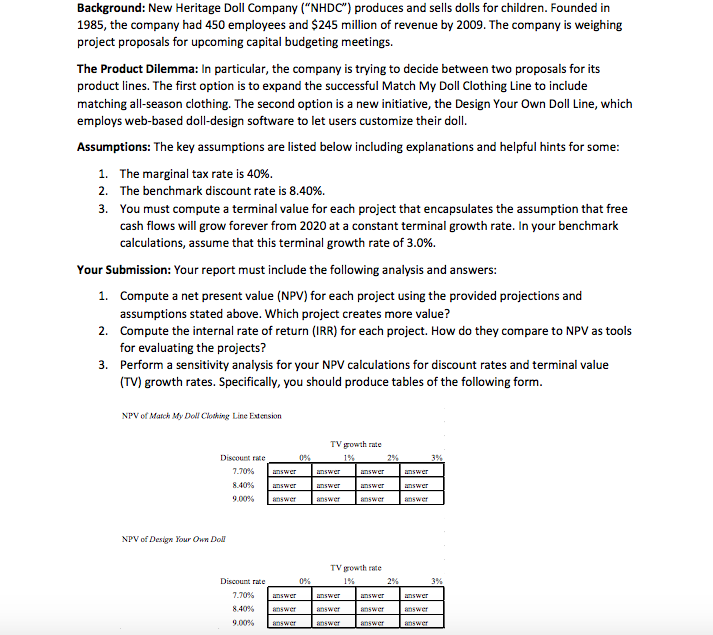

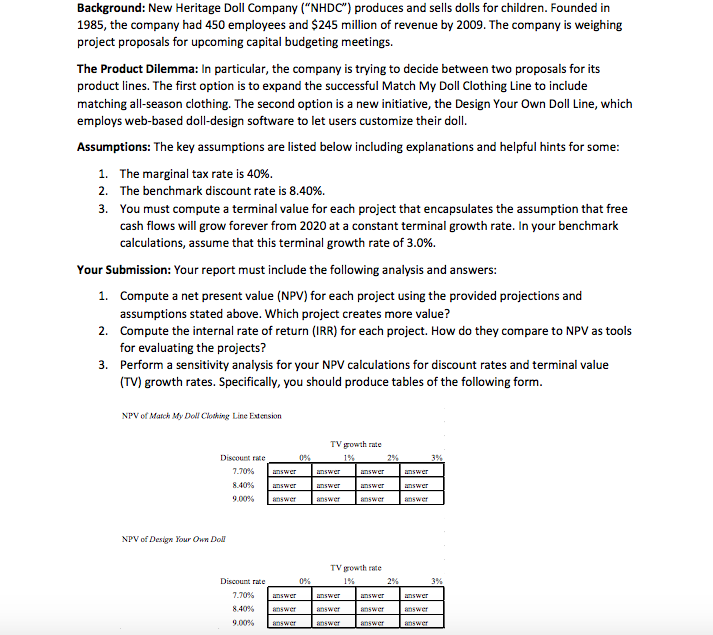

Background: New Heritage Doll Company ("NHDC") produces and sells dolls for children. Founded in 1985, the company had 450 employees and $245 million of revenue by 2009. The company is weighing project proposals for upcoming capital budgeting meetings. The Product Dilemma: In particular, the company is trying to decide between two proposals for its product lines. The first option is to expand the successful Match My Doll Clothing Line to include matching all-season clothing. The second option is a new initiative, the Design Your Own Doll Line, which employs web-based doll-design software to let users customize their doll. Assumptions: The key assumptions are listed below including explanations and helpful hints for some: 1. The marginal tax rate is 40%. 2. The benchmark discount rate is 8.40%. 3. You must compute a terminal value for each project that encapsulates the assumption that free cash flows will grow forever from 2020 at a constant terminal growth rate. In your benchmark calculations, assume that this terminal growth rate of 3.0%. Your Submission: Your report must include the following analysis and answers: 1. Compute a net present value (NPV) for each project using the provided projections and assumptions stated above. Which project creates more value? 2. Compute the internal rate of return (IRR) for each project. How do they compare to NPV as tools for evaluating the projects? 3. Perform a sensitivity analysis for your NPV calculations for discount rates and terminal value (TV) growth rates. Specifically, you should produce tables of the following form. NPV of March My Doll Clocking Line Extension TV growth rate 0 answer answer Discount re 7.70% 8 40% 9.00% answer answer answer answer answer NPV of Design Your Own Doll TV powth rate 0% Discount rate 7.70% 8.40% answer answer Background: New Heritage Doll Company ("NHDC") produces and sells dolls for children. Founded in 1985, the company had 450 employees and $245 million of revenue by 2009. The company is weighing project proposals for upcoming capital budgeting meetings. The Product Dilemma: In particular, the company is trying to decide between two proposals for its product lines. The first option is to expand the successful Match My Doll Clothing Line to include matching all-season clothing. The second option is a new initiative, the Design Your Own Doll Line, which employs web-based doll-design software to let users customize their doll. Assumptions: The key assumptions are listed below including explanations and helpful hints for some: 1. The marginal tax rate is 40%. 2. The benchmark discount rate is 8.40%. 3. You must compute a terminal value for each project that encapsulates the assumption that free cash flows will grow forever from 2020 at a constant terminal growth rate. In your benchmark calculations, assume that this terminal growth rate of 3.0%. Your Submission: Your report must include the following analysis and answers: 1. Compute a net present value (NPV) for each project using the provided projections and assumptions stated above. Which project creates more value? 2. Compute the internal rate of return (IRR) for each project. How do they compare to NPV as tools for evaluating the projects? 3. Perform a sensitivity analysis for your NPV calculations for discount rates and terminal value (TV) growth rates. Specifically, you should produce tables of the following form. NPV of March My Doll Clocking Line Extension TV growth rate 0 answer answer Discount re 7.70% 8 40% 9.00% answer answer answer answer answer NPV of Design Your Own Doll TV powth rate 0% Discount rate 7.70% 8.40%