Question

BACKGROUND FACTS: Bonnie B. Buyer, age 33, single, was a proud alumna of Western New England University. Buyer has been one of your firms clients

BACKGROUND FACTS: Bonnie B. Buyer, age 33, single, was a proud alumna of Western New England University. Buyer has been one of your firm’s clients for about five years. Buyer was the sole owner of a small CPA firm near Springfield, MA, which she opened a couple of years after graduation. A friendly older CPA, Sally S. Seller, told Bonnie that she was considering retiring and selling her accounting practice for $750,000. Seller’s tax practice was highly profitable, which put Sally in the top tax bracket. Turns out, Sally had been your client for nearly two decades.

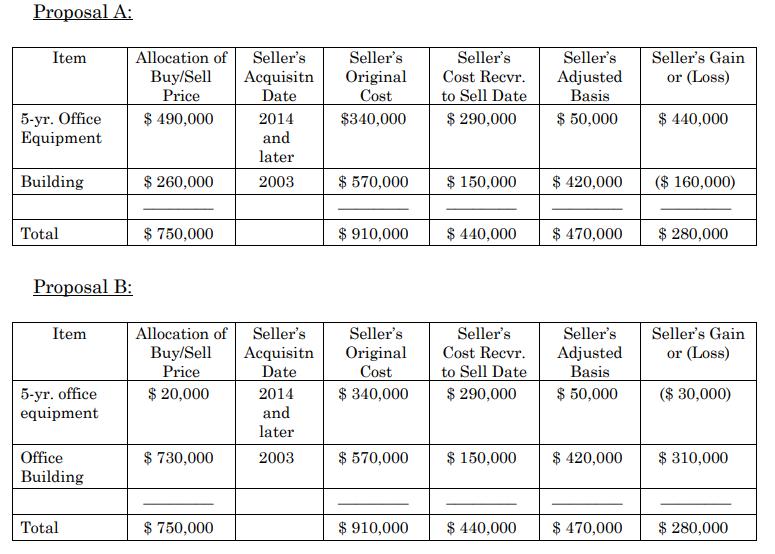

QUESTIONS: Below are two buy-sell proposals. Which proposal, A or B, would Buyer prefer? Which proposal would Seller prefer? Fully explain why for each person. Notwithstanding these two alternatives, explain what, in the real world, determines how to properly allocate the purchase price.

Proposal A: Item 5-yr. Office Equipment Building Total Proposal B: Item 5-yr. office equipment Office Building Total Allocation of Seller's Acquisitn Date Buy/Sell Price $ 490,000 $ 260,000 750,000 Allocation of Seller's Buy/Sell Acquisitn Price Date $ 20,000 $ 730,000 2014 and later 2003 750,000 2014 and later 2003 Seller's Original Cost $340,000 $570,000 $ 910,000 Seller's Original Cost $ 340,000 $570,000 $ 910,000 Seller's Cost Recvr. to Sell Date $ 290,000 $ 150,000 $ 440,000 Seller's Cost Recvr. to Sell Date $ 290,000 $ 150,000 $ 440,000 Seller's Adjusted Basis $ 50,000 $ 420,000 $ 470,000 Seller's Adjusted Basis $ 50,000 $ 420,000 $ 470,000 Seller's Gain or (Loss) $ 440,000 ($ 160,000) $ 280,000 Seller's Gain or (Loss) ($ 30,000) $ 310,000 $ 280,000

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Proposal A Buyers Preference Bonnie B Buyer would prefer Proposal A In this proposal the allocation of the purchase price results in a higher adjusted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started