Question

It is early January, 2017, and you are a member of the board of directors of Soledad National Ban-corp, located in Soledad, California. The board

It is early January, 2017, and you are a member of the board of directors of Soledad National Ban-corp, located in Soledad, California. The board is meeting to decide if there is enough positive evi-dence to reverse the deferred income tax valuation allowance that the Company has had since it went public at the end of 2008.

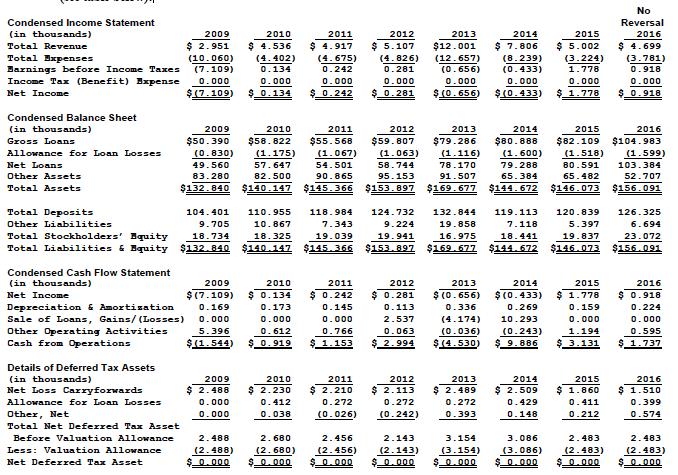

From 2009 through 2015, Soledad had a full valuation allowance on its deferred income tax assets (see table below):

At the time of the establishment of the full valuation allowance in 2009, management concluded that it was more likely than not that the full deferred tax asset would not be realized. Management con-sidered all positive and negative evidence regarding the ultimate ability to fully realize the deferred tax asset, including past operating results and the forecast of future taxable income. The valuation allowance was primarily recorded and maintained because the Company is a continuing cumulative loss company, i.e. the Company’s cumulative combined Earnings before Income Taxes beginning in 2009 through 2016 are a negative $4.845 million. However, the cumulative Earnings before Income Taxes from 2013 through 2016 are now a positive $1.607 million.

Highlights for the quarter ended December 31, 2016 include:

- A. Ninth consecutive profitable quarter

- B. Net loan growth of $4.9 million, or 5.0% versus linked-quarter

- C. Strong asset quality; no nonperforming assets

- D. Return on Assets and Return on Equity of 5.5% and 37.4%, respectively

- E. Martin P. May, President and CEO, commented: “We continued to grow our loan and deposit portfo-lios organically and our capital ratios significantly exceed all regulatory guidelines for a well-capitalized bank. The Company expects to record income tax expense in future quarters assuming the Company continues to generate pre-tax earnings.”

In addition, the Company’s share price had performed well during 2016. From a low of $4.80 a share in early February 2016, it reached a high of $7.60 a share in late December 2016 (see chart below):

Nevertheless, as a board member, your fiduciary duty is to recommend actions that are in the best interests of the Company’s shareholders. Without the reversal, the Company’s net deferred income tax asset would remain at $0 and its net income would be $918 thousand. If Soledad reverses the full1 deferred income tax asset valuation allowance the net deferred income tax asset change as will the Company’s net income for the year ended December 31, 2016. If the market believes the reversal is a signal that the Company has “turned the corner”, its growth prospects would be enhanced as would its share price. On the other hand, if the Company’s future performance does not live up to the ex-pectations suggested by the valuation allowance reversal in 2016, with hindsight, investors might accuse Soledad of “cooking its books” for 2016 and reduce its share price.

The CFO has asked for your help in deciding if the evidence is greater than 50% that the Company will realize the $2.483 million in benefits from its deferred income tax assets.

Questions:

1. Record (bookkeep) Soledad’s initiating its valuation allowance for fiscal year 2009.

2. Record (bookkeep) the impact of Soledad’s proposed full reversal of its valuation allowance in fiscal 2016. What will be the impact on Soledad’s 2016 income statement, balance sheet and cash flows for book accounting purposes? for tax accounting purposes? Please show any calculations to support your answer.

3. As a board member, list any positive evidence that you believe supports Soledad’s reversal of its valuation allowance in 2016.

4. As a board member, list any negative evidence that you believe supports Soledad’s not reversing its valuation allowance in 2016.

5. As a board member, based on your consideration of the evidence, what would you recommend to the CFO? Is the evidence sufficient or not sufficient to show a greater than 50% probability that the deferred income tax benefits will be realized in the future? Briefly explain.

2012 2013 2011 $ 4.917 (4.675) 0.242 0.000 $ 5.107 (4.826) 0.281 0.000 2014 $12.001 $7.806 (12.657) (8.239) (0.656) (0.433) 0.000 0.000 $(0.433) 2015 $ 5.002 (3.224) 1.778 0.000 No Reversal 2016 $ 4.699 (3.781) 0.918 0.000 $ 0.242 $ 0.281 $(0.656) $ 1.778 $ 0.918 2011 2012 2013 2016 $55.568 $59.807 $79.286 2014 2015 $80.888 $82.109 $104.983 (1.063) (1.116) (1.600) (1.518) (1.599) 58.744 78.170 79.288 80.591 103.384 95.153 91.507 65.384 65.482 52.707 $153.897 $169.677 $144.672 $146.073 $156.091 120.839 126.325 132.844 119.113 19.858 7.118 5.397 6.694 16.975 18.441 19.837 23.072 $169.677 $144.672 $146.073 $156.091 2014 2015 2016 $0.918 $ (0.433) 2013 $ (0.656) 0.336 (4.174) (0.036) $ 1.778 0.159 0.224 0.269 10.293 0.000 0.000 1.194 0.595 (0.243) $(4.530) $9.886 $ 3.131 $ 1.737 $ 2.489 0.272 0.393 2013 2014 $ 2.509 0.429 2015 $ 1.860 0.411 2016 $ 1.510 0.399 0.148 0.212 0.574 3.154 (3.154) $ 0.000 3.086 (3.086) $ 0.000 2.483 (2.483) 2.483 (2.483) $ 0.000 Condensed Income Statement (in thousands) Total Revenue 2009 $ 2.951 (10.060) (7.109) Total Expenses 2010 $4.536 (4.402) 0.134 0.000 Barnings before Income Taxes Income Tax (Benefit) Expense Net Income 0.000 $(7.109) $ 0.134 Condensed Balance Sheet (in thousands) 2009 2010 Gross Loans $50.390 $58.822 Allowance for Loan Losses (0.830) (1.175) (1.067) Net Loans 49.560 57.647 54.501 Other Assets 83.280 82.500 90.865 Total Assets $132.840 $140.147 $145.366 Total Deposits 104.401 Other Liabilities 9.705 18.734 Total Stockholders' Equity Total Liabilities & Equity $132.840 Condensed Cash Flow Statement (in thousands) 2009 Net Income $(7.109) 0.169 0.000 Depreciation & Amortization Sale of Loans, Gains/ (Losses) Other Operating Activities Cash from Operations 5.396 $(1.544) Details of Deferred Tax Assets (in thousands) 2009 $ 2.488 Net Loss Carryforwards Allowance for Loan Losses Other, Net 0.000 0.000 Total Net Deferred Tax Asset Before Valuation Allowance Less: Valuation Allowance Net Deferred Tax Asset 2.488 (2.488) $ 0.000 110.955 118.984 124.732 10.867 7.343 19.039 $145.366 $153.897 9.224 19.941 18.325 $140.147 2010 $ 0.134 0.173 0.000 0.612 2011 $ 0.242 0.145 0.000 0.766 2012 $ 0.281 0.113 2.537 0.063 $ 2.994 $ 0.919 $ 1.153 2010 $ 2.230 0.412 0.038 2011 $ 2.210 0.272 (0.026) 2012 $ 2.113 0.272 (0.242) 2.680 (2.680) $ 0.000 $ 0.000 2.456 (2.456) 2.143 (2.143) $ 0.000 $ 0.000

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Q1 To balance out its deferred tax assets the company needs record a valuation allowance of 2483 million Net income will be 918 thousand with a net deferred tax asset of 0 Q2 Fiscal 2016 would have a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started