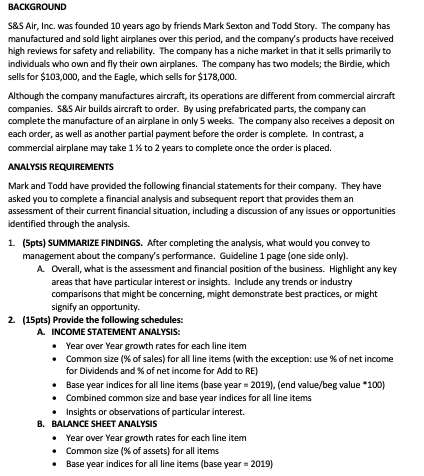

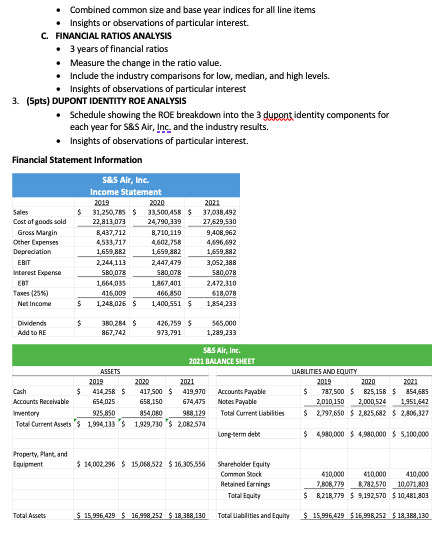

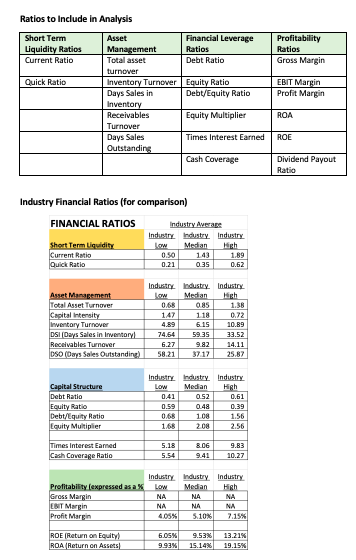

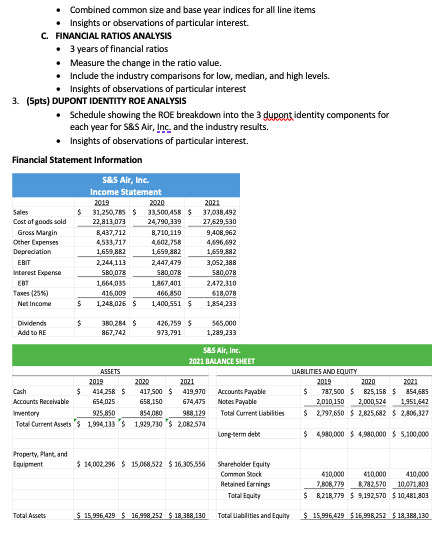

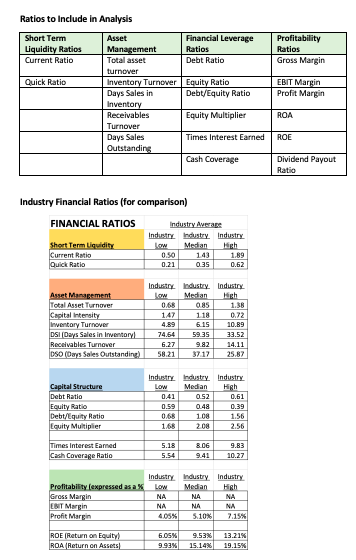

BACKGROUND S\&S Air, Inc. was founded 10 years ago by friends Mark Sexton and Todd Story. The company has manufactured and sold light airplanes over this period, and the company's products have received high reviews for safety and reliability. The company has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models; the Birdie, which sells for $103,000, and the Eagle, which sells for $178,000. Although the company manufactures aircraft, its operations are different from commercial aircraft companies. S\&.S Air builds aircraft to order. By using prefabricated parts, the company can complete the manufacture of an airplane in only 5 weeks. The company also recelves a deposit on each order, as well as another partial payment before the order is complete. In contrast, a commercial airplane may take 1y to 2 years to complete once the order is placed. ANALYSIS REQUIREMENTS Mark and Todd have provided the following financial statements for their company. They have asked you to complete a financial analysis and subsequent report that provides them an assessment of their current financial situation, including a discussion of any issues or opportunities identified through the analysis. 1. (5pts) SUMMARIZE FINDINGS. After completing the analysis, what would you convey to management about the company's performance. Guideline 1 page (one side only). A. Overall, what is the assessment and financial position of the business. Highlight any key areas that have particular interest or insights. Include any trends or industry comparisons that might be concerning, might demonstrate best practices, or might signify an opportunity. 2. (15pts) Provide the following schedules: A. INCOME STATEMENT ANALYSIS: - Year over Year growth rates for each line item - Common size (\% of sales) for all line items (with the exception: use % of net income for Dividends and % of net income for Add to RE) - Base year indices for all line items (base year = 2019), (end value/beg value *100) - Combined common size and base year indices for all line items - Insights or observations of particular interest. B. BALANCE SHEET ANALYSIS - Year over Year growth rates for each line item - Common size (\% of assets) for all items - Base year indices for all line items (base year =2019 ) - Combined common size and base year indices for all line items - Insights or observations of particular interest. C. FINANCIAL RATIOS ANALYSIS - 3 years of financial ratios - Measure the change in the ratio value. - Include the industry comparisons for low, median, and high levels. - Insights of observations of particular interest 3. (5pts) DUPONT IDENTITY ROE ANALYSIS - Schedule showing the ROE breakdown into the 3 dupgnt identity components for each year for S&SAir, Inc. and the industry results. - Insights of observations of particular interest. Financial Statement Information Ratios to Include in Analysis Industry Financial Ratios (for comparison) BACKGROUND S\&S Air, Inc. was founded 10 years ago by friends Mark Sexton and Todd Story. The company has manufactured and sold light airplanes over this period, and the company's products have received high reviews for safety and reliability. The company has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models; the Birdie, which sells for $103,000, and the Eagle, which sells for $178,000. Although the company manufactures aircraft, its operations are different from commercial aircraft companies. S\&.S Air builds aircraft to order. By using prefabricated parts, the company can complete the manufacture of an airplane in only 5 weeks. The company also recelves a deposit on each order, as well as another partial payment before the order is complete. In contrast, a commercial airplane may take 1y to 2 years to complete once the order is placed. ANALYSIS REQUIREMENTS Mark and Todd have provided the following financial statements for their company. They have asked you to complete a financial analysis and subsequent report that provides them an assessment of their current financial situation, including a discussion of any issues or opportunities identified through the analysis. 1. (5pts) SUMMARIZE FINDINGS. After completing the analysis, what would you convey to management about the company's performance. Guideline 1 page (one side only). A. Overall, what is the assessment and financial position of the business. Highlight any key areas that have particular interest or insights. Include any trends or industry comparisons that might be concerning, might demonstrate best practices, or might signify an opportunity. 2. (15pts) Provide the following schedules: A. INCOME STATEMENT ANALYSIS: - Year over Year growth rates for each line item - Common size (\% of sales) for all line items (with the exception: use % of net income for Dividends and % of net income for Add to RE) - Base year indices for all line items (base year = 2019), (end value/beg value *100) - Combined common size and base year indices for all line items - Insights or observations of particular interest. B. BALANCE SHEET ANALYSIS - Year over Year growth rates for each line item - Common size (\% of assets) for all items - Base year indices for all line items (base year =2019 ) - Combined common size and base year indices for all line items - Insights or observations of particular interest. C. FINANCIAL RATIOS ANALYSIS - 3 years of financial ratios - Measure the change in the ratio value. - Include the industry comparisons for low, median, and high levels. - Insights of observations of particular interest 3. (5pts) DUPONT IDENTITY ROE ANALYSIS - Schedule showing the ROE breakdown into the 3 dupgnt identity components for each year for S&SAir, Inc. and the industry results. - Insights of observations of particular interest. Financial Statement Information Ratios to Include in Analysis Industry Financial Ratios (for comparison)