Answered step by step

Verified Expert Solution

Question

1 Approved Answer

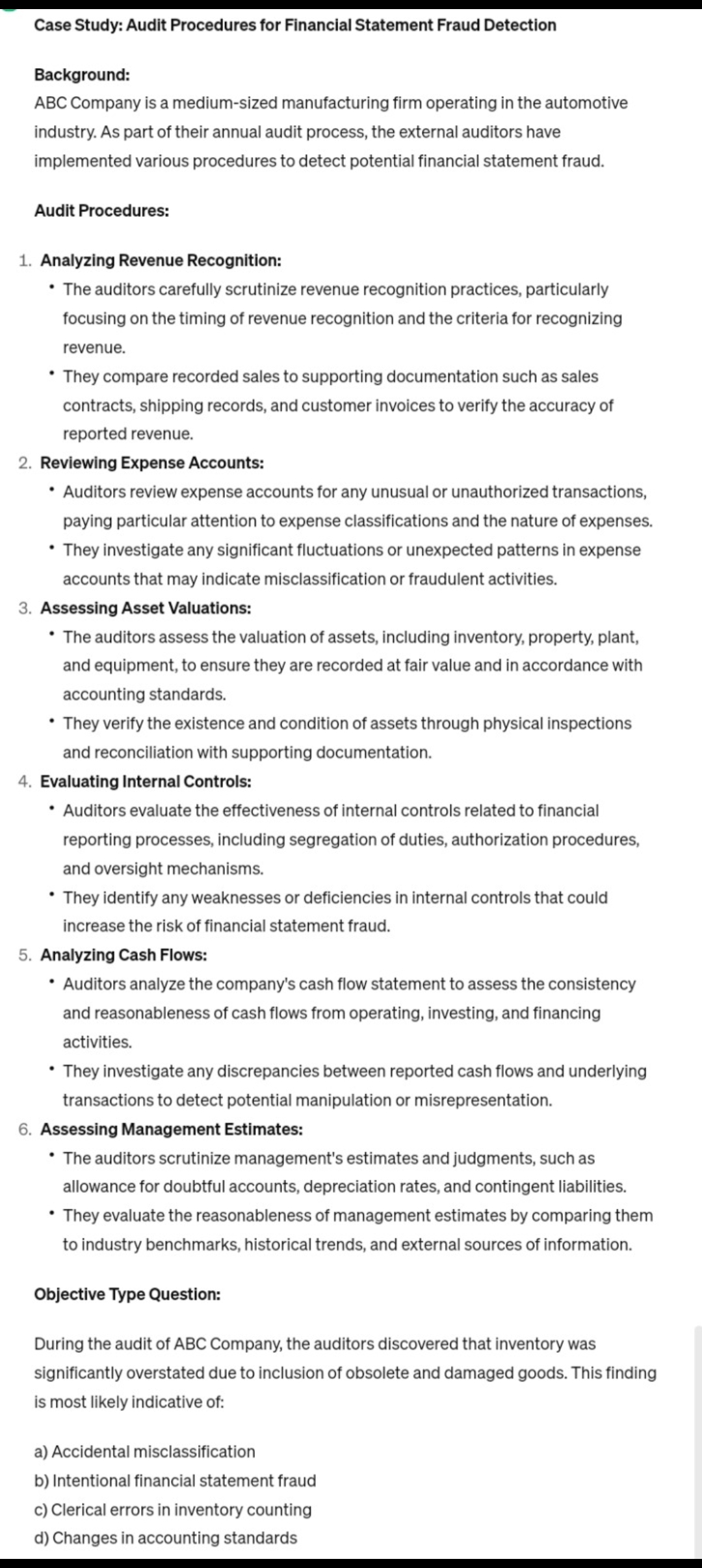

Background: ABC Company is a medium - sized manufacturing firm operating in the automotive industry. As part of their annual audit process, the external auditors

Background:

ABC Company is a mediumsized manufacturing firm operating in the automotive

industry. As part of their annual audit process, the external auditors have

implemented various procedures to detect potential financial statement fraud.

Audit Procedures:

Analyzing Revenue Recognition:

The auditors carefully scrutinize revenue recognition practices, particularly

focusing on the timing of revenue recognition and the criteria for recognizing

revenue.

They compare recorded sales to supporting documentation such as sales

contracts, shipping records, and customer invoices to verify the accuracy of

reported revenue.

Reviewing Expense Accounts:

Auditors review expense accounts for any unusual or unauthorized transactions,

paying particular attention to expense classifications and the nature of expenses.

They investigate any significant fluctuations or unexpected patterns in expense

accounts that may indicate misclassification or fraudulent activities.

Assessing Asset Valuations:

The auditors assess the valuation of assets, including inventory, property, plant,

and equipment, to ensure they are recorded at fair value and in accordance with

accounting standards.

They verify the existence and condition of assets through physical inspections

and reconciliation with supporting documentation.

Evaluating Internal Controls:

Auditors evaluate the effectiveness of internal controls related to financial

reporting processes, including segregation of duties, authorization procedures,

and oversight mechanisms.

They identify any weaknesses or deficiencies in internal controls that could

increase the risk of financial statement fraud.

Analyzing Cash Flows:

Auditors analyze the company's cash flow statement to assess the consistency

and reasonableness of cash flows from operating, investing, and financing

activities.

They investigate any discrepancies between reported cash flows and underlying

transactions to detect potential manipulation or misrepresentation.

Assessing Management Estimates:

The auditors scrutinize management's estimates and judgments, such as

allowance for doubtful accounts, depreciation rates, and contingent liabilities.

They evaluate the reasonableness of management estimates by comparing them

to industry benchmarks, historical trends, and external sources of information.

Objective Type Question:

During the audit of ABC Company, the auditors discovered that inventory was

significantly overstated due to inclusion of obsolete and damaged goods. This finding

is most likely indicative of:

a Accidental misclassification

b Intentional financial statement fraud

c Clerical errors in inventory counting

d Changes in accounting standards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started