Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background: BSA Company is a manufacturing company that produces and sells electronic devices. As an auditor, you have been engaged to perform the annual audit

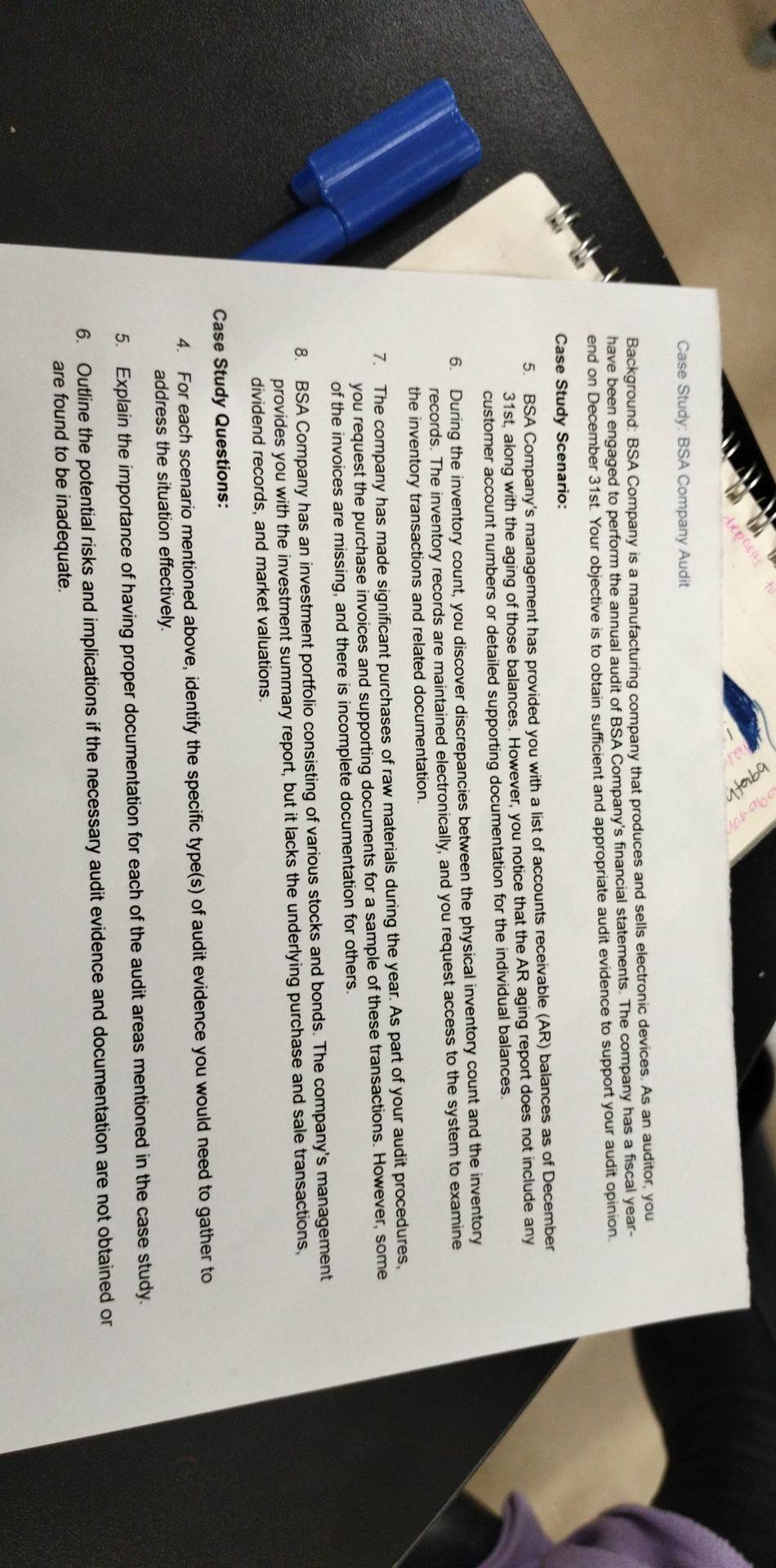

Background: BSA Company is a manufacturing company that produces and sells electronic devices. As an auditor, you have been engaged to perform the annual audit of BSA Company's financial statements. The company has a fiscal yearend on December 31st. Your objective is to obtain sufficient and appropriate audit evidence to support your audit opinion. Case Study Scenario: 5. BSA Company's management has provided you with a list of accounts receivable (AR) balances as of December 31 st, along with the aging of those balances. However, you notice that the AR aging report does not include any customer account numbers or detailed supporting documentation for the individual balances. 6. During the inventory count, you discover discrepancies between the physical inventory count and the inventory records. The inventory records are maintained electronically, and you request access to the system to examine the inventory transactions and related documentation. 7. The company has made significant purchases of raw materials during the year. As part of your audit procedures, you request the purchase invoices and supporting documents for a sample of these transactions. However, some of the invoices are missing, and there is incomplete documentation for others. 8. BSA Company has an investment portfolio consisting of various stocks and bonds. The company's management provides you with the investment summary report, but it lacks the underlying purchase and sale transactions, dividend records, and market valuations. Case Study Questions: 4. For each scenario mentioned above, identify the specific type(s) of audit evidence you would need to gather to address the situation effectively. 5. Explain the importance of having proper documentation for each of the audit areas mentioned in the case study. 6. Outline the potential risks and implications if the necessary audit evidence and documentation are not obtained o are found to be inadequate

Background: BSA Company is a manufacturing company that produces and sells electronic devices. As an auditor, you have been engaged to perform the annual audit of BSA Company's financial statements. The company has a fiscal yearend on December 31st. Your objective is to obtain sufficient and appropriate audit evidence to support your audit opinion. Case Study Scenario: 5. BSA Company's management has provided you with a list of accounts receivable (AR) balances as of December 31 st, along with the aging of those balances. However, you notice that the AR aging report does not include any customer account numbers or detailed supporting documentation for the individual balances. 6. During the inventory count, you discover discrepancies between the physical inventory count and the inventory records. The inventory records are maintained electronically, and you request access to the system to examine the inventory transactions and related documentation. 7. The company has made significant purchases of raw materials during the year. As part of your audit procedures, you request the purchase invoices and supporting documents for a sample of these transactions. However, some of the invoices are missing, and there is incomplete documentation for others. 8. BSA Company has an investment portfolio consisting of various stocks and bonds. The company's management provides you with the investment summary report, but it lacks the underlying purchase and sale transactions, dividend records, and market valuations. Case Study Questions: 4. For each scenario mentioned above, identify the specific type(s) of audit evidence you would need to gather to address the situation effectively. 5. Explain the importance of having proper documentation for each of the audit areas mentioned in the case study. 6. Outline the potential risks and implications if the necessary audit evidence and documentation are not obtained o are found to be inadequate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started