Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background: The Mason family operates a building supply store and counts the physical inventory once a year. The value assigned to the year-end inventory was

Background: The Mason family operates a building supply store and counts the physical inventory once a year. The value assigned to the year-end inventory was $35 000. They failed to count the inventory on four shelves in the warehouse. As a result, the year-end financial statements were prepared with an incorrect valuation for ending inventory. A couple of weeks after the statements were prepared, the omission was discovered and reported to the company's accountant. The value of the inventory missed was $7 500.

Required:

- Create a mini-income statement including:

- the incorrect ending inventory, net sales for the period were $325 000; beginning inventory was $65 000; purchases were $24 000; and operating expenses were $161 000.

- Create a revised income statement with the correct ending inventory figure.

- Evaluate the effect of the omission on each of the following:

- cost of goods sold

- gross profit

- net income

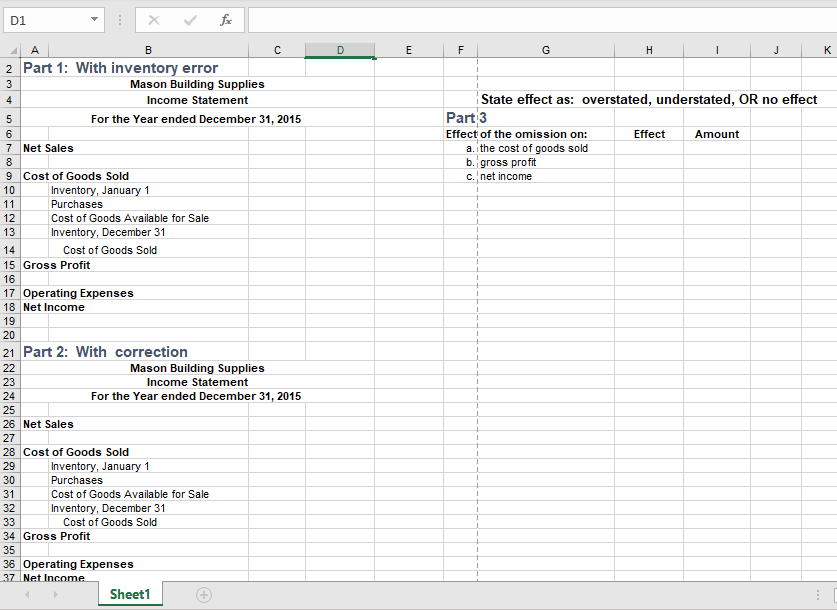

Template Screenshot:

D1 for D E F G H J K State effect as: overstated, understated, OR no effect Part 3 Effect of the omission on: Effect Amount a. the cost of goods sold b. gross profit c. net income 4A B 2 Part 1: With inventory error 3 Mason Building Supplies 4 Income Statement 5 For the Year ended December 31, 2015 6 7 Net Sales 8 9 Cost of Goods Sold 10 Inventory, January 1 11 Purchases 12 Cost of Goods Available for Sale 13 Inventory, December 31 14 Cost of Goods Sold 15 Gross Profit 16 17 Operating Expenses 18 Net Income 19 20 21 Part 2: With correction 22 Mason Building Supplies 23 Income Statement 24 For the Year ended December 31, 2015 25 26 Net Sales 27 28 Cost of Goods Sold 29 Inventory, January 1 30 Purchases 31 Cost of Goods Available for Sale 32 Inventory, December 31 33 Cost of Goods Sold 34 Gross Profit 35 36 Operating Expenses 37 Net Income Sheet1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started