Question

Background information: Cantona Industries has a target capital structure consisting of 40% debt, 15% preferred stock, and 45% common equity. The before-tax YTM on Cantona's

Background information: Cantona Industries has a target capital structure consisting of 40% debt, 15% preferred stock, and 45% common equity. The before-tax YTM on Cantona's long term bonds is 9.5%, its cost of preferred stock is 8% and its cost of retained earnings is 12.5%. The firm's rate is 40% and Cantona's WACC (if it doesn't have to issue new common stock) is 9.11%.

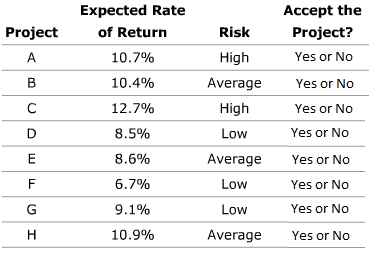

Cantona Industries undertakes a variety of projects with different levels of risk. Cantona adds 2 percentage points to its WACC for high-risk projects and subtracts 2 percentage points from its WACC for low-risk projects. In other words, the cost of capital for a high-risk project equals WACC + 2%, while a low-risk project uses a cost of capital equal to WACC -2%. WACC remains the same for average-risk projects.

Cantona's management is considering the following list of projects, and each project's risk is indicated in the table below. Indicate which projects Cantona Idustries should accept. List all projects that should be accepted.

Thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started