Question

Background InformationSaola Co. sells backpacks, laptop bags, briefcases, and other bags. The bags are purchased already made, then the Saola branding and finish is added.

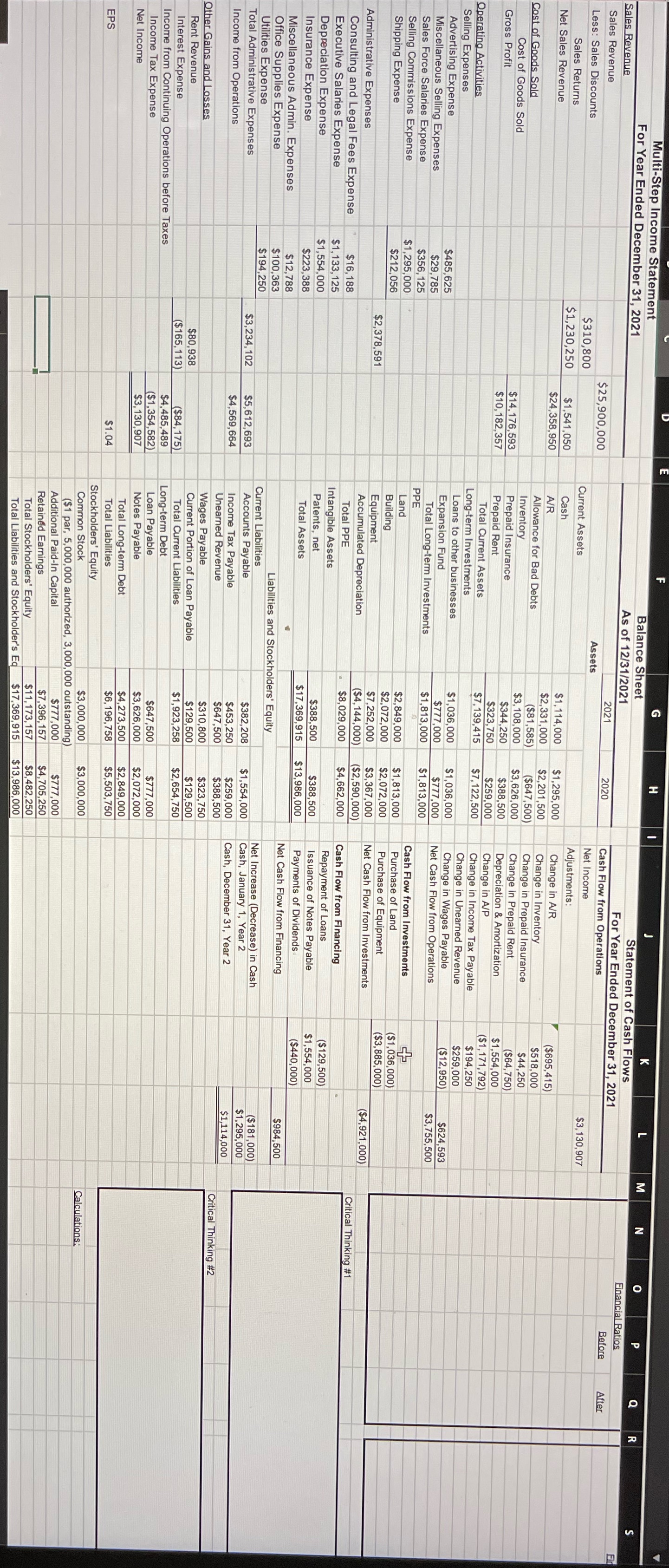

Background InformationSaola Co. sells backpacks, laptop bags, briefcases, and other bags. The bags are purchased already made, then the Saola branding and finish is added. Because of several exclusive contracts and high quality products, the company has a strong following in its home state of Georgia and the surrounding area. In addition to its own brand, the company also has contracts with many colleges, firms, and local organizations to sell bags with these other groups' logos. This practice has greatly increased Saola's sales, especially since the company is usually able to use lower quality inventory to fill these orders (this leads to lower costs for the other groups without damaging Saola's reputation).Because of its success during the past two (2) years, Saola was able to go public in January of last year. This has given the company additional capital to grow, as well as allowing the original owners to diversify some of their risk. Management's goal now is to begin marketing in the Northeast and Central regions of the country. If they are successful, they will continue on to the West Coast within a few years. Since much of their advertising is done through personal contacts and word of mouth, their growth will be slow. While that worries some of their new investors, recent economic trouble has left many investors pleased with the management team's more cautious growth.In their rush to go public, Saola's management has forgotten one small detail. They have not created a very strong accounting department. While their auditors have been willing to help them clean up their books in the past, the managers are starting to realize that their lack of in-house accounting expertise is a problem. During the past year they engaged in several transactions and decisions that might have important repercussions on their financial statements, and they didn't know it. In an effort to start cleaning up their accounting system, they have finally hired you and your partner. Your first job will be to go through Saola's decisions for the year and clean up any mistakes that have been made, and to record any transactions that have been missed. In the future, you will be expected to give management good advice about the accounting consequences of their actions before decisions are made.Based on recommendations from their auditor and SEC regulations, Saola uses an accrual accounting system based on U.S. GAAP. The company's fiscal year end is December 31st. Since Saola is a relatively small public company with an easy audit, the auditors don't usually arrive until about January 15th. However, you are expected to have the financial statements ready to go by January 1st so that upper management can issue an earnings announcement to the stockholders. Although an earnings announcement is known to be unaudited, investors are traditionally very harsh with companies that have a final earnings number below the initial earnings announcement. You will need to be as accurate as possible in order to avoid this type of market consequence.Saola has already completed most of the necessary transactions for the current year (see below). However, they have neglected to include several key pieces of information. Throughout the semester, you will be adding and incorporating this additional information to complete the company's financial report. Saola's tax rate is 30%.Information:Under new GAAP (the Current Expected Credit Loss or 'CECL' rules), companies are required to estimate their Allowance for Bad Debt based not only on their historical loss rates but also on current market conditions and future predictions. The accounting process is the same (debit Bad Debt Expense and credit Allowance for Bad Debt), but the estimate is different. Based on the new rules, Saola's management team has decided to adjust their historical rate based on a weighted average of their prediction of general economic risk in their area (weighted at 55.%) and on the credit risk of their customers (weighted at 45.%), as their loss rate. No adjusting entry has been made this year for bad debt.At the beginning of the year, Saola's collection team reported a historical loss rate of 5.%. They believe the local economy will grow by 1.% and that their average customer's credit risk has increased by 3.%. They have also decided to round their calculations to three (3) decimal places for consistency.In addition, the team reported that on December 31, they received a $12,000 payment from SSG, Inc. Saola closed SSG's account in July when they believed the company would not be able to pay any of their outstanding bill. No entries have been made for this transactions either.Saola's management would like to know the effect of these adjustments on the following ratios:? Quick Ratio ([Cash + Cash Equivalents + net A/R*] / Current Liabilities) ? Accounts Receivable Turnover Ratio (Net Sales / Average net A/R)? Current Ratio (Current Assets / Current Liabilities)Assignment:CalculationsMake the appropriate journal entries, if any, to account for the changes in receivables (including any necessary changes to income tax expense).Make any necessary changes to the financial statements.*Net A/R = A/R - Allowance for Bad debtCritical ThinkingCalculate each of the required ratios using the original values (before any changes) and the updated values (after your changes).Saola's VP of Marketing was concerned about the change in the recognized Allowance for Bad Debt, especially since her department has not changed any of their policies or procedures. How could you explain to her the need to use the new rules and the likely reaction of Saola's stakeholders to the change?The CFO, like many other financial leaders (including the VP of Marketing), has expressed frustration with the new CECL requirements for adjusting the loss rate. However, she has raised the possibility of using the new rules to improve future earnings. Since the company's financial results are strong this year, she has suggested increasing the loss rate so that they will have a higher bad debt expense and allowance this year, allowing them to record smaller expenses in the future. Assuming you feel that this suggestion would be misleading to investors, what business arguments could you use to convince the CFO not to create these "cookie jar reserves" for future years?Hints:You'll need to adjust A/R and the Allowance for Bad Debt for the write off and unexpected repayment BEFORE you can make the adjusting entry for bad debt. Since they are changing, I recommend creating t-accounts for both accounts. Once you have the updated balances for each account (after the adjustments), then you can use those updated balances and your adjusted loss rate to calculate the adjusting entry for bad debt.To calculate the percentage needed to estimate the ending Allowance for Bad Debt, you'll need to first calculate the weighted average of the economic and risk adjustments. For example, if they believe that economic risk will decrease by 10%, but that their customer's risk has increased by 4%, then they would subtract 3.7% from their historical loss rate. Remember to round to 3 decimal places!page8image48599200Economic Growth Credit RiskCECL AdjustmentCurrent Estimate-10.0% 4.0%Weight55.0% 45.0%Estimate-5.5% 1.8%-3.7%page8image485124323. Notice that I used negative for the current estimate for economic growth in the table above. If we think the economy will GROW, then the economic risk will SHRINK, so we use a NEGATIVE number for our current estimate. Similiarly, if we think our customer risk will DECREASE, then our risk will SHRINK and we'll use a negative number for our current estimate. Make sure you check the wording for Saola's assumptions so that you can use the correct sign!Final journal entries is what says next to financial ratios box. Please answer all questions .Thank you so much !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started