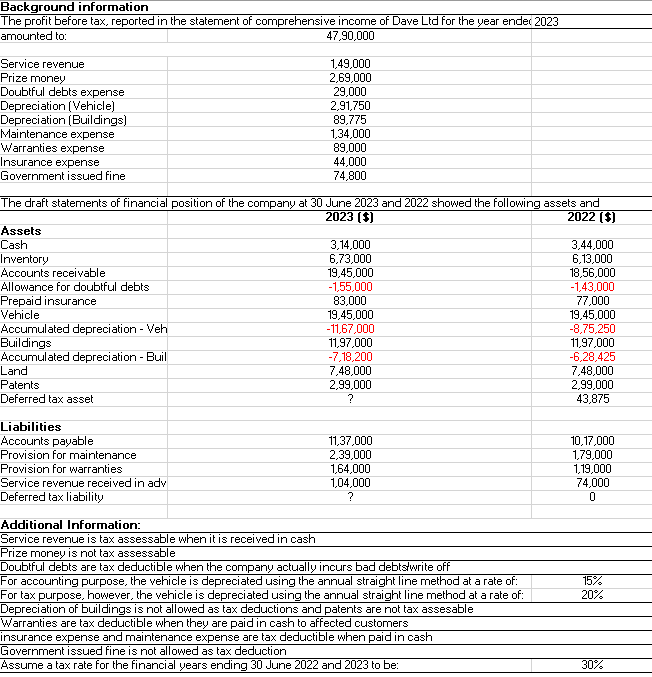

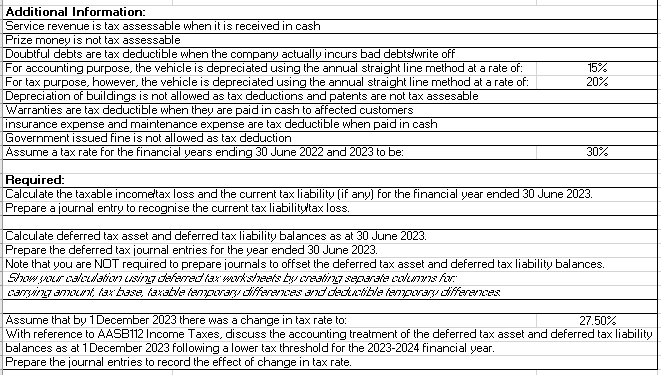

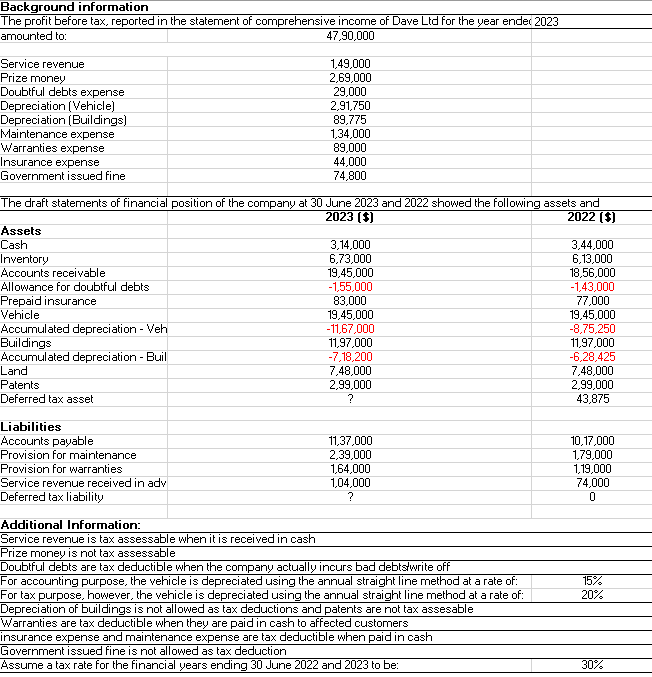

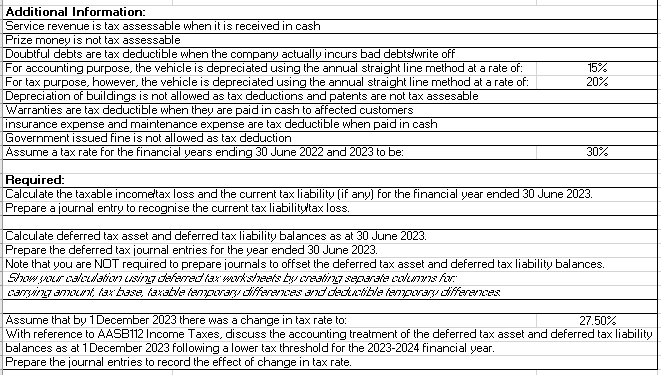

Background information The profit before tax, reported in the statement of comprehensive income of Dave Ltd for the year ender 2023 amounted to: 47,90,000 Service revenue 1,49,000 Prize money Doubtful debts expense 2,69,000 Depreciation (Vehicle) 2,91,750 Depreciation (Buildings) 89,775 Maintenance expense Warranties expense 1,34,000 89,000 Insurance expense 44,000 Government issued fine 74,800 The draft statements of financial position of the company at 30 June 2023 and 2022 showed the following assets and \begin{tabular}{l|c|c|c} \hline & 2023[$] & 2022 [\$] \\ \hline Assets & & 3,44,000 \\ \hline Cash & 3,14,000 & 6,13,000 \\ \hline Accentory & 6,73,000 & 18,56,000 \\ \hline Allowance for doubtful debts & 19,45,000 & 1,43,000 \\ \hline Prepaid insurance & 1,55,000 & 77,000 \\ \hline Vehicle & 83,000 & 19,45,000 \\ \hline Accumulated depreciation - Veh & 19,45,000 & 8,75,250 \\ \hline Buildings & 11,67,000 & 11,97,000 \\ \hline Accumulated depreciation - Buil & 11,97,000 & 6,28,425 \\ \hline Land & 7,18,200 & 7,48,000 \\ \hline Patents & 7,48,000 & 2,99,000 \\ \hline Deferred tax asset & 2,99,000 & 43,875 \\ \hline \end{tabular} Liabilities \begin{tabular}{|l|c|c|c|} \hline Accounts payable & 11,37,000 & 10,17,000 \\ \hline Provision for maintenance & 2,39,000 & 1,79,000 \\ \hline Provision for warranties & 1,64,000 & 1,19,000 \\ \hline Service revenue received in adv & 1,04,000 & 74,000 \\ \hline Deferred tax liability & ? & 0 \end{tabular} Additional Information: Service revenue is tax assessable when it is received in cash Prize money is not tax assessable Doubtful debts are tax deductible when the company actually incurs bad debts'write off For accounting purpose, the vehicle is depreciated using the annual straight line method at a rate of: 15% For tax purpose, however, the vehicle is depreciated using the annual straight line method at a rate of: Depreciation of buildings is not allowed as tax deductions and patents are not tax assesable Warranties are tax deductible when they are paid in cash to affected customers insurance expense and maintenance expense are tax deductible when paid in cash Government issued fine is not allowed as tax deduction Assume a tax rate for the financial years ending 30 June 2022 and 2023 to be: 30% Additional Information: Service revenue is tax assessable when it is received in cash Prize money is not tax assessable Doubtful debts are tax deductible when the company actually incurs bad debtstwrite off For accounting purpose, the vehicle is depreciated using the annual straight line method at a rate of: For tax purpose, however, the vehicle is depreciated using the annual straight line method at a rate of: Depreciation of buildings is not allowed as tax deductions and patents are not tax assesable Warranties are tax deductible when they are paid in cash to affected customers insurance expense and maintenance expense are tax deductible when paid in cash Government issued fine is not allowed as tax deduction Assume a tax rate for the financial years ending 30 June 2022 and 2023 to be: 30% Required: Calculate the taxable incomettax loss and the current tax liability [if any) for the financial year ended 30 June 2023. Prepare a journal entry to recognise the current tax liabilityltax loss. Calculate deferred tax asset and deferred tax liability balances as at 30 . June 2023. Prepare the deferred tax journal entries for the year ended 30 June 2023. Note that you are NDT required to prepare journals to offset the deferred tax asset and deferred tax liability balances. Assume that by 1 December 2023 there was a change in tax rate to: 27.50% With reference to A.SS112 Income Taxes, discuss the accounting treatment of the deferred tax asset and deferred tax liability balances as at 1December 2023 following a lower tax threshold for the 2023-2024 financial year. Prepare the journal entries to record the effect of change in tax rate