Answered step by step

Verified Expert Solution

Question

1 Approved Answer

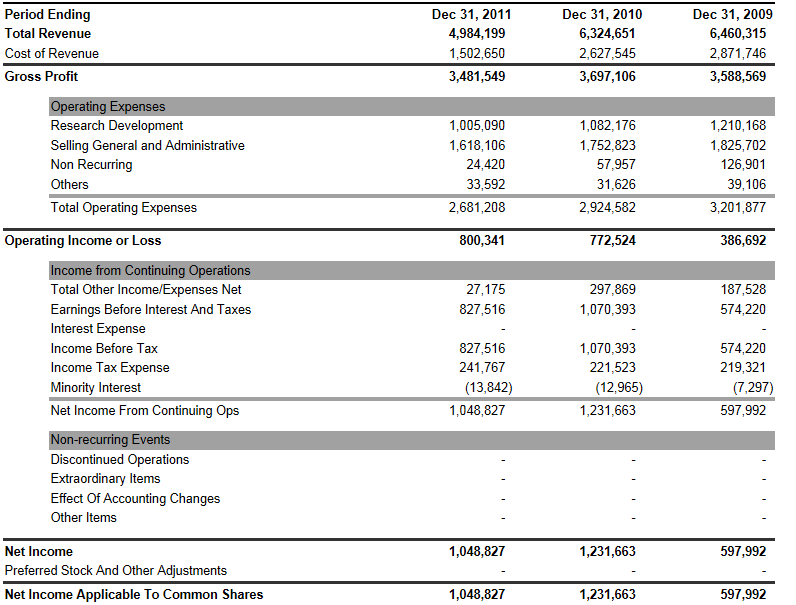

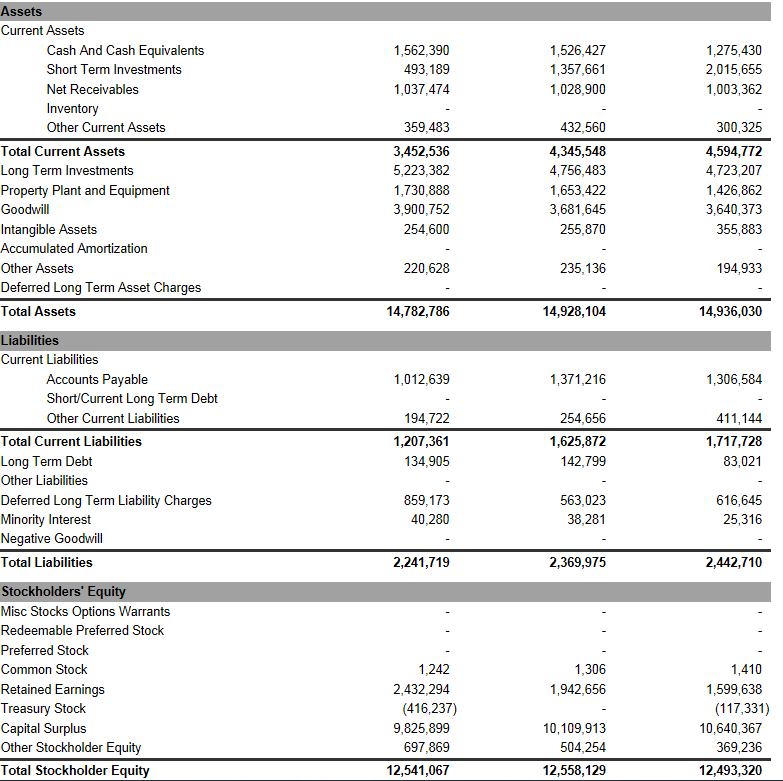

Background Information: Use the following Yahoo financial statements to complete the tasks listed below. Assume 1,180,000 shares and a market price of $16.00. Task: Using

Background Information: Use the following Yahoo financial statements to complete the tasks listed below. Assume 1,180,000 shares and a market price of $16.00.

Task:

Using the preceding information from the Yahoo financial statements, compute the following ratios:

Earnings Per Share

Price Per Earnings

Dividend Yield

Receivables Turnover

Days in Receivables

Inventory Turnover

Days in Inventory

Profit Margin

Return on Total Assets

Return on Stockholders Equity

Current Ratio

Quick Ratio

Period Ending Total Revenue Cost of Revenue Gross Profit Dec 31, 2011 4,984,199 1,502,650 3,481,549 Dec 31, 2010 6,324,651 2,627,545 3,697,106 Dec 31, 2009 6,460,315 2,871,746 3,588,569 erating Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses 1,005,090 1,618,106 24,420 33,592 2,681,208 1,082,176 1,752,823 57,957 31,626 2,924,582 1,210,168 1,825,702 126,901 39,106 3,201,877 Operating Income or Loss 800,341 772,524 386,692 erations come Total Other Income/Expenses Net Earnings Before InterestAnd Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest Net Income From Continuing 27,175 827,516 187,528 574,220 297,869 1,070,393 827,516 241,767 (13,842) 1,048,827 1,070,393 221,523 (12,965) 1,231,663 574,220 219,321 (7,297) 597,992 Ops vents on-re Discontinued Operations Extraordinary ltems Effect Of Accounting Changes Other Items Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 1,048,827 1,231,663 597,992 1,048,827 1,231,663 597,992Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started