 S 24,000 S 80,000 104,000 $ 0 S 0 S 104,000 Minority Interest $ 84,000 $ 87,000 Preferred Stock $ 32,000 $ 32,000 S 32,000 Capital Stock 20,000 20,000 S 20,000 Retained Earnings 184,000 191,000 Shareholders' Equity $ 236,000 $ Liabilities and Shareholders' Equity $ 243,000 $ 420,000 $ 434,000 S 0 S 0 0 S 0 Adjusted Enterprise Value and Equity Value Enterprise Market Value Value Equity Value Debt $ 76,000 Preferred Stock 33,600 310,400 310,400 400,000 400,000 Options Common Equity Subtotal Cash and Equivalents Previous Total Unconsolidated Affiliates 820,000 $ 710,400 -80,000 -80,000 $ 740,000 $ 630,400 Minority Interest Total Adjusted Market Multiples $ 740,000 $ 630,400 Market Multiples Numerator Denominator Multiple EBIT Net Income Interest Expense Interest Tax Shield Unlevered Earnings Depreciation 0 6,400 -1920 $ 740,000 $ 4,480 165.2 $ 740,000 $ EBITDA 6,400 50,000 $ 740,000 $ 56,400 115.6 13.1 Revenue $ 740,000 $ 200,000 3.7 Net Income $ 0 Preferred Stock Dividends -2,880 Net Income to Common $ 630,400 $ -2,880 -218.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started