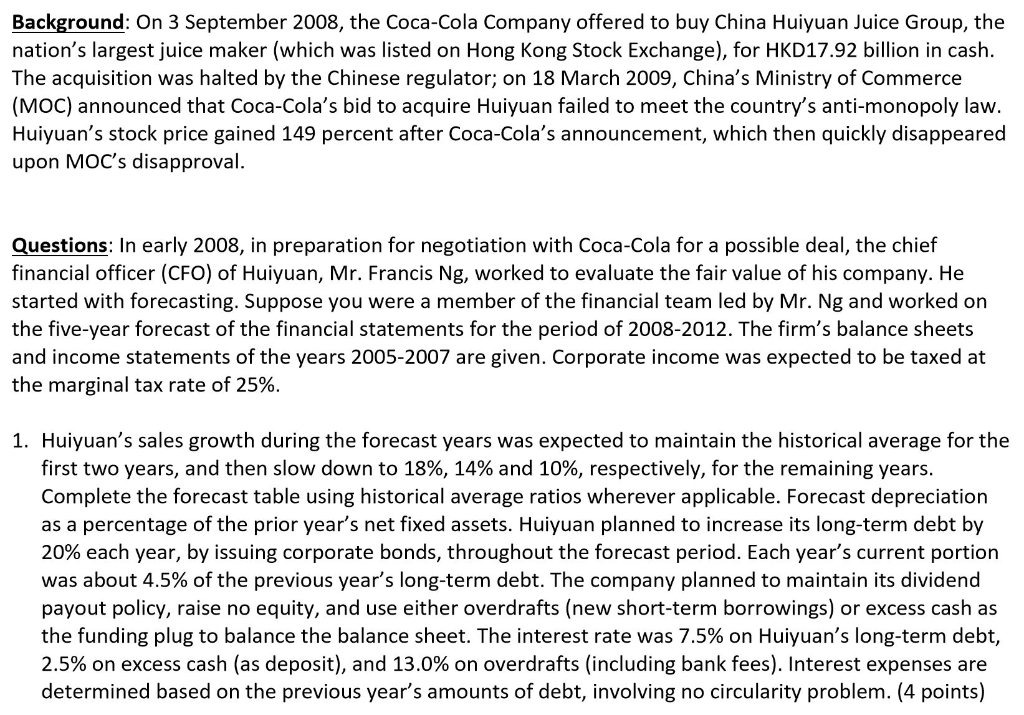

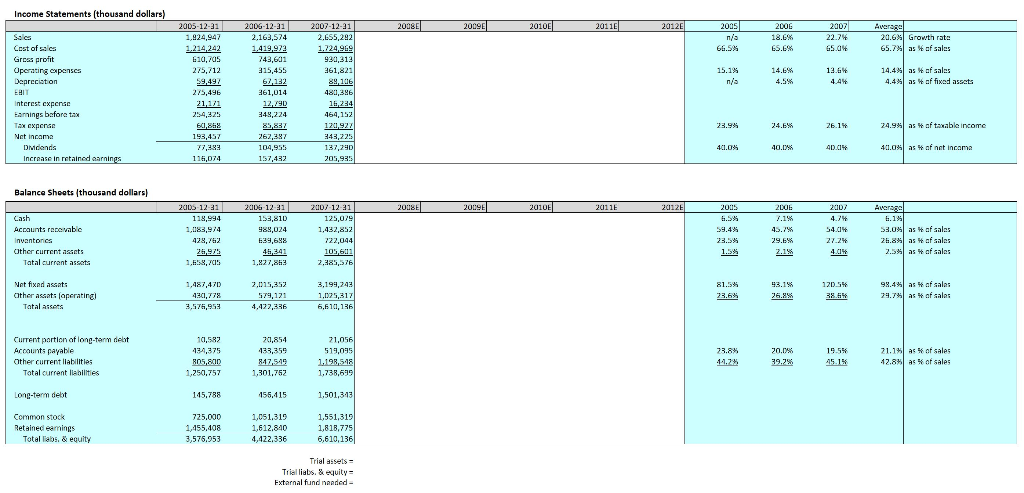

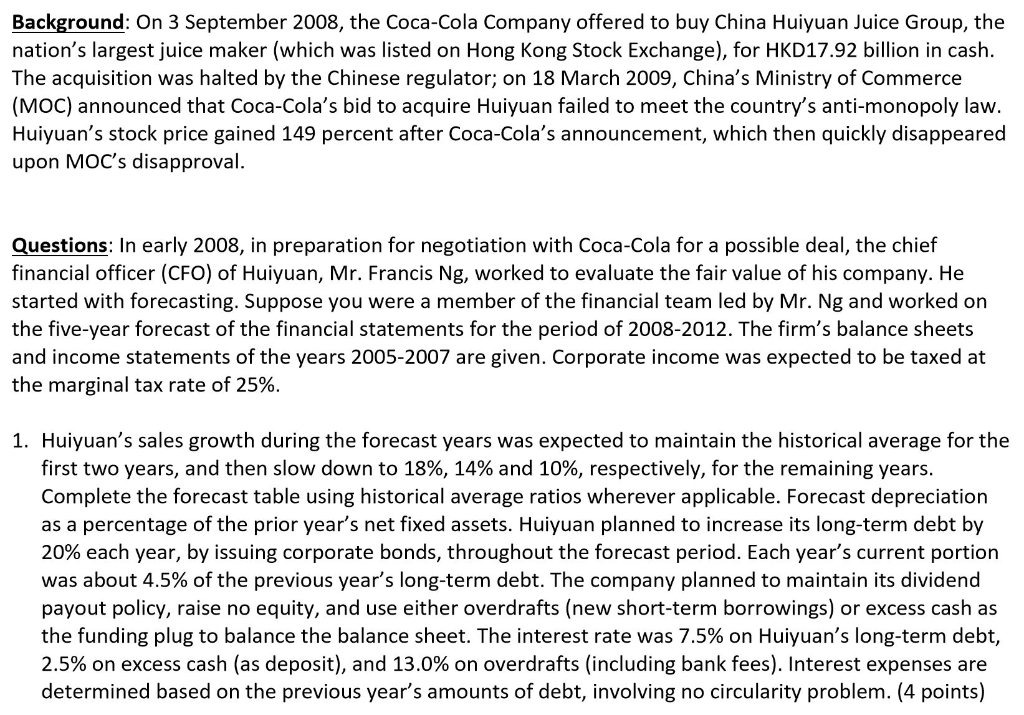

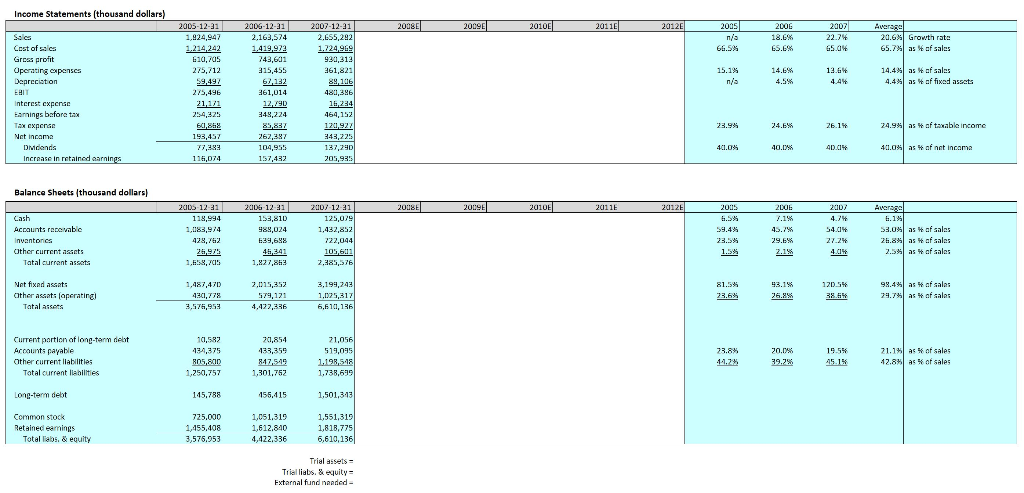

Background: On 3 September 2008, the Coca-Cola Company offered to buy China Huiyuan Juice Group, the nation's largest juice maker (which was listed on Hong Kong Stock Exchange), for HKD17.92 billion in cash. The acquisition was halted by the Chinese regulator; on 18 March 2009, China's Ministry of Commerce (MOC) announced that Coca-Cola's bid to acquire Huiyuan failed to meet the country's anti-monopoly law. Huiyuan's stock price gained 149 percent after Coca-Cola's announcement, which then quickly disappeared upon MOC's disapproval. Questions: In early 2008, in preparation for negotiation with Coca-Cola for a possible deal, the chief financial officer (CFO) of Huiyuan, Mr. Francis Ng, worked to evaluate the fair value of his company. He started with forecasting. Suppose you were a member of the financial team led by Mr. Ng and worked on the five-year forecast of the financial statements for the period of 2008-2012. The firm's balance sheets and income statements of the years 2005-2007 are given. Corporate income was expected to be taxed at the marginal tax rate of 25%. 1. Huiyuan's sales growth during the forecast years was expected to maintain the historical average for the first two years, and then slow down to 18%, 14% and 10%, respectively, for the remaining years. Complete the forecast table using historical average ratios wherever applicable. Forecast depreciation as a percentage of the prior year's net fixed assets. Huiyuan planned to increase its long-term debt by 20% each year, by issuing corporate bonds, throughout the forecast period. Each year's current portion was about 4.5% of the previous year's long-term debt. The company planned to maintain its dividend payout policy, raise no equity, and use either overdrafts (new short-term borrowings) or excess cash as the funding plug to balance the balance sheet. The interest rate was 7.5% on Huiyuan's long-term debt, 2.5% on excess cash (as deposit), and 13.0% on overdrafts (including bank fees). Interest expenses are determined based on the previous year's amounts of debt, involving no circularity problem. (4 points) Income Statements (thousand dollars) 2008 2009 2010 20110 2 0126 2005 2006 18.6% 65.6% 2007 22.74 65.04 Average 23.6 Growth rate 65.7% as of sales 66.5% Cost of sales Gross profit Operating expenses Depreciation 2005-12-31 1.924,947 1.224,242 610,705 275,712 54.492 275,496 21.171 13.6 15.15 nis 14.6% 4.5% 14.4 4.4 as Haf sales as affixed assets 2006-12-31 2,163,574 1.419,972 243,601 315,455 6232 361,014 72/90 348,224 837 262,387 104,955 157.432 2007-12-31 2.655,292 1,224969 920,313 361,822 89,106 48.1,29 16,234 464,152 120,927 344,225 137,290 205,935 23.95 26.14 24.95 as of taxable income interest cxpcnac Esmings bafore tax Tax experte Net income DMdonds Increase in retained aarnings BIKE 195,457 77,483 116,074 401.0% 40,146 40.0% 0.0% as of not income Balance Sheets (thousand dollars) 2008 2009 2010 2011 2012 2005 2006 2007 4.2 2005-12-31 118,994 1,083,974 428,762 26,975 Cash Accounts recevable Invantones Other current assets Tatal current assets 59.4% 2008-12-31 153,810 989,024 E39,698 45,341 1.827,853 2017-12-31 125,079 1.432,852 722,044 105,601 2.885,576 45.76 29.6% 2.18 Average 1.18 53.0% as Haf sales 26.8% as Haf sales 2.5% as of sales 4.04 Not fixed assets Other assot: laperating) Tatal assers 1,487,470 4301,778 3,576,953 2,015,352 579,171 4.427,336 3,199,243 1,025,317 6,6101, 136 81.5% 23.65 93.18 26.8% 120.5% 38.5% 98.4% as of sales 29.74 W af sales 10,582 Current portion of long-term delit Accounts payable Other current liabilities Total current liabilities 20,854 433,359 842,549 1,301,752 21,056 519,095 1.108,548 1.738,699 23.8% 11.25 20.0% 39.25 19.5% 15.1% 21.1% 12.8% of sales of sales as 805, AD 1,250,757 Long-term debt 145,788 155,415 1.501,313 Common stock Retained earings Total labs & equity 725.000 1,455,108 3.575,953 1,051,319 1,612.840 4.422.336 1,551,319 1.818,775 6.610,136 Trial assets Trial liabs & equity = External fund nanded