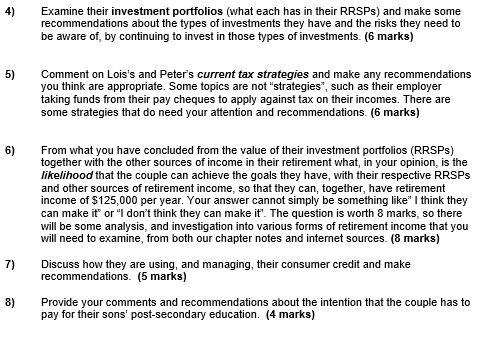

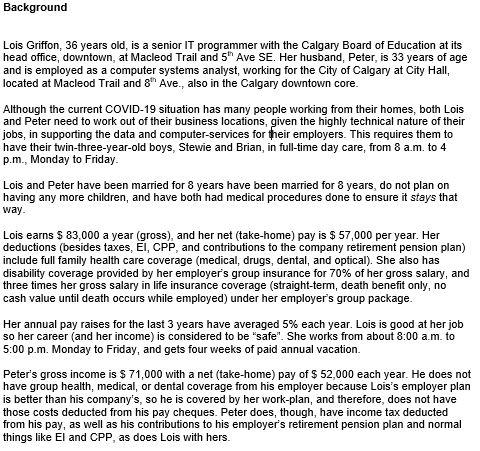

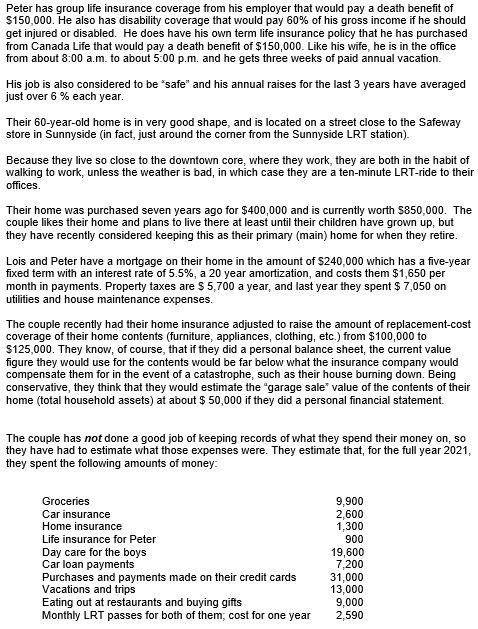

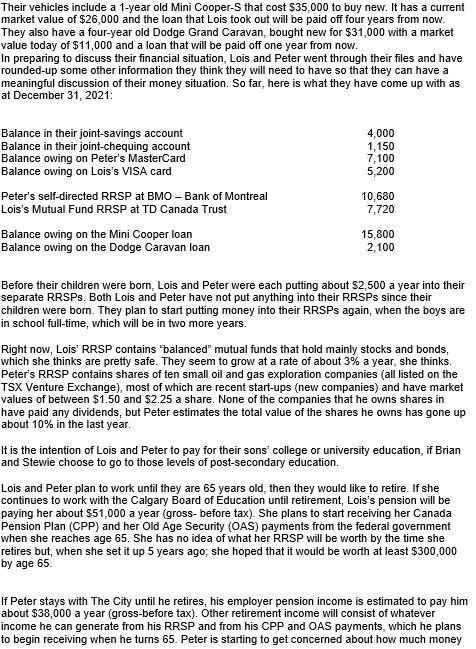

Background Lois Griffon, 36 years old, is a senior IT programmer with the Calgary Board of Education at its head office, downtown, at Macleod Trail and 5" Ave SE. Her husband, Peter, is 33 years of age and is employed as a computer systems analyst, working for the City of Calgary at City Hall, located at Macleod Trail and 8h Ave., also in the Calgary downtown core. Although the current COVID-19 situation has many people working from their homes, both Lois and Peter need to work out of their business locations, given the highly technical nature of their jobs, in supporting the data and computer-services for their employers. This requires them to have their twin-three-year-old boys, Stewie and Brian, in full-time day care, from 8 a.m. to 4 p.m., Monday to Friday Lois and Peter have been married for 8 years have been married for 8 years, do not plan on having any more children, and have both had medical procedures done to ensure it stays that way Lois earns $ 83,000 a year (gross), and her net (take-home) pay is $ 57,000 per year. Her deductions (besides taxes, EI, CPP, and contributions to the company retirement pension plan) include full family health care coverage (medical, drugs, dental, and optical). She also has disability coverage provided by her employer's group insurance for 70% of her gross salary, and three times her gross salary in life insurance coverage (straight-term, death benefit only, no cash value until death occurs while employed) under her employer's group package. Her annual pay raises for the last 3 years have averaged 5% each year. Lois is good at her job so her career and her income) is considered to be "safe". She works from about 8:00 am to 5:00 p.m. Monday to Friday, and gets four weeks of paid annual vacation. Peter's gross income is $ 71,000 with a net (take-home) pay of $ 52,000 each year. He does not have group health, medical, or dental coverage from his employer because Lois's employer plan is better than his company's, so he is covered by her work-plan, and therefore, does not have those costs deducted from his pay cheques. Peter does, though, have income tax deducted from his pay, as well as his contributions to his employer's retirement pension plan and normal things like El and CPP as does Lois with hers. Peter has group life insurance coverage from his employer that would pay a death benefit of $150,000. He also has disability coverage that would pay 60% of his gross income if he should get injured or disabled. He does have his own term life insurance policy that he has purchased from Canada Life that would pay a death benefit of $150,000. Like his wife, he is in the office from about 8:00 a.m. to about 5:00p.m. and he gets three weeks of paid annual vacation. His job is also considered to be "safe" and his annual raises for the last 3 years have averaged just over 6 % each year. Their 60-year-old home is in very good shape, and is located on a street close to the Safeway store in Sunnyside (in fact, just around the corner from the Sunnyside LRT station). Because they live so close to the downtown core, where they work, they are both in the habit of walking to work, unless the weather is bad, in which case they are a ten-minute LRT-ride to their offices. Their home was purchased seven years ago for $400,000 and is currently worth $850,000. The couple likes their home and plans to live there at least until their children have grown up, but they have recently considered keeping this as their primary (main) home for when they retire. Lois and Peter have a mortgage on their home in the amount of $240,000 which has a five-year fixed term with an interest rate of 5.5%, a 20 year amortization, and costs them $1,650 per month in payments. Property taxes are $ 5,700 a year, and last year they spent $ 7,050 on utilities and house maintenance expenses. The couple recently had their home insurance adjusted to raise the amount of replacement-cost coverage of their home contents (furniture, appliances, clothing, etc.) from $100,000 to $125,000. They know, of course, that if they did a personal balance sheet, the current value figure they would use for the contents would be far below what the insurance company would compensate them for in the event of a catastrophe, such as their house burning down. Being conservative, they think that they would estimate the garage sale value of the contents of their home (total household assets) at about $ 50,000 if they did a personal financial statement. The couple has not done a good job of keeping records of what they spend their money on, so they have had to estimate what those expenses were. They estimate that, for the full year 2021, they spent the following amounts of money Groceries Car insurance Home insurance Life insurance for Peter Day care for the boys Car loan payments Purchases and payments made on their credit cards Vacations and trips Eating out at restaurants and buying gifts Monthly LRT passes for both of them, cost for one year 9,900 2,600 1,300 900 19,600 7,200 31,000 13,000 9,000 2.590 Their vehicles include a 1-year old Mini Cooper-S that cost $35,000 to buy new. It has a current market value of $26,000 and the loan that Lois took out will be paid off four years from now. They also have a four-year old Dodge Grand Caravan, bought new for $31,000 with a market value today of $11,000 and a loan that will be paid off one year from now. In preparing to discuss their financial situation, Lois and Peter went through their files and have rounded-up some other information they think they will need to have so that they can have a meaningful discussion of their money situation. So far, here is what they have come up with as at December 31, 2021: 4,000 1,150 7,100 5,200 Balance in their joint-savings account Balance in their joint-chequing account Balance owing on Peter's MasterCard Balance owing on Lois's VISA card Peter's self-directed RRSP at BMO - Bank of Montreal Lois's Mutual Fund RRSP at TD Canada Trust Balance owing on the Mini Cooper loan Balance owing on the Dodge Caravan loan 10,680 7.720 15,800 2,100 Before their children were born, Lois and Peter were each putting about $2.500 a year into their separate RRSPs. Both Lois and Peter have not put anything into their RRSPs since their children were born. They plan to start putting money into their RRSPs again, when the boys are in school full-time, which will be in two more years. Right now, Lois' RRSP contains "balanced" mutual funds that hold mainly stocks and bonds, which she thinks are pretty safe. They seem to grow at a rate of about 3% a year, she thinks. Peter's RRSP contains shares of ten small oil and gas exploration companies (all listed on the TSX Venture Exchange), most of which are recent start-ups (new companies) and have market values of between $1.50 and $2.25 a share. None of the companies that he owns shares in have paid any dividends, but Peter estimates the total value of the shares he owns has gone up about 10% in the last year. It is the intention of Lois and Peter to pay for their sons' college or university education, if Brian and Stewie choose to go to those levels of post-secondary education. Lois and Peter plan to work until they are 65 years old, then they would like to retire. If she continues to work with the Calgary Board of Education until retirement, Lois's pension will be paying her about $51,000 a year (gross- before tax). She plans to start receiving her Canada Pension Plan (CPP) and her Old Age Security (OAS) payments from the federal government when she reaches age 65. She has no idea of what her RRSP will be worth by the time she retires but when she set it up 5 years ago; she hoped that it would be worth at least $300,000 by age 65 If Peter stays with The City until he retires, his employer pension income is estimated to pay him about $38,000 a year (gross-before tax). Other retirement income will consist of whatever income he can generate from his RRSP and from his CPP and OAS payments, which he plans to begin receiving when he turns 65. Peter is starting to get concerned about how much money he will actually be able to build into his RRSP by the time he reaches age 65 but, like his wife, originally thought he could have about $300,000 in his RRSP by the time he hits age 65. When they do retire, Lois and Peter would like to spend at least 3 months each winter in either Arizona or Mexico. With this being part of their plan, they believe they will need to have a joint (combined) gross-annual income, at retirement of at least $125,000 per year. Lois and Peter are not good at saving money, and even worse at knowing where the money goes. They use their credit cards to buy almost everything so they can build-up the Air Miles and other travel-points to take vacations on. Some months they pay large amounts of money against their credit card balances, other months they make only the minimum payments. Your Assignment 1) Using the concept that is contained in Exhibit 2 - 3 from the course textbook (a copy of which is on page 9), create a joint personal balance sheet as at Dec. 31, 2021 and provide your conclusions about what you see in their balance sheet. (5 marks for the balance sheet, and 5 marks for your conclusions) 2) 2) Using the concept that is contained in Exhibit 2 - 4 from the course textbook (a copy of which is on page 10) create a joint cash-flow statement as at Dec. 31, 2021 and provide your conclusions about what that cash-flow statement seems to indicate. (5 marks for the cash flow statement and 5 marks for your conclusions) Before you continue to do any more questions, show me your balance sheet and your cash-flow statement. If your numbers are "way off" in questions # 1 and # 2 (mainly in Q #2) your recommendations and conclusions for the rest of the case will be WRONG, which will DRASTICALLY REDUCE your grade earned, not just for your answers to questions 1 and 2 but for many of your conclusions and recommendations relating to the other questions, to follow. 3) Evaluate their risk-management situation (their use of insurance products to protect various aspects of their lives). We already know that they have home and vehicle insurance, so it is safe to conclude that they have a good grasp of that. You do not need to comment on home and vehicle insurance in this question. What this question does require you to do is to focus on the most importance part of the risk-management process, which involves life insurance, and whether the clients have adequate amounts of it. This is what you will do with this question. Chapter 9 provides you with the basic tools. One of those tools is "the family-need method", but we do not want you to use that tool. There is another, more appropriate, math-formula- based tool for you to use from Chapter 9 to obtain a solid appreciation of whether both Lois and Peter have adequate amounts of life insurance, based upon their current income situations. (6 marks) 4) Examine their investment portfolios (what each has in their RRSPs) and make some recommendations about the types of investments they have and the risks they need to be aware of, by continuing to invest in those types of investments. (6 marks) 5) Comment on Lois's and Peter's current tax strategies and make any recommendations you think are appropriate. Some topics are not "strategies", such as their employer taking funds from their pay cheques to apply against tax on their incomes. There are some strategies that do need your attention and recommendations. (6 marks) 6) From what you have concluded from the value of their investment portfolios (RRSPs) together with the other sources of income in their retirement what, in your opinion, is the likelihood that the couple can achieve the goals they have, with their respective RRSPS and other sources of retirement income, so that they can, together, have retirement income of $125,000 per year. Your answer cannot simply be something like I think they can make it" or "I don't think they can make it'. The question is worth 8 marks, so there will be some analysis, and investigation into various forms of retirement income that you will need to examine, from both our chapter notes and internet sources. (8 marks) 7) Discuss how they are using, and managing, their consumer credit and make recommendations. (5 marks) 8) 8 Provide your comments and recommendations about the intention that the couple has to pay for their sons' post-secondary education. (4 marks) Background Lois Griffon, 36 years old, is a senior IT programmer with the Calgary Board of Education at its head office, downtown, at Macleod Trail and 5" Ave SE. Her husband, Peter, is 33 years of age and is employed as a computer systems analyst, working for the City of Calgary at City Hall, located at Macleod Trail and 8h Ave., also in the Calgary downtown core. Although the current COVID-19 situation has many people working from their homes, both Lois and Peter need to work out of their business locations, given the highly technical nature of their jobs, in supporting the data and computer-services for their employers. This requires them to have their twin-three-year-old boys, Stewie and Brian, in full-time day care, from 8 a.m. to 4 p.m., Monday to Friday Lois and Peter have been married for 8 years have been married for 8 years, do not plan on having any more children, and have both had medical procedures done to ensure it stays that way Lois earns $ 83,000 a year (gross), and her net (take-home) pay is $ 57,000 per year. Her deductions (besides taxes, EI, CPP, and contributions to the company retirement pension plan) include full family health care coverage (medical, drugs, dental, and optical). She also has disability coverage provided by her employer's group insurance for 70% of her gross salary, and three times her gross salary in life insurance coverage (straight-term, death benefit only, no cash value until death occurs while employed) under her employer's group package. Her annual pay raises for the last 3 years have averaged 5% each year. Lois is good at her job so her career and her income) is considered to be "safe". She works from about 8:00 am to 5:00 p.m. Monday to Friday, and gets four weeks of paid annual vacation. Peter's gross income is $ 71,000 with a net (take-home) pay of $ 52,000 each year. He does not have group health, medical, or dental coverage from his employer because Lois's employer plan is better than his company's, so he is covered by her work-plan, and therefore, does not have those costs deducted from his pay cheques. Peter does, though, have income tax deducted from his pay, as well as his contributions to his employer's retirement pension plan and normal things like El and CPP as does Lois with hers. Peter has group life insurance coverage from his employer that would pay a death benefit of $150,000. He also has disability coverage that would pay 60% of his gross income if he should get injured or disabled. He does have his own term life insurance policy that he has purchased from Canada Life that would pay a death benefit of $150,000. Like his wife, he is in the office from about 8:00 a.m. to about 5:00p.m. and he gets three weeks of paid annual vacation. His job is also considered to be "safe" and his annual raises for the last 3 years have averaged just over 6 % each year. Their 60-year-old home is in very good shape, and is located on a street close to the Safeway store in Sunnyside (in fact, just around the corner from the Sunnyside LRT station). Because they live so close to the downtown core, where they work, they are both in the habit of walking to work, unless the weather is bad, in which case they are a ten-minute LRT-ride to their offices. Their home was purchased seven years ago for $400,000 and is currently worth $850,000. The couple likes their home and plans to live there at least until their children have grown up, but they have recently considered keeping this as their primary (main) home for when they retire. Lois and Peter have a mortgage on their home in the amount of $240,000 which has a five-year fixed term with an interest rate of 5.5%, a 20 year amortization, and costs them $1,650 per month in payments. Property taxes are $ 5,700 a year, and last year they spent $ 7,050 on utilities and house maintenance expenses. The couple recently had their home insurance adjusted to raise the amount of replacement-cost coverage of their home contents (furniture, appliances, clothing, etc.) from $100,000 to $125,000. They know, of course, that if they did a personal balance sheet, the current value figure they would use for the contents would be far below what the insurance company would compensate them for in the event of a catastrophe, such as their house burning down. Being conservative, they think that they would estimate the garage sale value of the contents of their home (total household assets) at about $ 50,000 if they did a personal financial statement. The couple has not done a good job of keeping records of what they spend their money on, so they have had to estimate what those expenses were. They estimate that, for the full year 2021, they spent the following amounts of money Groceries Car insurance Home insurance Life insurance for Peter Day care for the boys Car loan payments Purchases and payments made on their credit cards Vacations and trips Eating out at restaurants and buying gifts Monthly LRT passes for both of them, cost for one year 9,900 2,600 1,300 900 19,600 7,200 31,000 13,000 9,000 2.590 Their vehicles include a 1-year old Mini Cooper-S that cost $35,000 to buy new. It has a current market value of $26,000 and the loan that Lois took out will be paid off four years from now. They also have a four-year old Dodge Grand Caravan, bought new for $31,000 with a market value today of $11,000 and a loan that will be paid off one year from now. In preparing to discuss their financial situation, Lois and Peter went through their files and have rounded-up some other information they think they will need to have so that they can have a meaningful discussion of their money situation. So far, here is what they have come up with as at December 31, 2021: 4,000 1,150 7,100 5,200 Balance in their joint-savings account Balance in their joint-chequing account Balance owing on Peter's MasterCard Balance owing on Lois's VISA card Peter's self-directed RRSP at BMO - Bank of Montreal Lois's Mutual Fund RRSP at TD Canada Trust Balance owing on the Mini Cooper loan Balance owing on the Dodge Caravan loan 10,680 7.720 15,800 2,100 Before their children were born, Lois and Peter were each putting about $2.500 a year into their separate RRSPs. Both Lois and Peter have not put anything into their RRSPs since their children were born. They plan to start putting money into their RRSPs again, when the boys are in school full-time, which will be in two more years. Right now, Lois' RRSP contains "balanced" mutual funds that hold mainly stocks and bonds, which she thinks are pretty safe. They seem to grow at a rate of about 3% a year, she thinks. Peter's RRSP contains shares of ten small oil and gas exploration companies (all listed on the TSX Venture Exchange), most of which are recent start-ups (new companies) and have market values of between $1.50 and $2.25 a share. None of the companies that he owns shares in have paid any dividends, but Peter estimates the total value of the shares he owns has gone up about 10% in the last year. It is the intention of Lois and Peter to pay for their sons' college or university education, if Brian and Stewie choose to go to those levels of post-secondary education. Lois and Peter plan to work until they are 65 years old, then they would like to retire. If she continues to work with the Calgary Board of Education until retirement, Lois's pension will be paying her about $51,000 a year (gross- before tax). She plans to start receiving her Canada Pension Plan (CPP) and her Old Age Security (OAS) payments from the federal government when she reaches age 65. She has no idea of what her RRSP will be worth by the time she retires but when she set it up 5 years ago; she hoped that it would be worth at least $300,000 by age 65 If Peter stays with The City until he retires, his employer pension income is estimated to pay him about $38,000 a year (gross-before tax). Other retirement income will consist of whatever income he can generate from his RRSP and from his CPP and OAS payments, which he plans to begin receiving when he turns 65. Peter is starting to get concerned about how much money he will actually be able to build into his RRSP by the time he reaches age 65 but, like his wife, originally thought he could have about $300,000 in his RRSP by the time he hits age 65. When they do retire, Lois and Peter would like to spend at least 3 months each winter in either Arizona or Mexico. With this being part of their plan, they believe they will need to have a joint (combined) gross-annual income, at retirement of at least $125,000 per year. Lois and Peter are not good at saving money, and even worse at knowing where the money goes. They use their credit cards to buy almost everything so they can build-up the Air Miles and other travel-points to take vacations on. Some months they pay large amounts of money against their credit card balances, other months they make only the minimum payments. Your Assignment 1) Using the concept that is contained in Exhibit 2 - 3 from the course textbook (a copy of which is on page 9), create a joint personal balance sheet as at Dec. 31, 2021 and provide your conclusions about what you see in their balance sheet. (5 marks for the balance sheet, and 5 marks for your conclusions) 2) 2) Using the concept that is contained in Exhibit 2 - 4 from the course textbook (a copy of which is on page 10) create a joint cash-flow statement as at Dec. 31, 2021 and provide your conclusions about what that cash-flow statement seems to indicate. (5 marks for the cash flow statement and 5 marks for your conclusions) Before you continue to do any more questions, show me your balance sheet and your cash-flow statement. If your numbers are "way off" in questions # 1 and # 2 (mainly in Q #2) your recommendations and conclusions for the rest of the case will be WRONG, which will DRASTICALLY REDUCE your grade earned, not just for your answers to questions 1 and 2 but for many of your conclusions and recommendations relating to the other questions, to follow. 3) Evaluate their risk-management situation (their use of insurance products to protect various aspects of their lives). We already know that they have home and vehicle insurance, so it is safe to conclude that they have a good grasp of that. You do not need to comment on home and vehicle insurance in this question. What this question does require you to do is to focus on the most importance part of the risk-management process, which involves life insurance, and whether the clients have adequate amounts of it. This is what you will do with this question. Chapter 9 provides you with the basic tools. One of those tools is "the family-need method", but we do not want you to use that tool. There is another, more appropriate, math-formula- based tool for you to use from Chapter 9 to obtain a solid appreciation of whether both Lois and Peter have adequate amounts of life insurance, based upon their current income situations. (6 marks) 4) Examine their investment portfolios (what each has in their RRSPs) and make some recommendations about the types of investments they have and the risks they need to be aware of, by continuing to invest in those types of investments. (6 marks) 5) Comment on Lois's and Peter's current tax strategies and make any recommendations you think are appropriate. Some topics are not "strategies", such as their employer taking funds from their pay cheques to apply against tax on their incomes. There are some strategies that do need your attention and recommendations. (6 marks) 6) From what you have concluded from the value of their investment portfolios (RRSPs) together with the other sources of income in their retirement what, in your opinion, is the likelihood that the couple can achieve the goals they have, with their respective RRSPS and other sources of retirement income, so that they can, together, have retirement income of $125,000 per year. Your answer cannot simply be something like I think they can make it" or "I don't think they can make it'. The question is worth 8 marks, so there will be some analysis, and investigation into various forms of retirement income that you will need to examine, from both our chapter notes and internet sources. (8 marks) 7) Discuss how they are using, and managing, their consumer credit and make recommendations. (5 marks) 8) 8 Provide your comments and recommendations about the intention that the couple has to pay for their sons' post-secondary education. (4 marks)