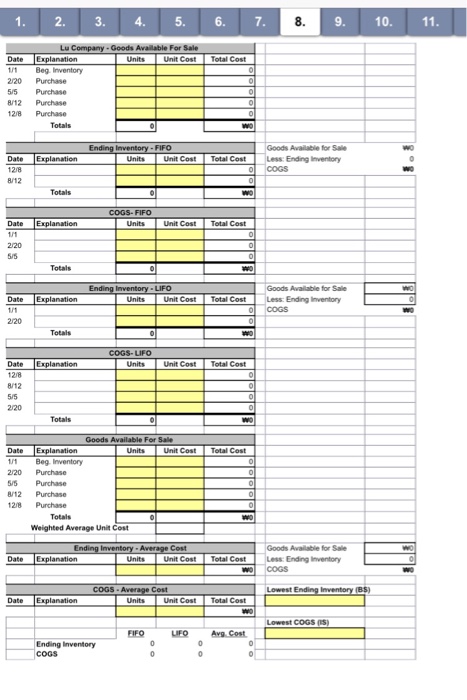

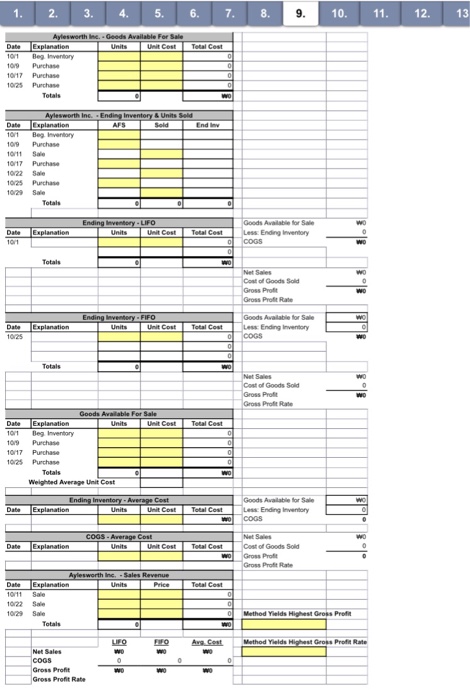

Background Merchandising businesses no longer have to determine Ending Inventory and Cost Goods Sold (COGS) valuations manually. 1. Inventory purchases and sales are taled 2. Costs are applied using FIF0, LIF0, or Weighted Average costfom assumptions Ending Inventory & C0GS amounts are calculated 4. Gross Profit & GNoss Prof Rales are calculated To help you understand these processes, this assignmentrequres youto enter Inventory-elated Mems and calculate the FIFO, LIF0, and Weighted-Average Ending Inventory& Costo GoodsSold(COGS valuations and calculate the Gross PNoftand GNoss Profit Rates for each approach. Use the folowing tactpatternto complete the appropriate tabsinthe A1 Workbook, posted on Blackboard. C.Lu Company had a beginning inventory of400 units of Item 1 (the only productsold by te company. ata cost 38 per unit. During the year, purchases were: 600 units at $9 Aug 12 300 units at $11 May 500 units at SIO 2 units at S12 Lu Company uses a periodic imventory system. Sales totaled 1,500 units. ab 1. Enter the purchase data necessary to Goods Avalable to Sale secton ofthe worksheet. 2. Enter the appropriate amounts to calculate Ending lnventory and Costo GoodsSold(COGS) under each of the assumed cost fow methods (FIF0, LIF0, and Average). 3, Determine and enterin cells G52 and G55 which cost fow method resultsin: 3.1. the lowest Ending Inventory amount for the Balance Sheet (Cel G52. 3.2 the lowest COGS for the Income Statement (Cell G55). D. Data tom Aylesworth Inc. for the month ended October 31, 2012 is as follows: Unit Cost or Description Units Selling Price Beginning inventory October 1 October 17 Purchase October 25 October 29 Sale 110 Aylesworth uses the periodic method forinventory. ab Enter the purchase data necessary to Goods Avalable tor Sale sectonotte worksheet 2. Enter the appropriate amounts to calculate Ending Inventory, Cost otGoods Sold(COGS.Gross Proft, and Gross Profit Rates under each of the assumed cost low methods (FIFO,LIFO, and Average. 3. Determine and enterincels G62 and G65 which cost fow method Nesutsin 31. the highest Gross Profit (CelG62) 32. the highest Gross Protr Rate (Cel G65)