Question

Background: You are the finance manager having to compare 2 projects: 7 and 8 and select one to recommend to the Board of Directors. The

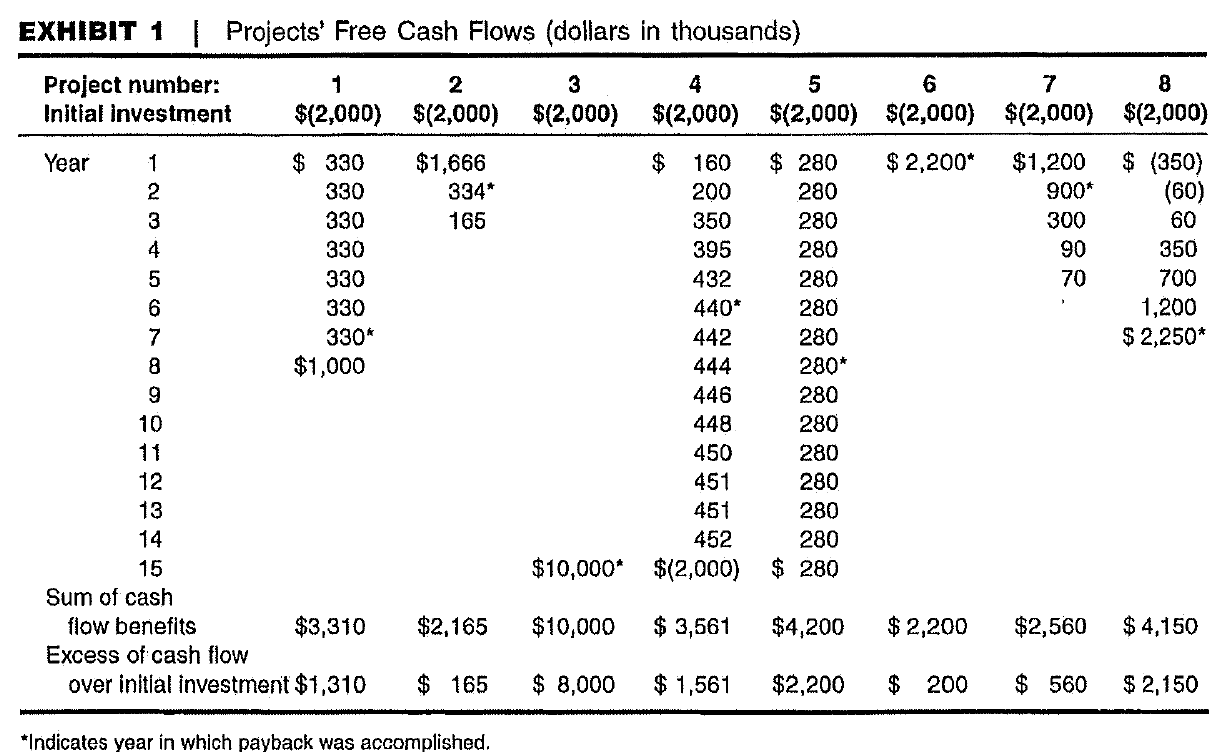

| Background: You are the finance manager having to compare 2 projects: 7 and 8 and select one to recommend to the Board of Directors. The discount rate is 10%. | |

| Task 1: Compute NPV, PI, and IRR of Project 7 and 8. [Word limit: 20 words] Type your answer below:

|

Max: 20 Marks

|

| Task 2: List 2 reasons why 7 is better than 8. [Word limit: 20 words] Type your answer below: |

Max: 20 Marks

|

| Task 3: List 2 reasons why 8 is better than 7. [Word limit: 20 words] Type your answer below: | Max: 20 Marks

|

| Task 4: Consider qualitative factors: What kind of business (e.g., manufacturing, trading, etc) will have cashflow pattern of Projects 7 and 8 respectively? Which project would you pick after taking these qualitative factors into account? [Word Limit: 50 words] Type your answer below:

| Max: 40 Marks |

Note: You may attach appendices, tables, etc with different documents and send with your Marking Scheme.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started