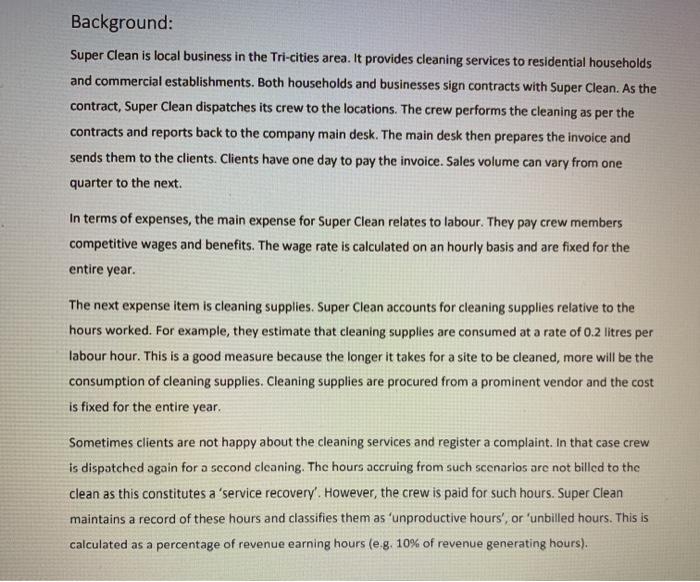

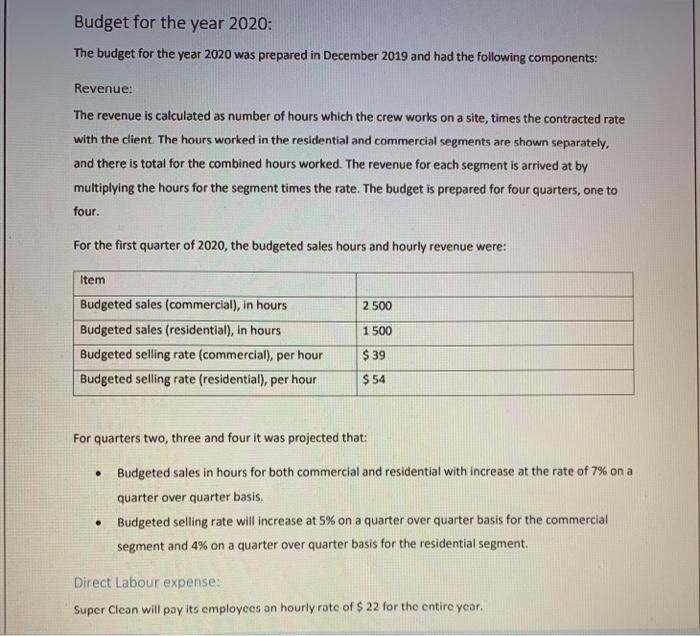

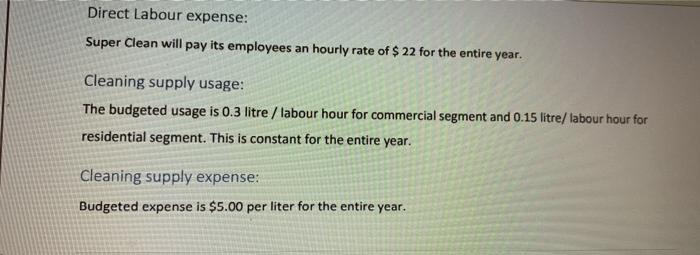

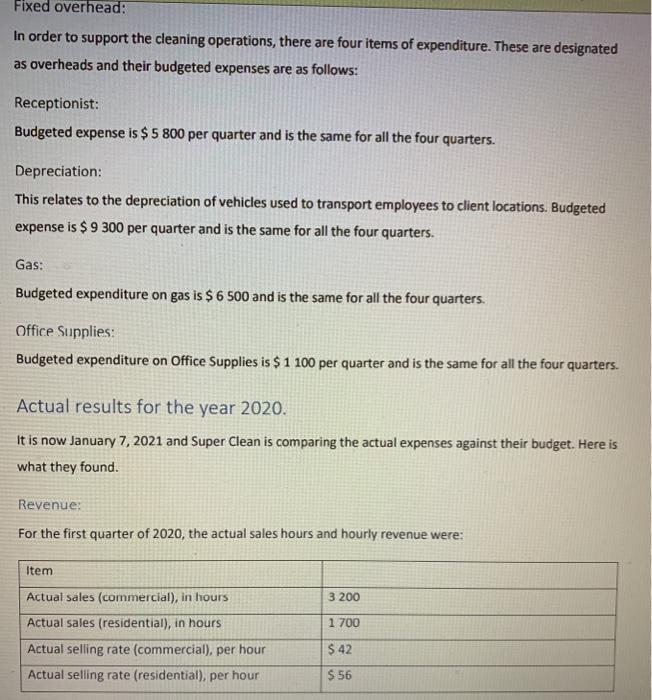

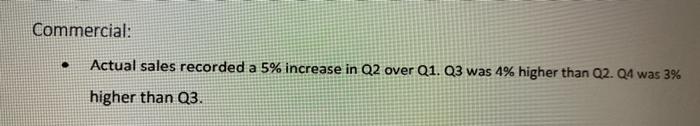

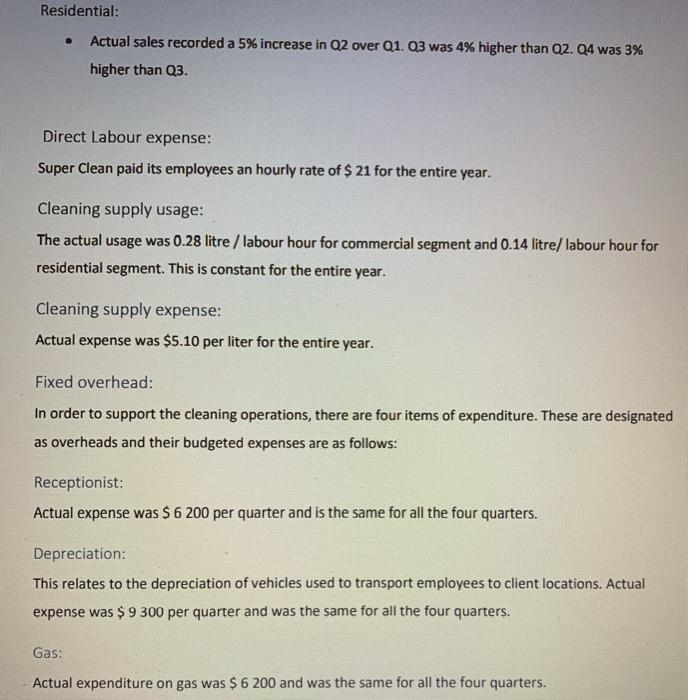

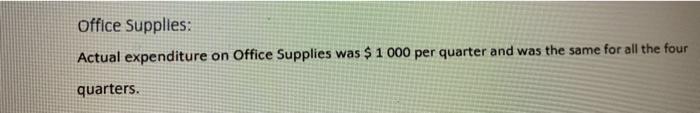

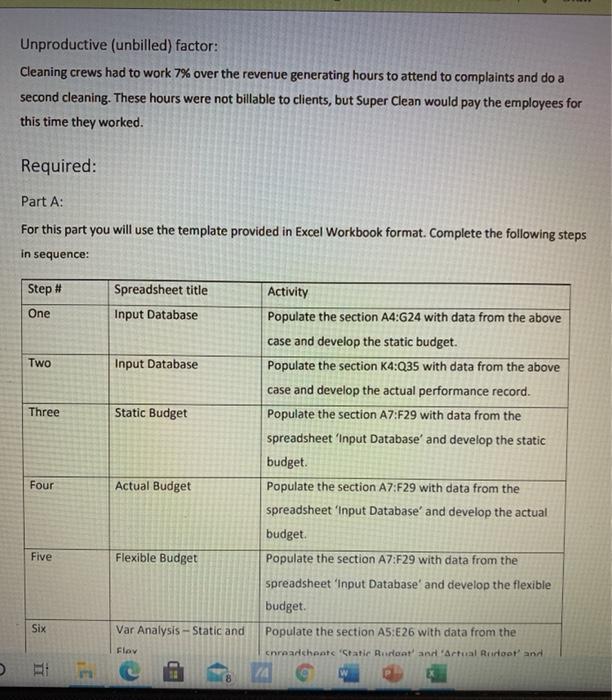

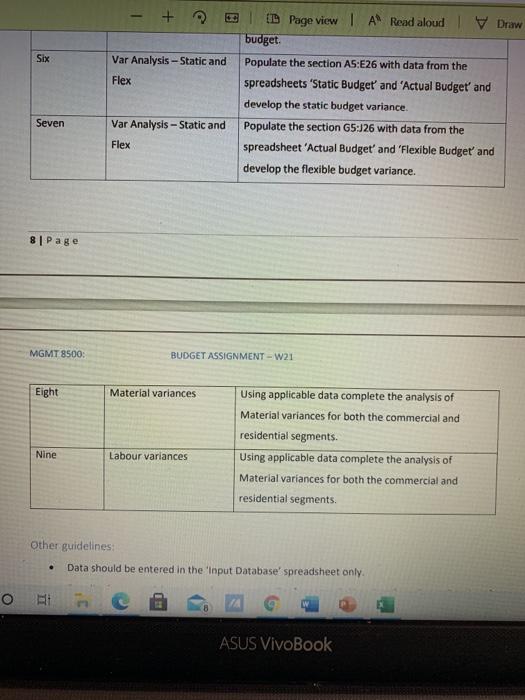

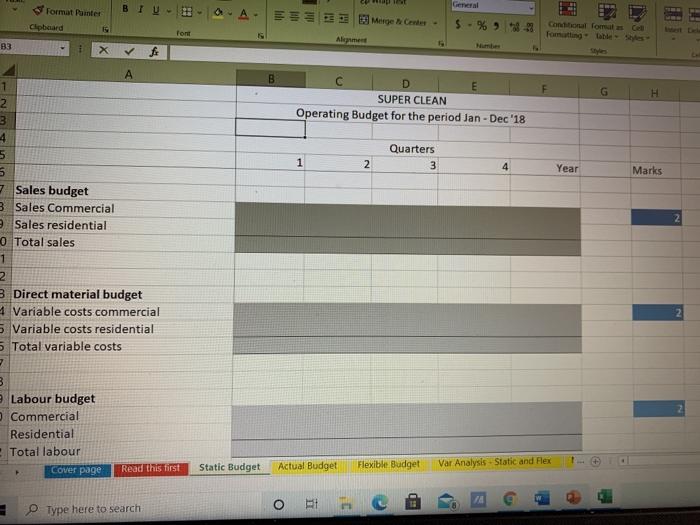

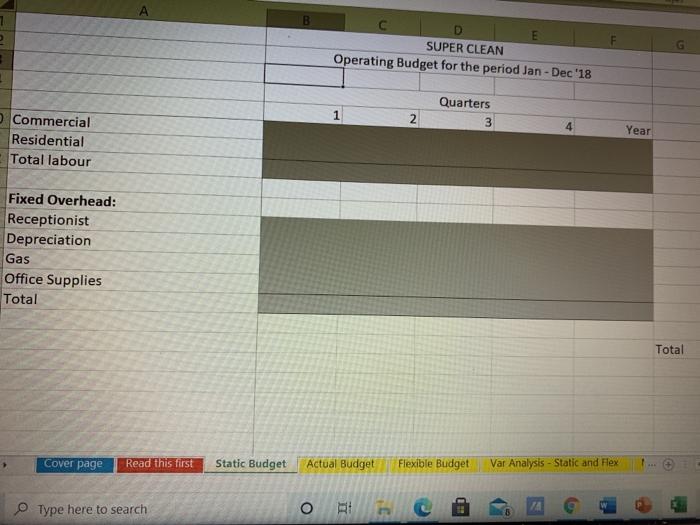

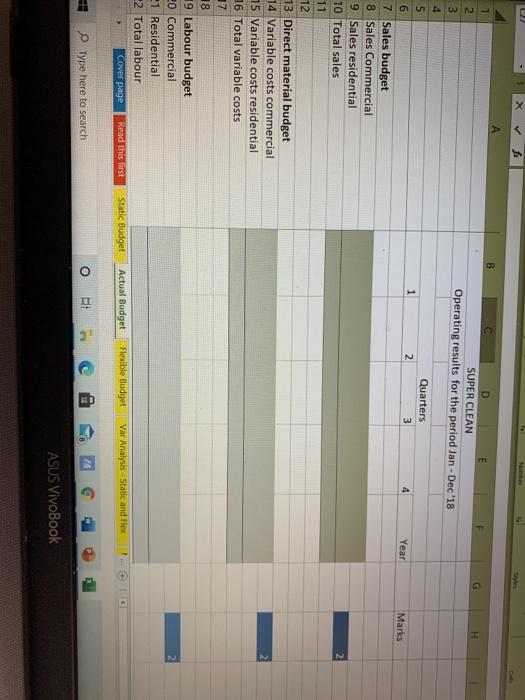

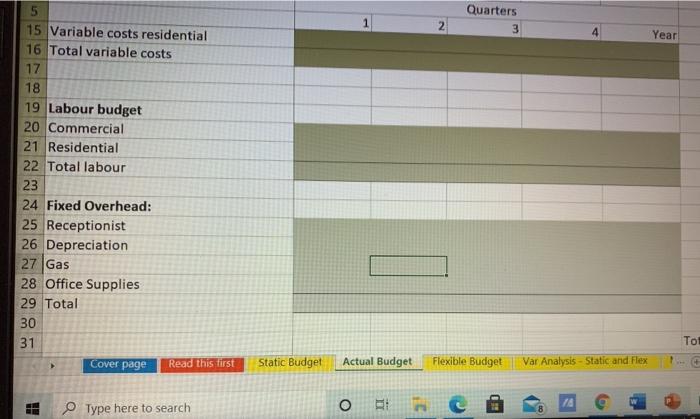

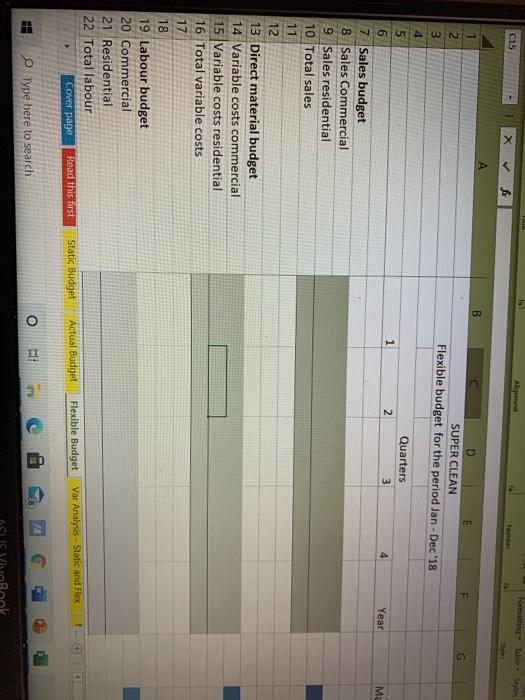

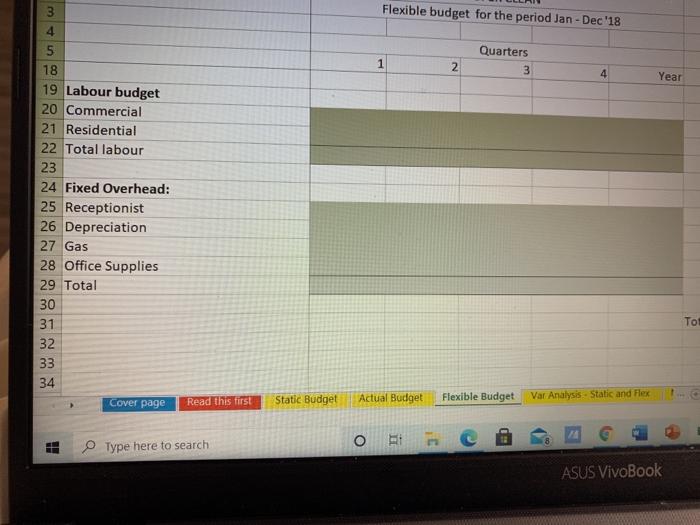

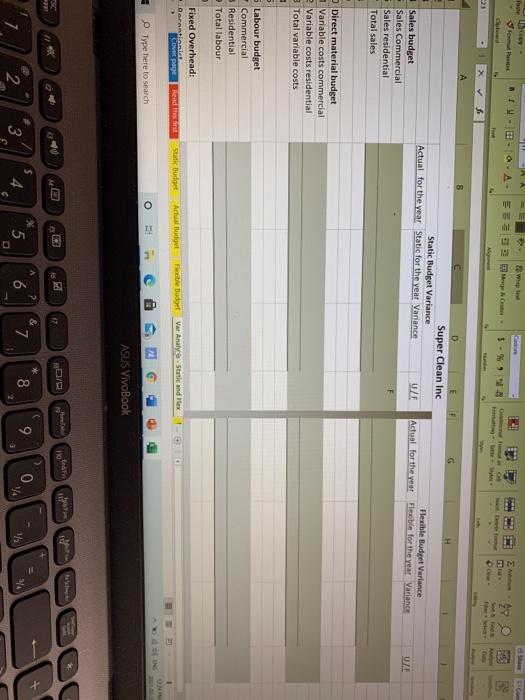

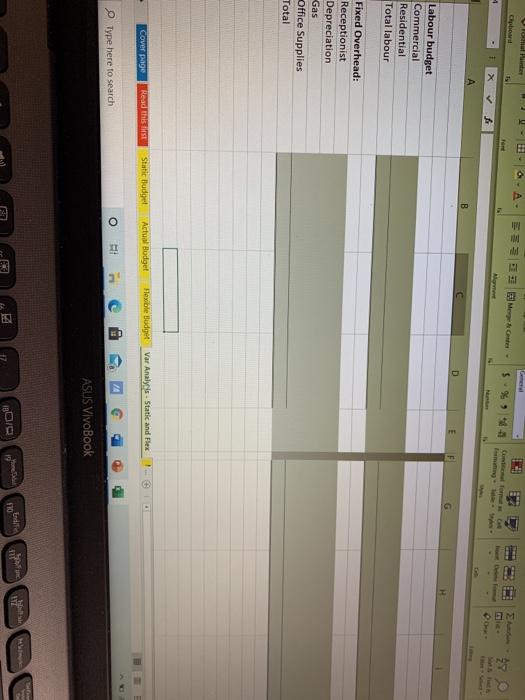

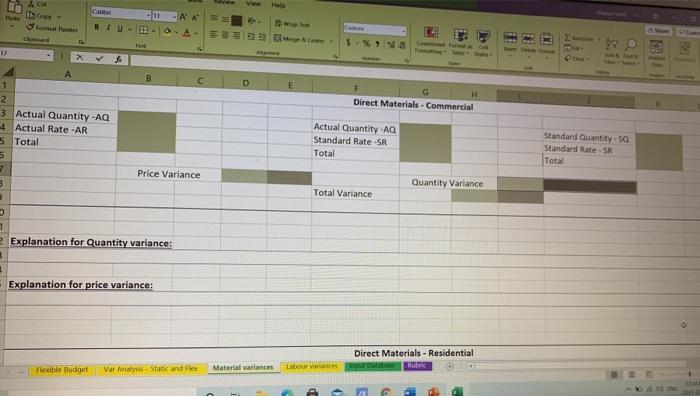

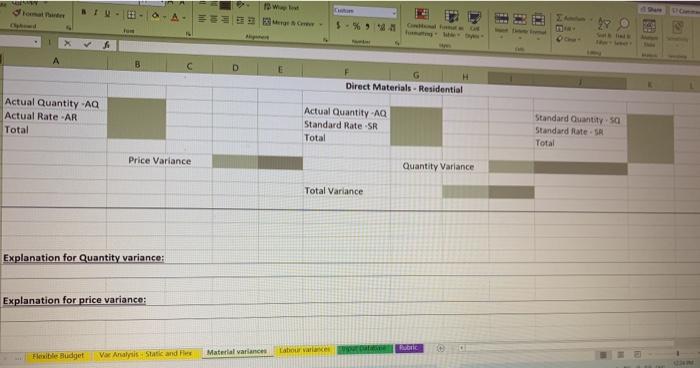

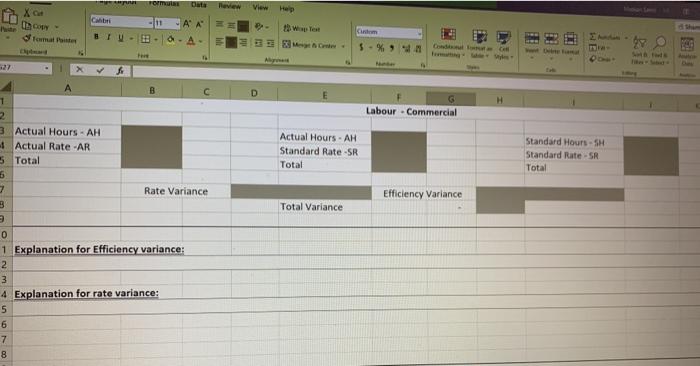

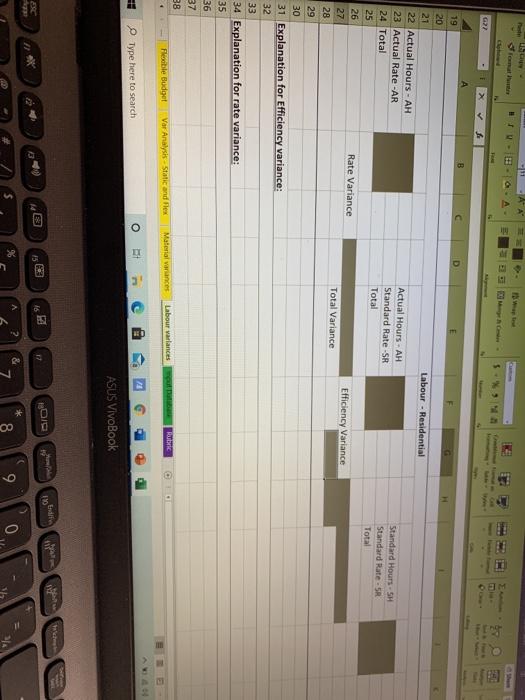

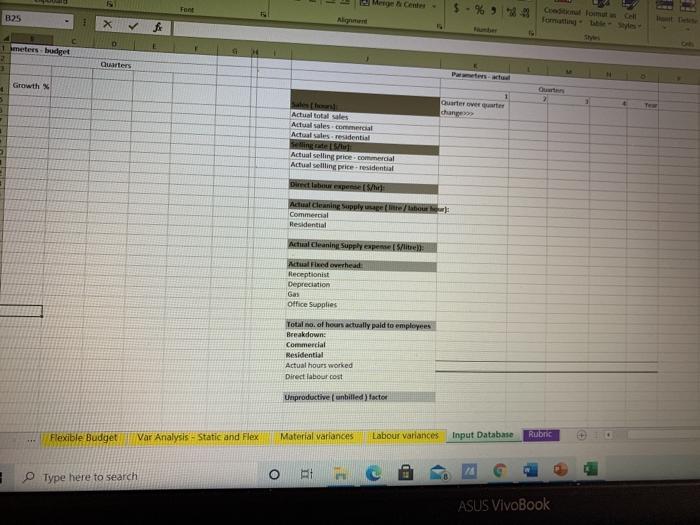

Background: Super Clean is local business in the Tri-cities area. It provides cleaning services to residential households and commercial establishments. Both households and businesses sign contracts with Super Clean. As the contract, Super Clean dispatches its crew to the locations. The crew performs the cleaning as per the contracts and reports back to the company main desk. The main desk then prepares the invoice and sends them to the clients. Clients have one day to pay the invoice. Sales volume can vary from one quarter to the next. In terms of expenses, the main expense for Super Clean relates to labour. They pay crew members competitive wages and benefits. The wage rate is calculated on an hourly basis and are fixed for the entire year. The next expense item is cleaning supplies. Super Clean accounts for cleaning supplies relative to the hours worked. For example, they estimate that cleaning supplies are consumed at a rate of 0.2 litres per labour hour. This is a good measure because the longer it takes for a site to be cleaned, more will be the consumption of cleaning supplies. Cleaning supplies are procured from a prominent vendor and the cost is fixed for the entire year. Sometimes clients are not happy about the cleaning services and register a complaint. In that case crew is dispatched again for a second cleaning. The hours accruing from such scenarios are not billed to the clean as this constitutes a 'service recovery'. However, the crew is paid for such hours. Super Clean maintains a record of these hours and classifies them as 'unproductive hours' or 'unbilled hours. This is calculated as a percentage of revenue earning hours (e.g. 10% of revenue generating hours). Budget for the year 2020: The budget for the year 2020 was prepared in December 2019 and had the following components: Revenue: The revenue is calculated as number of hours which the crew works on a site, times the contracted rate with the client. The hours worked in the residential and commercial segments are shown separately, and there is total for the combined hours worked. The revenue for each segment is arrived at by multiplying the hours for the segment times the rate. The budget is prepared for four quarters, one to four. For the first quarter of 2020, the budgeted sales hours and hourly revenue were: Item 2 500 1 500 Budgeted sales (commercial), in hours Budgeted sales (residential), in hours Budgeted selling rate (commercial), per hour Budgeted selling rate (residential), per hour $ 39 $ 54 For quarters two, three and four it was projected that: . Budgeted sales in hours for both commercial and residential with increase at the rate of 7% on a quarter over quarter basis. Budgeted selling rate will increase at 5% on a quarter over quarter basis for the commercial segment and 4% on a quarter over quarter basis for the residential segment. . Direct Labour expense! Super Clean will pay its employees an hourly rate of $ 22 for the entire year. Direct Labour expense: Super Clean will pay its employees an hourly rate of $ 22 for the entire year. Cleaning supply usage: The budgeted usage is 0.3 litre / labour hour for commercial segment and 0.15 litre/ labour hour for residential segment. This is constant for the entire year. Cleaning supply expense: Budgeted expense is $5.00 per liter for the entire year. Fixed overhead: In order to support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Budgeted expense is $5 800 per quarter and is the same for all the four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Budgeted expense is $ 9 300 per quarter and is the same for all the four quarters. Gas: Budgeted expenditure on gas is $ 6 500 and is the same for all the four quarters. Office Supplies: Budgeted expenditure on Office Supplies is $ 1 100 per quarter and is the same for all the four quarters. Actual results for the year 2020. It is now January 7, 2021 and Super Clean is comparing the actual expenses against their budget. Here is what they found. Revenue: For the first quarter of 2020, the actual sales hours and hourly revenue were: Item 3 200 1 700 Actual sales (commercial), in hours Actual sales (residential), in hours Actual selling rate (commercial), per hour Actual selling rate (residential), per hour $ 42 $ 56 Commercial: Actual sales recorded a 5% increase in Q2 over Q1. Q3 was 4% higher than Q2. Q4 was 3% higher than Q3. Residential: . Actual sales recorded a 5% increase in Q2 over Q1. Q3 was 4% higher than Q2. Q4 was 3% higher than Q3. Direct Labour expense: Super Clean paid its employees an hourly rate of $ 21 for the entire year. Cleaning supply usage: The actual usage was 0.28 litre / labour hour for commercial segment and 0.14 litre/ labour hour for residential segment. This is constant for the entire year. Cleaning supply expense: Actual expense was $5.10 per liter for the entire year. Fixed overhead: In order to support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Actual expense was $ 6 200 per quarter and is the same for all the four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Actual expense was $ 9 300 per quarter and was the same for all the four quarters. Gas: Actual expenditure on gas was $6 200 and was the same for all the four quarters. Office Supplies: Actual expenditure on Office Supplies was $ 1 000 per quarter and was the same for all the four quarters. Unproductive (unbilled) factor: Cleaning crews had to work 7% over the revenue generating hours to attend to complaints and do a second cleaning. These hours were not billable to clients, but Super Clean would pay the employees for this time they worked. Required: Part A: For this part you will use the template provided in Excel Workbook format. Complete the following steps in sequence: Step # Spreadsheet title One Input Database Two Input Database Three Static Budget Activity Populate the section A4:G24 with data from the above case and develop the static budget. Populate the section K4:Q35 with data from the above case and develop the actual performance record. Populate the section A7:F29 with data from the spreadsheet 'Input Database and develop the static budget Populate the section A7:F29 with data from the spreadsheet 'Input Database and develop the actual budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the flexible budget. Populate the section A5:E26 with data from the cnroad chante 'Static fiat' and 'Artual Root and Four Actual Budget Five Flexible Budget Six Var Analysis - Static and Flav Six Var Analysis -Static and Flex ID Page view | A Read aloud V Draw budget Populate the section AS:E26 with data from the spreadsheets 'Static Budget' and 'Actual Budget' and develop the static budget variance. Populate the section G5:J26 with data from the spreadsheet 'Actual Budget' and 'Flexible Budget and develop the flexible budget variance. Seven Var Analysis -Static and Flex 8 Page MGMT 8500 BUDGET ASSIGNMENT - W21 Eight Material variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Nine Labour variances Other guidelines Data should be entered in the 'Input Database' spreadsheet only OBI ASUS VivoBook General BIW- Format Pointer Clobaard A.A. 2. E3 Merge Center IS % 21 Cantonal format font Almere 83 B G H SUPER CLEAN Operating Budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year Marks 2 2 3 4 5 5 7 Sales budget 3 Sales Commercial e Sales residential 0 Total sales 1 2 3 Direct material budget 1 Variable costs commercial 5 Variable costs residential 6 Total variable costs 7 3 Labour budget Commercial Residential Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex o 14 Type here to search 1 E SUPER CLEAN Operating Budget for the period Jan-Dec '18 1 Quarters 3 2 4 Year Commercial Residential Total labour Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total Total Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search o 74 Hund 1 G H SUPER CLEAN Operating results for the period Jan-Dec '18 NMODO 1 Quarters 3 2 4 Year Marks 2 6 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 2 Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search O BI ASUS VIVOBook Quarters 3 2 Year 5 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 Cover page Read this first Toi Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search o Aligne B AN SUPER CLEAN Flexible budget for the period Jan-Dec '18 1 Quarters 3 2 4 Year Me 5 6 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex HE Type here to search o Bool Flexible budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year 3 4 5 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 32 33 34 Tot Nm Read this first Cover page Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex BI Type here to search m ASUS VivoBook Wap 23 f A Super Clean Inc Static Budget Variance Actual for the year Static for the year Variance ULE Flexible Budget Variance Actual for the year Febble for the year Variance UXE Sales budget Sales Commercial Sales residential Total sales Direct material budget Variable costs commercial Variable costs residential 3 Total variable costs Labour budget Commercial 3 Residential Total labour Fixed Overhead: Qarantanice CO pages Start Budget Actus Budget we Budor Var AnalyStatic and Flex Type here to search II o IC 0 V W Book 25 10 tro interesa 17 is C > A 2 & 7 3 5 0 6 5 8 2 9 2 va Vi 3 F1 Meet 11 + B D Labour budget Commercial Residential Total labour Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total . Cover page Read this Static Budget Actual Budget Hexible Budget Var Analy's Static and Flex Type here to search o ASUS VivoBook ETE phase haberi ulteri Ichten -11 A B D E F Direct Materials - Commercial 1 2 3 Actual Quantity -AQ 4 Actual Rate -AR 5 Total 5 7 3 . Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - 50 Standard Rate SR Total Price Variance Quantity Variance Total Variance 7 Explanation for Quantity variance: Explanation for price variance: Direct Materials - Residential rpu outtee on Var Analysis - Static and flex Flexible Budget Material variances Latour variance 13 A- FEB 28 A D E F G H Direct Materials - Residential Actual Quantity-AQ Actual Rate -AR Total Actual Quantity-AQ Standard Rate.SR Total Standard Quantity sa Standard Rate - SA Total Price Variance Quantity Variance Total Variance Explanation for Quantity variance: Explanation for price variance: PC Var Analysis: Static and Her Material variances Labour valke Flexible Budget Formulas Data View Help ch 11 A A ant gy $ -% 9 Pere D Labour - Commercial 1 2 3 Actual Hours -AH - Actual Rate -AR 5 Total 5 1 3 Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate - SR Total Rate Variance Efficiency Variance Total Variance 0 1 Explanation for Efficiency variance: 2 3 4 Explanation for rate variance: 5 6 7 8 3 G 19 H Labour - Residential 20 21 22 Actual Hours - AH 23 Actual Rate -AR 24 Total 25 26 27 28 Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate.SR Total Rate Variance Efficiency Variance Total Variance 29 30 31 Explanation for Efficiency variance: 32 33 34 Explanation for rate variance: 35 36 37 38 Flebole Budget Var Analysis - Static and Flex Material variances Labour variances Rube O IT C Type here to search C ASUS VivoBook 0 w 110 DID is 17 A ? C % & 7 8 9 0 Font Crostolom B25 X 1 metersbudget Quarters Growth Quarter over change Actualtotal sales Actual sales comercial Actual sales residential Actual selling price commercial Actual selling price-residential Direct labeur expense She Adal cleaning Supply to: Commercial Residential Actual Cleaning Supplypelit Actualmed overhead Receptionist Depreciation Gas Office Supplies Totalno of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost Unproductive (unbilled)factor exible Budget Var Analysis - Static and Flex Material variances Labour variances Input Database Rubric 3 Type here to search o ASUS VivoBook Background: Super Clean is local business in the Tri-cities area. It provides cleaning services to residential households and commercial establishments. Both households and businesses sign contracts with Super Clean. As the contract, Super Clean dispatches its crew to the locations. The crew performs the cleaning as per the contracts and reports back to the company main desk. The main desk then prepares the invoice and sends them to the clients. Clients have one day to pay the invoice. Sales volume can vary from one quarter to the next. In terms of expenses, the main expense for Super Clean relates to labour. They pay crew members competitive wages and benefits. The wage rate is calculated on an hourly basis and are fixed for the entire year. The next expense item is cleaning supplies. Super Clean accounts for cleaning supplies relative to the hours worked. For example, they estimate that cleaning supplies are consumed at a rate of 0.2 litres per labour hour. This is a good measure because the longer it takes for a site to be cleaned, more will be the consumption of cleaning supplies. Cleaning supplies are procured from a prominent vendor and the cost is fixed for the entire year. Sometimes clients are not happy about the cleaning services and register a complaint. In that case crew is dispatched again for a second cleaning. The hours accruing from such scenarios are not billed to the clean as this constitutes a 'service recovery'. However, the crew is paid for such hours. Super Clean maintains a record of these hours and classifies them as 'unproductive hours' or 'unbilled hours. This is calculated as a percentage of revenue earning hours (e.g. 10% of revenue generating hours). Budget for the year 2020: The budget for the year 2020 was prepared in December 2019 and had the following components: Revenue: The revenue is calculated as number of hours which the crew works on a site, times the contracted rate with the client. The hours worked in the residential and commercial segments are shown separately, and there is total for the combined hours worked. The revenue for each segment is arrived at by multiplying the hours for the segment times the rate. The budget is prepared for four quarters, one to four. For the first quarter of 2020, the budgeted sales hours and hourly revenue were: Item 2 500 1 500 Budgeted sales (commercial), in hours Budgeted sales (residential), in hours Budgeted selling rate (commercial), per hour Budgeted selling rate (residential), per hour $ 39 $ 54 For quarters two, three and four it was projected that: . Budgeted sales in hours for both commercial and residential with increase at the rate of 7% on a quarter over quarter basis. Budgeted selling rate will increase at 5% on a quarter over quarter basis for the commercial segment and 4% on a quarter over quarter basis for the residential segment. . Direct Labour expense! Super Clean will pay its employees an hourly rate of $ 22 for the entire year. Direct Labour expense: Super Clean will pay its employees an hourly rate of $ 22 for the entire year. Cleaning supply usage: The budgeted usage is 0.3 litre / labour hour for commercial segment and 0.15 litre/ labour hour for residential segment. This is constant for the entire year. Cleaning supply expense: Budgeted expense is $5.00 per liter for the entire year. Fixed overhead: In order to support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Budgeted expense is $5 800 per quarter and is the same for all the four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Budgeted expense is $ 9 300 per quarter and is the same for all the four quarters. Gas: Budgeted expenditure on gas is $ 6 500 and is the same for all the four quarters. Office Supplies: Budgeted expenditure on Office Supplies is $ 1 100 per quarter and is the same for all the four quarters. Actual results for the year 2020. It is now January 7, 2021 and Super Clean is comparing the actual expenses against their budget. Here is what they found. Revenue: For the first quarter of 2020, the actual sales hours and hourly revenue were: Item 3 200 1 700 Actual sales (commercial), in hours Actual sales (residential), in hours Actual selling rate (commercial), per hour Actual selling rate (residential), per hour $ 42 $ 56 Commercial: Actual sales recorded a 5% increase in Q2 over Q1. Q3 was 4% higher than Q2. Q4 was 3% higher than Q3. Residential: . Actual sales recorded a 5% increase in Q2 over Q1. Q3 was 4% higher than Q2. Q4 was 3% higher than Q3. Direct Labour expense: Super Clean paid its employees an hourly rate of $ 21 for the entire year. Cleaning supply usage: The actual usage was 0.28 litre / labour hour for commercial segment and 0.14 litre/ labour hour for residential segment. This is constant for the entire year. Cleaning supply expense: Actual expense was $5.10 per liter for the entire year. Fixed overhead: In order to support the cleaning operations, there are four items of expenditure. These are designated as overheads and their budgeted expenses are as follows: Receptionist: Actual expense was $ 6 200 per quarter and is the same for all the four quarters. Depreciation: This relates to the depreciation of vehicles used to transport employees to client locations. Actual expense was $ 9 300 per quarter and was the same for all the four quarters. Gas: Actual expenditure on gas was $6 200 and was the same for all the four quarters. Office Supplies: Actual expenditure on Office Supplies was $ 1 000 per quarter and was the same for all the four quarters. Unproductive (unbilled) factor: Cleaning crews had to work 7% over the revenue generating hours to attend to complaints and do a second cleaning. These hours were not billable to clients, but Super Clean would pay the employees for this time they worked. Required: Part A: For this part you will use the template provided in Excel Workbook format. Complete the following steps in sequence: Step # Spreadsheet title One Input Database Two Input Database Three Static Budget Activity Populate the section A4:G24 with data from the above case and develop the static budget. Populate the section K4:Q35 with data from the above case and develop the actual performance record. Populate the section A7:F29 with data from the spreadsheet 'Input Database and develop the static budget Populate the section A7:F29 with data from the spreadsheet 'Input Database and develop the actual budget Populate the section A7:F29 with data from the spreadsheet 'Input Database' and develop the flexible budget. Populate the section A5:E26 with data from the cnroad chante 'Static fiat' and 'Artual Root and Four Actual Budget Five Flexible Budget Six Var Analysis - Static and Flav Six Var Analysis -Static and Flex ID Page view | A Read aloud V Draw budget Populate the section AS:E26 with data from the spreadsheets 'Static Budget' and 'Actual Budget' and develop the static budget variance. Populate the section G5:J26 with data from the spreadsheet 'Actual Budget' and 'Flexible Budget and develop the flexible budget variance. Seven Var Analysis -Static and Flex 8 Page MGMT 8500 BUDGET ASSIGNMENT - W21 Eight Material variances Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Using applicable data complete the analysis of Material variances for both the commercial and residential segments. Nine Labour variances Other guidelines Data should be entered in the 'Input Database' spreadsheet only OBI ASUS VivoBook General BIW- Format Pointer Clobaard A.A. 2. E3 Merge Center IS % 21 Cantonal format font Almere 83 B G H SUPER CLEAN Operating Budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year Marks 2 2 3 4 5 5 7 Sales budget 3 Sales Commercial e Sales residential 0 Total sales 1 2 3 Direct material budget 1 Variable costs commercial 5 Variable costs residential 6 Total variable costs 7 3 Labour budget Commercial Residential Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex o 14 Type here to search 1 E SUPER CLEAN Operating Budget for the period Jan-Dec '18 1 Quarters 3 2 4 Year Commercial Residential Total labour Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total Total Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search o 74 Hund 1 G H SUPER CLEAN Operating results for the period Jan-Dec '18 NMODO 1 Quarters 3 2 4 Year Marks 2 6 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 2 Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search O BI ASUS VIVOBook Quarters 3 2 Year 5 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 Cover page Read this first Toi Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex Type here to search o Aligne B AN SUPER CLEAN Flexible budget for the period Jan-Dec '18 1 Quarters 3 2 4 Year Me 5 6 7 Sales budget 8 Sales Commercial 9 Sales residential 10 Total sales 11 12 13 Direct material budget 14 Variable costs commercial 15 Variable costs residential 16 Total variable costs 17 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour Cover page Read this first Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex HE Type here to search o Bool Flexible budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year 3 4 5 18 19 Labour budget 20 Commercial 21 Residential 22 Total labour 23 24 Fixed Overhead: 25 Receptionist 26 Depreciation 27 Gas 28 Office Supplies 29 Total 30 31 32 33 34 Tot Nm Read this first Cover page Static Budget Actual Budget Flexible Budget Var Analysis - Static and Flex BI Type here to search m ASUS VivoBook Wap 23 f A Super Clean Inc Static Budget Variance Actual for the year Static for the year Variance ULE Flexible Budget Variance Actual for the year Febble for the year Variance UXE Sales budget Sales Commercial Sales residential Total sales Direct material budget Variable costs commercial Variable costs residential 3 Total variable costs Labour budget Commercial 3 Residential Total labour Fixed Overhead: Qarantanice CO pages Start Budget Actus Budget we Budor Var AnalyStatic and Flex Type here to search II o IC 0 V W Book 25 10 tro interesa 17 is C > A 2 & 7 3 5 0 6 5 8 2 9 2 va Vi 3 F1 Meet 11 + B D Labour budget Commercial Residential Total labour Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total . Cover page Read this Static Budget Actual Budget Hexible Budget Var Analy's Static and Flex Type here to search o ASUS VivoBook ETE phase haberi ulteri Ichten -11 A B D E F Direct Materials - Commercial 1 2 3 Actual Quantity -AQ 4 Actual Rate -AR 5 Total 5 7 3 . Actual Quantity -AQ Standard Rate -SR Total Standard Quantity - 50 Standard Rate SR Total Price Variance Quantity Variance Total Variance 7 Explanation for Quantity variance: Explanation for price variance: Direct Materials - Residential rpu outtee on Var Analysis - Static and flex Flexible Budget Material variances Latour variance 13 A- FEB 28 A D E F G H Direct Materials - Residential Actual Quantity-AQ Actual Rate -AR Total Actual Quantity-AQ Standard Rate.SR Total Standard Quantity sa Standard Rate - SA Total Price Variance Quantity Variance Total Variance Explanation for Quantity variance: Explanation for price variance: PC Var Analysis: Static and Her Material variances Labour valke Flexible Budget Formulas Data View Help ch 11 A A ant gy $ -% 9 Pere D Labour - Commercial 1 2 3 Actual Hours -AH - Actual Rate -AR 5 Total 5 1 3 Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate - SR Total Rate Variance Efficiency Variance Total Variance 0 1 Explanation for Efficiency variance: 2 3 4 Explanation for rate variance: 5 6 7 8 3 G 19 H Labour - Residential 20 21 22 Actual Hours - AH 23 Actual Rate -AR 24 Total 25 26 27 28 Actual Hours - AH Standard Rate -SR Total Standard Hours -SH Standard Rate.SR Total Rate Variance Efficiency Variance Total Variance 29 30 31 Explanation for Efficiency variance: 32 33 34 Explanation for rate variance: 35 36 37 38 Flebole Budget Var Analysis - Static and Flex Material variances Labour variances Rube O IT C Type here to search C ASUS VivoBook 0 w 110 DID is 17 A ? C % & 7 8 9 0 Font Crostolom B25 X 1 metersbudget Quarters Growth Quarter over change Actualtotal sales Actual sales comercial Actual sales residential Actual selling price commercial Actual selling price-residential Direct labeur expense She Adal cleaning Supply to: Commercial Residential Actual Cleaning Supplypelit Actualmed overhead Receptionist Depreciation Gas Office Supplies Totalno of hours actually paid to employees Breakdown: Commercial Residential Actual hours worked Direct labour cost Unproductive (unbilled)factor exible Budget Var Analysis - Static and Flex Material variances Labour variances Input Database Rubric 3 Type here to search o ASUS VivoBook