Answered step by step

Verified Expert Solution

Question

1 Approved Answer

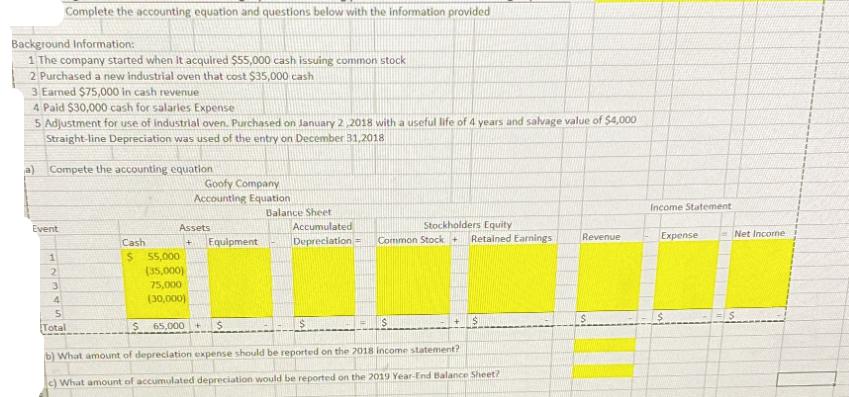

Background Information: 1 The company started when it acquired $55,000 cash issuing common stock 2 Purchased a new industrial oven that cost $35,000 cash

Background Information: 1 The company started when it acquired $55,000 cash issuing common stock 2 Purchased a new industrial oven that cost $35,000 cash 3 Earned $75,000 in cash revenue 4 Paid $30,000 cash for salaries Expense 5 Adjustment for use of industrial oven. Purchased on January 2,2018 with a useful life of 4 years and salvage value of $4,000 Straight-line Depreciation was used of the entry on December 31,2018 a) Compete the accounting equation Event 1 Complete the accounting equation and questions below with the information provided 2 3 4 5 Total Goofy Company Accounting Equation Assets + Cash $ 55,000 (35,000) 75,000 (30,000) $ 65,000 Equipment + Balance Sheet $ Accumulated Stockholders Equity Depreciation= Common Stock + $ $ b) What amount of depreciation expense should be reported on the 2018 income statement? c) What amount of accumulated depreciation would be reported on the 2019 Year-End Balance Sheet? Retained Earnings Revenue Income Statement Expense Net Income

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Completing the accounting equation in table format Assets Liabilities Equity Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started