Question

Background QML is a company that manufactures office equipment, and it has been privately held by the John Edwards family for 3 generations. The company

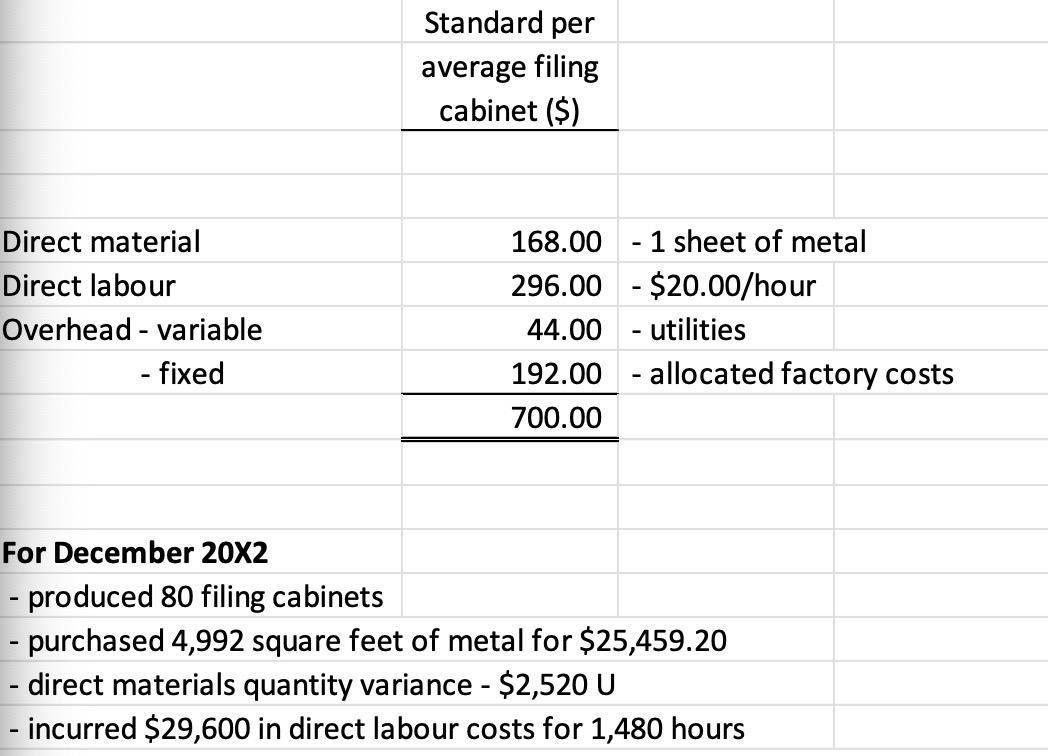

Background QML is a company that manufactures office equipment, and it has been privately held by the John Edwards family for 3 generations. The company has been quite successful for the last 10 years and employs 200 people. The company manufactures many different office products but one of their higher margin product lines is the filing cabinet line. QML sells approximately 1,000 filing cabinets per year at an average selling price of $1,000 per cabinet. The equipment purchase that QML is considering is a metal fabricating machine that will build all of the metal cabinets that are used for the filing cabinets that QML sells. The equipment will take up about 10,000 square feet of shop space since it completes several processes. Raw materials (in the form of 4- foot by 8-foot sheets of metal that are 1 millimetre thick) are placed into the machine at the beginning of the process and they are cut into the various pieces needed for the specified filing cabinet run. The second process then folds the cut pieces into the shape of the final product and the third process spot welds the joints. The filing cabinet is then ready for painting. Up to now, QML has been manufacturing the filing cabinets with smaller, older pieces of metal fabrication equipment that are rather labour intensive. The New Machine The new machine will cost $1,000,000 and have a useful life of 10 years. The new machine will result in less scrap metal which is estimated to save $35,000 per year and reduce labour costs which is estimated to save $75,000 per year. However, the new machine will require a major overhaul at the end of year 6 which is estimated to cost $100,000. QML will have sufficient taxable income to be able to deduct all of the 20% CCA each year over the useful life of the machine. Due to inflation and the major overhaul that is required in year 6, John feels the salvage value after 10 years will actually be equal to the company’s original purchase price. Since the machine is somewhat specialized, it will have to be paid for in full when QML places the order for the machine. QML expects to place the order on March 31, 20X3. Unfavourable variances The new machine is expected to reduce the quantity of scrap which should reduce the direct material actual quantity for a filing cabinet by 17%. In addition, the manufacturers of the new machine claim that less labour will be required than what the company is presently incurring so QML is predicting a 20% reduction in the actual labour quantity for a filing cabinet. For the month of December 20X2, the following amounts were recorded.

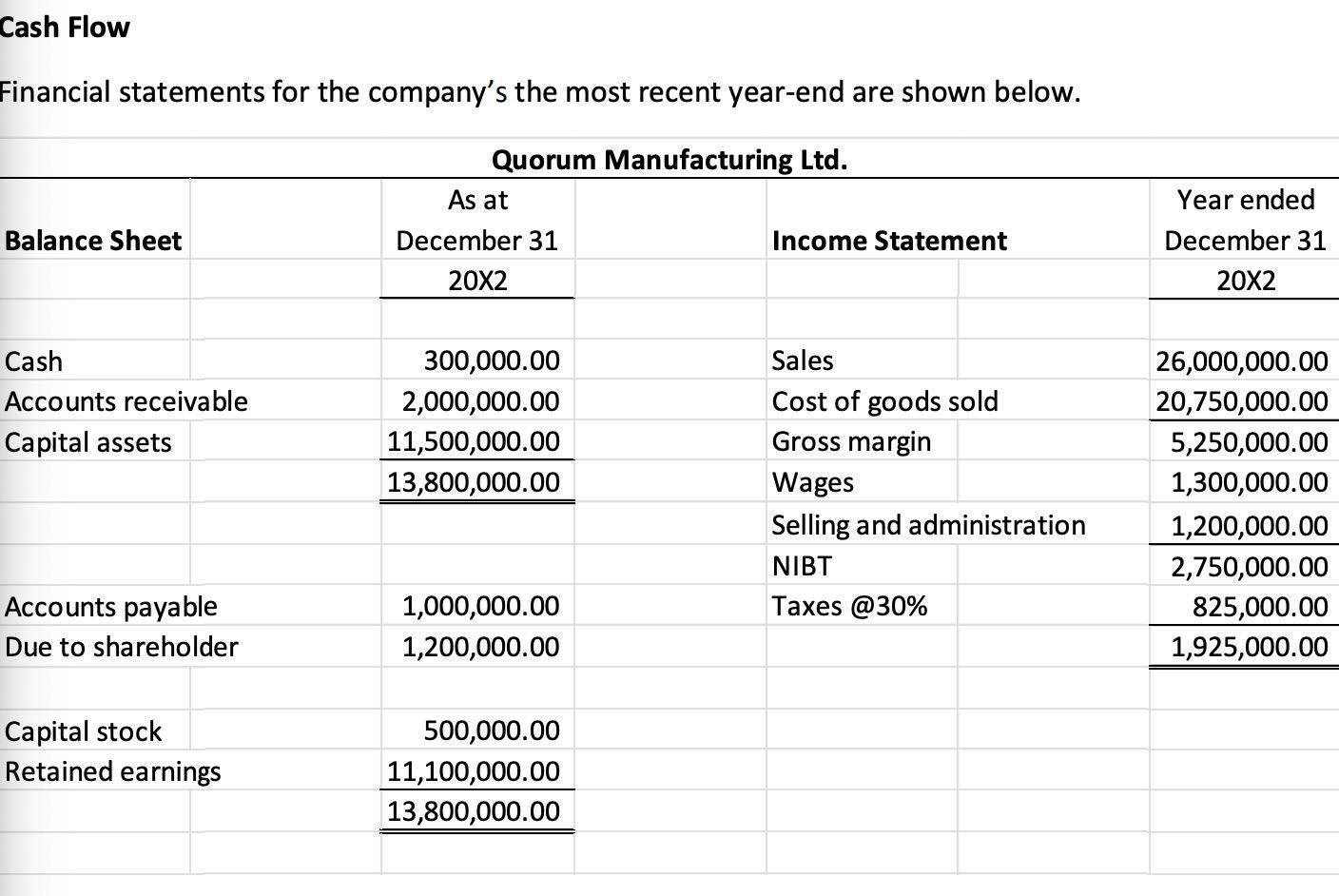

QML is going to make some changes to improve cash flow to hopefully have the required payment for the new machine at the end of March 20X3. QML is planning to collect 95% of the current months sales in the month following the sale (the remaining 5% will remain in accounts receivable for now) and the company will defer cash payments by paying amounts as shown below: COGS & Selling and administration – paid ½ in the month of the expense and ½ in the month following the expense Wages – paid in the month incurred. All wages for the company are posted to this account. Taxes – paid in the month of the expense QML expects the gross margin percentage to be 20% for each month in the 1st quarter of 20X3 and 20X3 sales are estimated to be $2,000,000 in January, $2,500,000 in February and $3,000,000 in March. December 20X2 accounts receivable will be collected in January 20X3 and December 20X2 accounts payable will be paid in January 20X3. No dividend or shareholder payments are planned for the next 12 months and selling and administration expenses are fixed and wages are variable.Jack Austin Jack Austin of A1 Metal Fabrication is a long-time friend of John’s and Jack has been in the metal fabrication business for years. He has developed an excellent reputation for delivering good quality products on time. Jack has offered to supply all of the metal filing cabinets at an average price of $525.00. When John reviews the standard cost figures above ($700) he cannot understand why it wouldn’t be better to purchase the cabinets from Jack since Jack would only charge $525. Also, John figures that the company could rent out the vacant space that would be freed up if the company was not producing the cabinets. John estimates the company could receive $5.00 per square foot per year for the vacant space.

QML is going to make some changes to improve cash flow to hopefully have the required payment for the new machine at the end of March 20X3. QML is planning to collect 95% of the current months sales in the month following the sale (the remaining 5% will remain in accounts receivable for now) and the company will defer cash payments by paying amounts as shown below: COGS & Selling and administration – paid ½ in the month of the expense and ½ in the month following the expense Wages – paid in the month incurred. All wages for the company are posted to this account. Taxes – paid in the month of the expense QML expects the gross margin percentage to be 20% for each month in the 1st quarter of 20X3 and 20X3 sales are estimated to be $2,000,000 in January, $2,500,000 in February and $3,000,000 in March. December 20X2 accounts receivable will be collected in January 20X3 and December 20X2 accounts payable will be paid in January 20X3. No dividend or shareholder payments are planned for the next 12 months and selling and administration expenses are fixed and wages are variable.Jack Austin Jack Austin of A1 Metal Fabrication is a long-time friend of John’s and Jack has been in the metal fabrication business for years. He has developed an excellent reputation for delivering good quality products on time. Jack has offered to supply all of the metal filing cabinets at an average price of $525.00. When John reviews the standard cost figures above ($700) he cannot understand why it wouldn’t be better to purchase the cabinets from Jack since Jack would only charge $525. Also, John figures that the company could rent out the vacant space that would be freed up if the company was not producing the cabinets. John estimates the company could receive $5.00 per square foot per year for the vacant space.

Required

1) Prepare a capital budget calculation to determine if the new machine meets the company’s capital investment threshold. Also, list any qualitative issues that should be considered.

2) For the December 20X2 results, calculate the following variances and show all figures used to calculate the variances:

a. Direct materials – price and quantity variance

b. Direct labour – rate and efficiency variance

3) What will the direct material quantity variance and the direct labour efficiency variance become if the savings mentioned in the question are realized? Show all calculations

4) Calculate the budgeted cash balance for March 20X3 and determine if the there will be sufficient cash on hand to purchase the new machine. If there is not sufficient cash, what options are there for John to generate the cash to complete the purchase? Show all work in an organized fashion.

5) Using the standard cost figures shown above of $700 per cabinet, would you accept Jack Austin’s offer? Show all calculations and list any qualitative issues that should also be addressed.

Direct material Direct labour Overhead - variable - fixed Standard per average filing cabinet ($) 168.001 sheet of metal 296.00 - $20.00/hour 44.00 utilities 192.00 700.00 allocated factory costs For December 20X2 - produced 80 filing cabinets - purchased 4,992 square feet of metal for $25,459.20 direct materials quantity variance - $2,520 U - incurred $29,600 in direct labour costs for 1,480 hours

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

1 The capital budget calculation is as follows NPV 1000000 3500012 7500012 10000012 1000000 29167 62...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started