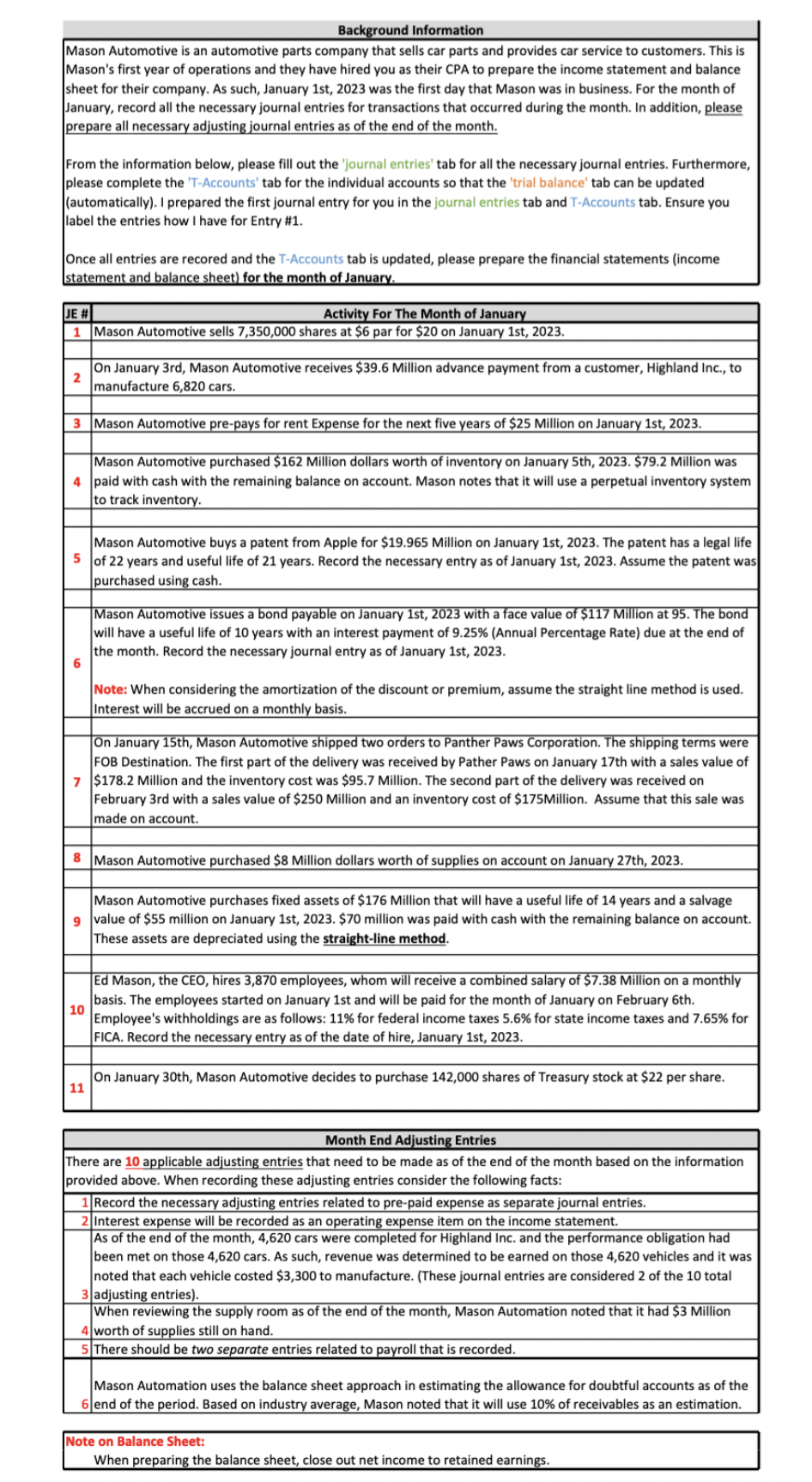

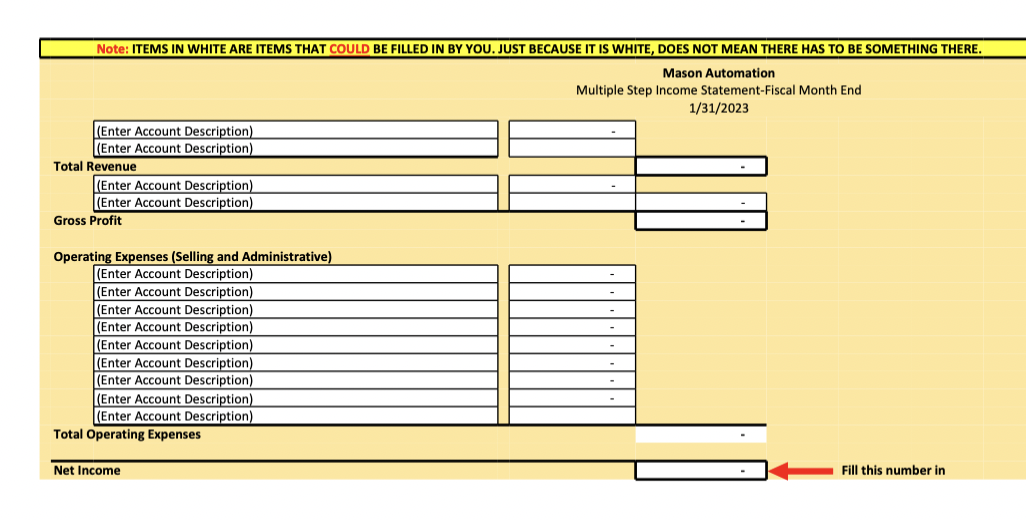

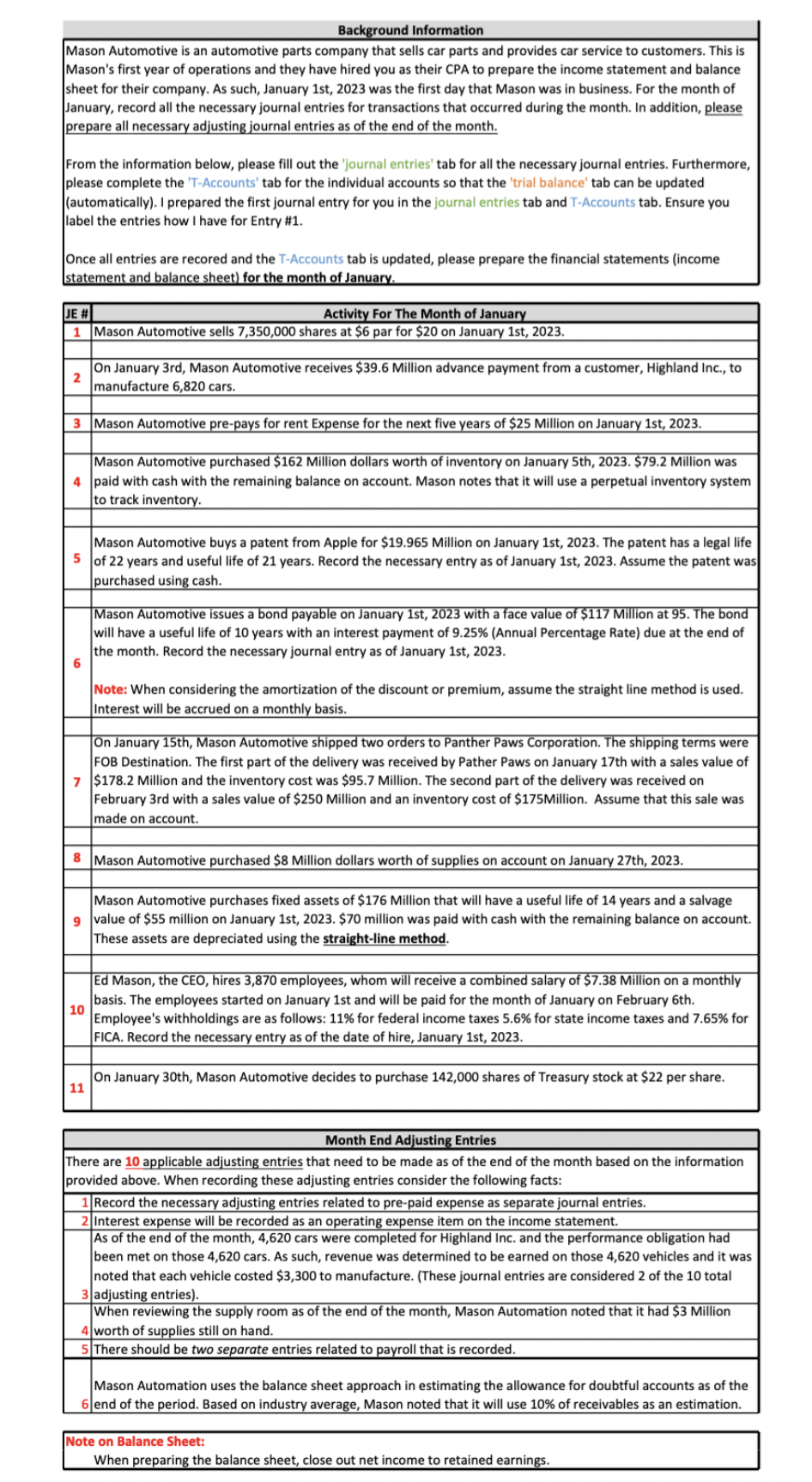

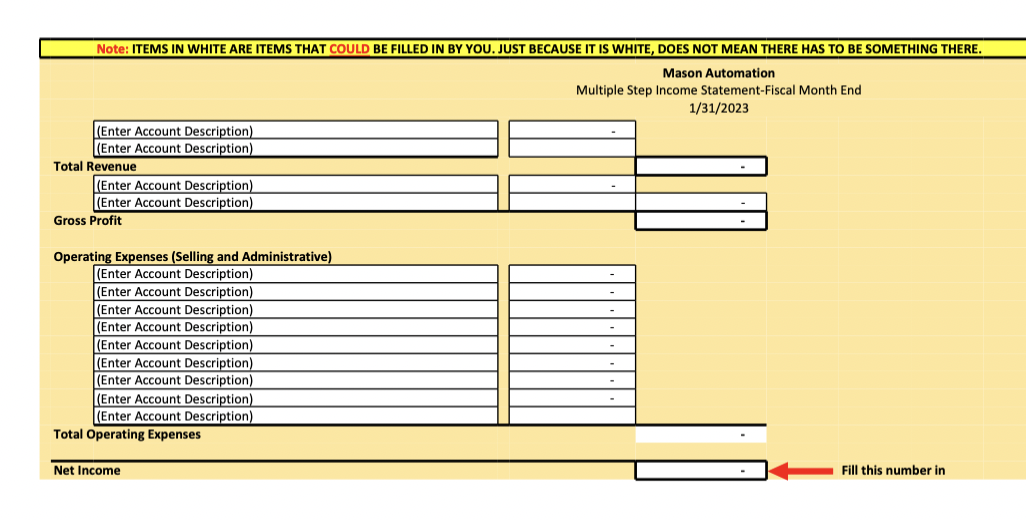

Background Information Mason Automotive is an automotive parts company that sells car parts and provides car service to customers. This is Mason's first year of operations and they have hired you as their CPA to prepare the income statement and balance sheet for their company. As such, January 1st, 2023 was the first day that Mason was in business. For the month of January, record all the necessary journal entries for transactions that occurred during the month. In addition, please prepare all necessary adjusting journal entries as of the end of the month. From the information below, please fill out the 'journal entries' tab for all the necessary journal entries. Furthermore, please complete the 'T-Accounts' tab for the individual accounts so that the 'trial balance' tab can be updated (automatically). I prepared the first journal entry for you in the journal entries tab and T-Accounts tab. Ensure you label the entries how I have for Entry \#1. Once all entries are recored and the T-Accounts tab is updated, please prepare the financial statements (income Note: ITEMS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU. JUST BECAUSE IT IS WHITE, DOES NOT MEAN THERE HAS TO BE SOMETHING THERE. Mason Automation Multiple Step Income Statement-Fiscal Month End 1/31/2023 \begin{tabular}{|l|} \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline \end{tabular} Total Revenue (Enter Account Description) (Enter Account Description) Gross Profit \begin{tabular}{|c|c|} \hline & \\ \hline & - \\ \hline- & - \\ \hline & - \\ \hline & - \\ \hline \end{tabular} Operating Expenses (Selling and Administrative) \begin{tabular}{|l|} \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline \end{tabular} \begin{tabular}{|l|} \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline \\ \hline \end{tabular} Total Operating Expenses Net Income Fill this number in Background Information Mason Automotive is an automotive parts company that sells car parts and provides car service to customers. This is Mason's first year of operations and they have hired you as their CPA to prepare the income statement and balance sheet for their company. As such, January 1st, 2023 was the first day that Mason was in business. For the month of January, record all the necessary journal entries for transactions that occurred during the month. In addition, please prepare all necessary adjusting journal entries as of the end of the month. From the information below, please fill out the 'journal entries' tab for all the necessary journal entries. Furthermore, please complete the 'T-Accounts' tab for the individual accounts so that the 'trial balance' tab can be updated (automatically). I prepared the first journal entry for you in the journal entries tab and T-Accounts tab. Ensure you label the entries how I have for Entry \#1. Once all entries are recored and the T-Accounts tab is updated, please prepare the financial statements (income Note: ITEMS IN WHITE ARE ITEMS THAT COULD BE FILLED IN BY YOU. JUST BECAUSE IT IS WHITE, DOES NOT MEAN THERE HAS TO BE SOMETHING THERE. Mason Automation Multiple Step Income Statement-Fiscal Month End 1/31/2023 \begin{tabular}{|l|} \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline \end{tabular} Total Revenue (Enter Account Description) (Enter Account Description) Gross Profit \begin{tabular}{|c|c|} \hline & \\ \hline & - \\ \hline- & - \\ \hline & - \\ \hline & - \\ \hline \end{tabular} Operating Expenses (Selling and Administrative) \begin{tabular}{|l|} \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline \end{tabular} \begin{tabular}{|l|} \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline- \\ \hline \\ \hline \end{tabular} Total Operating Expenses Net Income Fill this number in