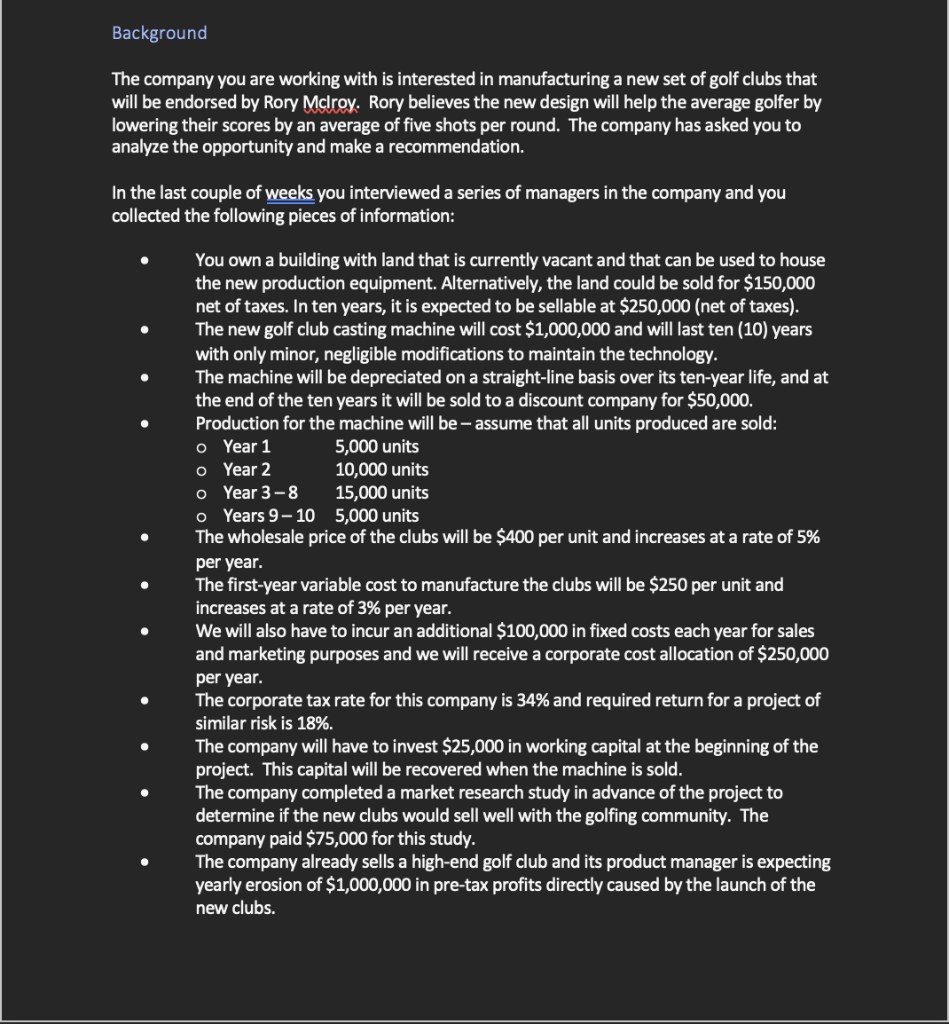

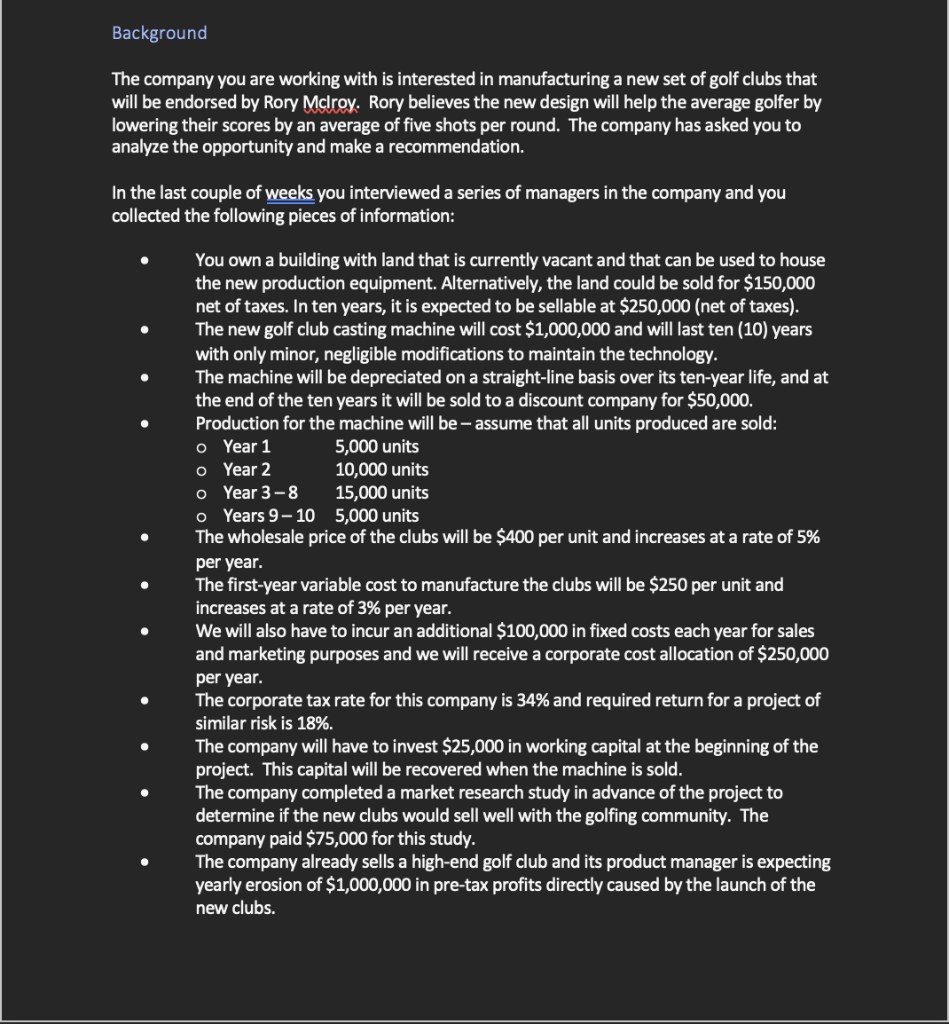

Background The company you are working with is interested in manufacturing a new set of golf clubs that will be endorsed by Rory Mclroy. Rory believes the new design will help the average golfer by lowering their scores by an average of five shots per round. The company has asked you to analyze the opportunity and make a recommendation. In the last couple of weeks you interviewed a series of managers in the company and you collected the following pieces of information: . You own a building with land that is currently vacant and that can be used to house the new production equipment. Alternatively, the land could be sold for $150,000 net of taxes. In ten years, it is expected to be sellable at $250,000 (net of taxes). The new golf club casting machine will cost $1,000,000 and will last ten (10) years with only minor, negligible modifications to maintain the technology. The machine will be depreciated on a straight-line basis over its ten-year life, and at the end of the ten years it will be sold to a discount company for $50,000. Production for the machine will be - assume that all units produced are sold: o Year 1 5,000 units o Year 2 10,000 units o Year 3-8 15,000 units o Years 9-10 5,000 units The wholesale price of the clubs will be $400 per unit and increases at a rate of 5% per year. The first-year variable cost to manufacture the clubs will be $250 per unit and increases at a rate of 3% per year. We will also have to incur an additional $100,000 in fixed costs each year for sales and marketing purposes and we will receive a corporate cost allocation of $250,000 per year. The corporate tax rate for this company is 34% and required return for a project of similar risk is 18%. The company will have to invest $25,000 in working capital at the beginning of the project. This capital will be recovered when the machine is sold. The company completed a market research study in advance of the project to determine if the new clubs would sell well with the golfing community. The company paid $75,000 for this study. The company already sells a high-end golf club and its product manager is expecting yearly erosion of $1,000,000 in pre-tax profits directly caused by the launch of the new clubs. Instructions 1. Analyze the Base Case Build an Excel model that puts the information above into a well-organized spreadsheet The model should show all the assumptions and present the detailed cash flow calculations by line (units sold, sales, depreciation, etc.) Calculate the Net Present Value of the project