Question

Background Hello, my name is Shady Slim. I understand that you are going to help me figure out my gross income for the year, whatever

Background Hello, my name is Shady Slim. I understand that you are going to help me figure out my gross income for the year, whatever that means. It's been a busy year and I'm a busy man, so let me give you the lowdown on my life, and you can do your thing.

I was unemployed at the beginning of the year and got $2,000 in unemployment compensation. I later got a job as a manager for Roca Cola. I earned $55,000 in base salary this year. My boss gave me a $5,000 Christmas bonus on December 22, but I decided to hold on to that check and not cash it until next year so that I won't have to pay taxes on it this year. Pretty smart, huh?

As part of my manager duties, I get to decide on certain things, like contracts, for the company. My good buddy, Eddie, runs a bottling company. I made sure that he won the bottling contract for Roca Cola for this year (even though his contract wasnt quite the best). Eddie bought me a Corvette this year for being such a good friend. It Corvette cost $50,000, and I'm sure he bought it for me out of the goodness of his heart. What a great guy!

Here's a bit of good luck for the year: Upon leaving my office one day, I found $8,000 lying in the street! Well, one person's bad luck is my good luck, right? I like to gamble a lot. I won a $220,000 poker tournament in Las Vegas this year. I also won about $5,000 over the year playing the guys at our Friday night game. Can you believe that I didnt lose anything this year?

Speaking of the guys, one of them said that I should put that money I won at gamblingwell, $200,000 of itinto an annuity? So I did just that, and now I'll get $1,000 a month for the next 20 years. I already got $3,000 of it! Please tell me none of that is taxable!

My ex-wife, Alice, is still paying me alimony. She's a lawyer who divorced me a few years ago because I was "unethical, or something like that. Since she was making so much money and I was unemployed at the time, the judge ruled that she had to pay me alimony. Isnt that something? She sent me $3,000 in alimony payments this year. She still kind of likes me, though; she sent me a check for $500 as a Christmas gift this year. (I didn't get her anything, though.)

So, there you go...that's this year in a nutshell.

Can you figure out my gross income? And since youre a student, this is free, right? Thanks, I owe you one! Let me know if I can get you a six-pack of Roca Cola or something.

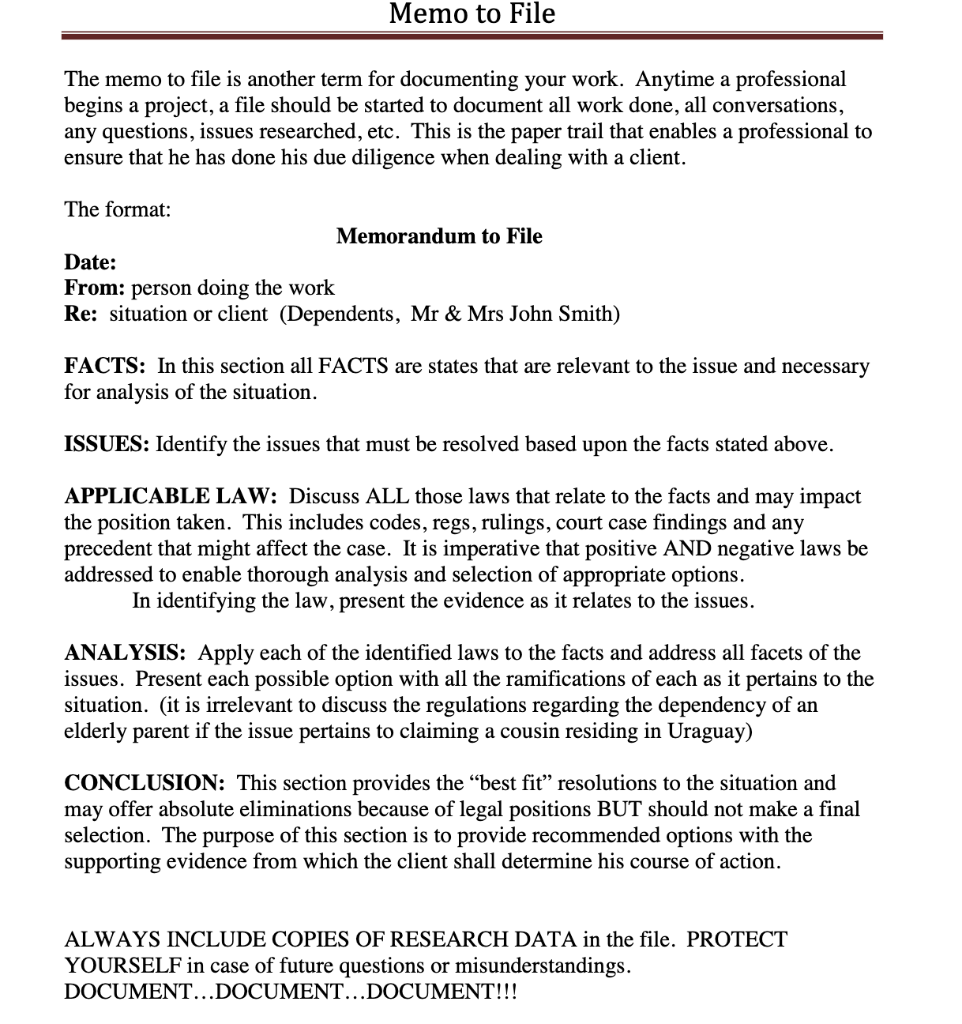

Task You must cite all relevant tax code to determine what items would be included or excluded from gross income. Prepare your response in a tax memo format. Any reference to this year is the current tax year you are advising in.

If you need help, check out the sample Memorandum to File

Sample

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started