Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background The Rockcliffe Flying Club (RFC) is heavily marketing its flying school. It's a historic club that has been in business for over 50

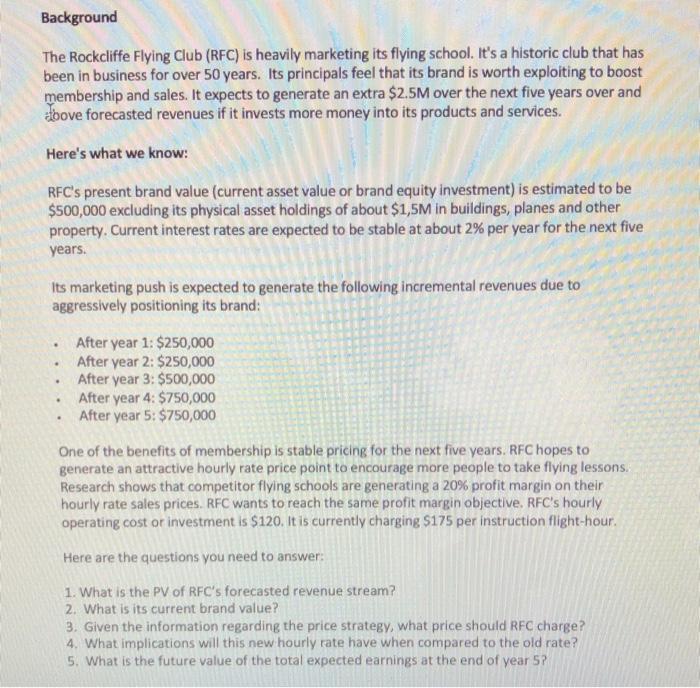

Background The Rockcliffe Flying Club (RFC) is heavily marketing its flying school. It's a historic club that has been in business for over 50 years. Its principals feel that its brand is worth exploiting to boost membership and sales. It expects to generate an extra $2.5M over the next five years over and above forecasted revenues if it invests more money into its products and services. Here's what we know: RFC's present brand value (current asset value or brand equity investment) is estimated to be $500,000 excluding its physical asset holdings of about $1,5M in buildings, planes and other property. Current interest rates are expected to be stable at about 2% per year for the next five years. Its marketing push is expected to generate the following incremental revenues due to aggressively positioning its brand: . . . . After year 1: $250,000 After year 2: $250,000 After year 3: $500,000 After year 4: $750,000 After year 5: $750,000 One of the benefits of membership is stable pricing for the next five years. RFC hopes to generate an attractive hourly rate price point to encourage more people to take flying lessons. Research shows that competitor flying schools are generating a 20% profit margin on their hourly rate sales prices. RFC wants to reach the same profit margin objective. RFC's hourly operating cost or investment is $120. It is currently charging $175 per instruction flight-hour. Here are the questions you need to answer: 1. What is the PV of RFC's forecasted revenue stream? 2. What is its current brand value? 3. Given the information regarding the price strategy, what price should RFC charge? 4. What implications will this new hourly rate have when compared to the old rate? 5. What is the future value of the total expected earnings at the end of year 5?

Step by Step Solution

★★★★★

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the present value PV of RFCs forecasted revenue stream we can use the formula PV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started