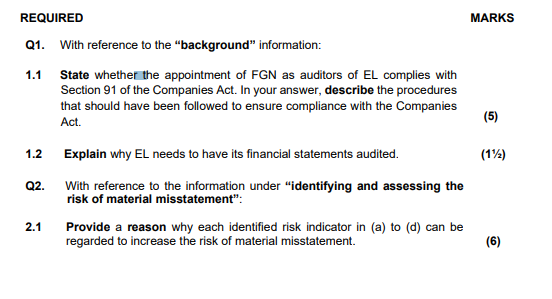

Question

Background information You are a first-year trainee auditor at Fisher, Gani and Nkosi Auditors (FGN), a medium-sized auditing firm founded in 2003. You have been

Background information

You are a first-year trainee auditor at Fisher, Gani and Nkosi Auditors (FGN), a medium-sized auditing firm founded in 2003. You have been assigned to the audit of a newly acquired client, Evergreen Lawn Ltd. (EL), for the financial year that ended 31 March 2023. EL has been listed on the Johannesburg Stock Exchange (JSE) for 20 years and its main business is selling variety of instant lawn to the public. FGN was appointed by the financial director as the auditors for EL after the financial year-end following the resignation of the previous auditors. The previous auditors filed a notice of their resignation on 15 January 2023. The financial director did not discuss the appointment of the new auditors with the rest of the EL board members. FGN was the only registered auditing firm considered for the appointment.

Identifying and assessing the risk of material misstatement:

In terms of the International Standard on Auditing (ISA) 315, the auditor is required to conduct risk assessment procedures to gather information about the client so that the identification and assessment of risks of material misstatement at the financial statement and assertion levels can take place. As part of your preliminary engagement activities, you identified the following risk indicators at EL:

a) EL aspires to expand the business and start with exports to Europe soon.

b) There are rumours that the financial director of EL might be involved in fraud, but the investigations are still underway.

c) The bank that handles the business account for EL requested a signed audit report by 30 April 2023 to re-negotiate the terms of the loan agreement, or for the loan to be paidup by 31 May 2023. EL would like to extend the repayment terms of the loan.

d) As a result of the regular load shedding, the internal controls relating to ELs accounting system did not always operate effectively during the financial year.

Assertions, audit procedures and audit evidence

In terms of ISA 330, the auditor shall design and implement overall responses to assessed risks of material misstatement at the financial statement level and should design and perform further audit procedures to respond to assessed risks relating to the assertions.

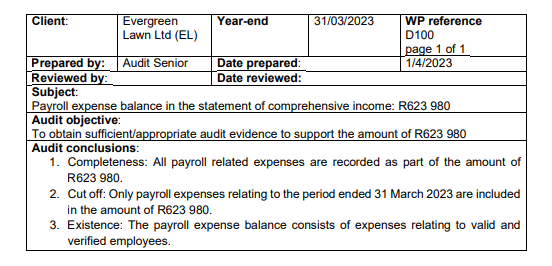

The provisional working paper for payroll:

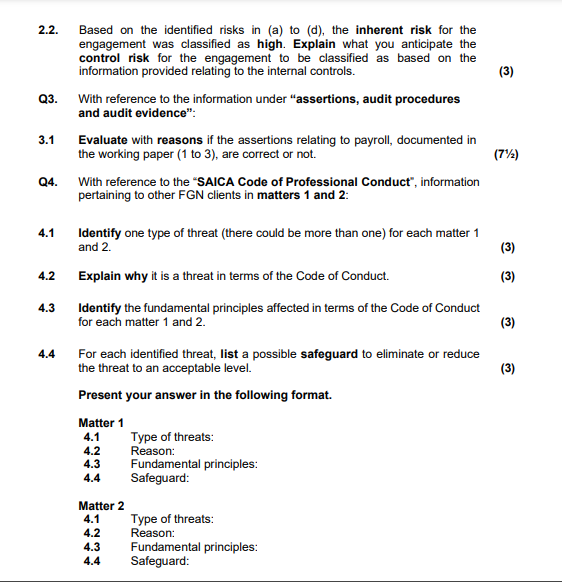

Matters pertaining to other FGN clients

SAICA Code of Professional Conduct

The following separate matters pertaining to other clients of FGN were brought to the attention of the respective engagement partners of FGN:

Matter 1

Cloe Denker, the audit partner responsible for the audit of Halo Ltd.s wife owns 15% of Halo Ltd.s share capital.

Matter 2

Helen Manyere, an audit manager at FGN, has been asked by her audit client to prepare the calculations of current and deferred tax liabilities to process the final journal entries before the audit starts.

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started