Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Background: Your company has been approached by another aircraft lessor who is interested in selling a portfolio of ten aircraft. The company would like your

Background:

Your company has been approached by another aircraft lessor who is interested in selling a portfolio of ten aircraft. The company would like your help in evaluating the portfolio as they consider the possibility of acquiring the aircraft from the seller.

Assumptions:

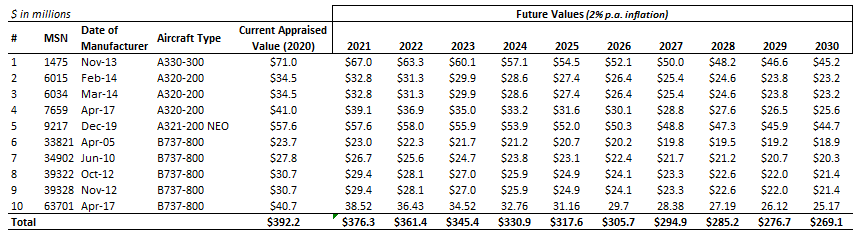

- Purchase price/acquisition cost assume aircraft are acquired at the current appraised value as indicated in the schedule below:

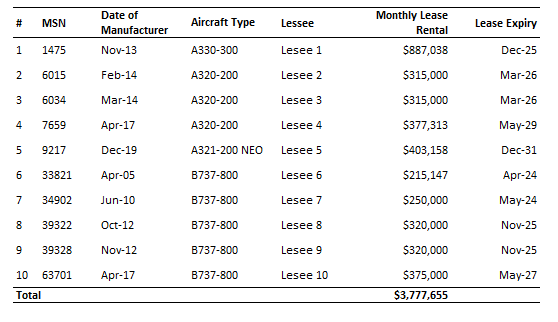

- Aircraft and lease terms see below:

- Debt terms:

- Advance amount of 75% loan-to-value (LTV)

- Debt matures in 7 years

- Debt coupon of L + 1.75%

- Upfront fee of 1.0% of initial loan amount

- Mortgage style amortization to a balloon of 50% of future value at debt maturity

- We will hedge interest rate risk; see the current fixed payer LIBOR swap curve below:

| Average Swap Life: | Fixed Payer Swap Rate: |

| 3 year | 1.50% |

| 5 year | 1.60% |

| 7 year | 1.70% |

- Aircraft depreciation purchase price is depreciated to a residual value equal to 15% of the estimated cost of the aircraft when brand new and assuming a 25-year useful life

- SG&A make your own assumptions

Task:

The task is to project both GAAP and cash three-year P&Ls for a portfolio of 10 aircraft using the Assumptions below.

S in millions Future Values (2% p.a. inflation) Current Appraised Value (2020) Date of Aircraft Type 23 MSN 2022 2026 2027 2029 Manufacturer 2021 2023 2024 2025 2028 2030 $63.3 1475 $71.0 $67.0 $60.1 $57.1 $54.5 $52.1 $50.0 $48.2 $46.6 $45.2 Nov-13 30-300 $34.5 6015 $32.8 $31.3 $29.9 $28.6 $27.4 $26.4 $25.4 $24.6 $23.8 $23.2 Feb-14 A320-200 A320-200 $34.5 $32.8 $31.3 $29.9 $28.6 $27.4 $26.4 $25.4 $24.6 $23.8 $23.2 6034 Mar-14 7659 $41.0 $39.1 $36.9 $35.0 $33.2 $31.6 $30.1 $28.8 $27.6 $26.5 $25.6 Apr-17 A320-200 $57.6 $57.6 $58.0 $55.9 $53.9 $52.0 $50.3 $48.8 $47.3 $45.9 $44.7 9217 Dec-19 A321-200 NEO 33821 Apr-05 $23.7 $23.0 $22.3 $21.7 $21.2 $20.7 $20.2 $19.8 $19.5 $19.2 $18.9 B737-800 34902 Jun-10 $27.8 $26.7 $25.6 $24.7 $23.8 $23.1 $22.4 $21.7 $21.2 $20.7 $20.3 B737-800 $30.7 $29.4 $28.1 $27.0 $25.9 $24.9 $24.1 $23.3 $22.6 $22.0 $21.4 39322 Oct-12 B737-800 $30.7 $29.4 $28.1 $27.0 $25.9 $24.9 $24.1 $23.3 $22.6 $22.0 $21.4 39328 Nov-12 B737-800 63701 Apr-17 $40.7 34.52 32.76 31.16 29.7 10 B737-800 38.52 36.43 28.38 27.19 26.12 25.17 $392.2 $376.3 $361.4 $345.4 $330.9 $317.6 $305.7 $294.9 $285.2 $276.7 $269.1 Total Monthly Lease Rental Date of Lease Expiry Aircraft Type 23 MSN Lessee Manufacturer $887,038 1475 Nov-13 A330-300 Lesee 1 Dec-25 $315,000 6015 Feb-14 A320-200 Lesee 2 Mar-26 $315,000 6034 Mar-14 A320-200 Lesee 3 Mar-26 $377,313 7659 May-29 Apr-17 A320-200 Lesee 4 9217 $403,158 Dec-19 A321-200 NEO Lesee 5 Dec-31 $215,147 Apr-24 33821 Apr-05 B737-800 Lesee 6 34902 $250,000 Jun-10 B737-800 Lesee 7 May-24 39322 $320,000 Oct-12 B737-800 Lesee 8 Nov-25 $320,000 39328 Nov-12 B737-800 Lesee 9 Nov-25 B737-800 $375,000 10 63701 Apr-17 Lesee 10 May-27 Total $3,777,655 S in millions Future Values (2% p.a. inflation) Current Appraised Value (2020) Date of Aircraft Type 23 MSN 2022 2026 2027 2029 Manufacturer 2021 2023 2024 2025 2028 2030 $63.3 1475 $71.0 $67.0 $60.1 $57.1 $54.5 $52.1 $50.0 $48.2 $46.6 $45.2 Nov-13 30-300 $34.5 6015 $32.8 $31.3 $29.9 $28.6 $27.4 $26.4 $25.4 $24.6 $23.8 $23.2 Feb-14 A320-200 A320-200 $34.5 $32.8 $31.3 $29.9 $28.6 $27.4 $26.4 $25.4 $24.6 $23.8 $23.2 6034 Mar-14 7659 $41.0 $39.1 $36.9 $35.0 $33.2 $31.6 $30.1 $28.8 $27.6 $26.5 $25.6 Apr-17 A320-200 $57.6 $57.6 $58.0 $55.9 $53.9 $52.0 $50.3 $48.8 $47.3 $45.9 $44.7 9217 Dec-19 A321-200 NEO 33821 Apr-05 $23.7 $23.0 $22.3 $21.7 $21.2 $20.7 $20.2 $19.8 $19.5 $19.2 $18.9 B737-800 34902 Jun-10 $27.8 $26.7 $25.6 $24.7 $23.8 $23.1 $22.4 $21.7 $21.2 $20.7 $20.3 B737-800 $30.7 $29.4 $28.1 $27.0 $25.9 $24.9 $24.1 $23.3 $22.6 $22.0 $21.4 39322 Oct-12 B737-800 $30.7 $29.4 $28.1 $27.0 $25.9 $24.9 $24.1 $23.3 $22.6 $22.0 $21.4 39328 Nov-12 B737-800 63701 Apr-17 $40.7 34.52 32.76 31.16 29.7 10 B737-800 38.52 36.43 28.38 27.19 26.12 25.17 $392.2 $376.3 $361.4 $345.4 $330.9 $317.6 $305.7 $294.9 $285.2 $276.7 $269.1 Total Monthly Lease Rental Date of Lease Expiry Aircraft Type 23 MSN Lessee Manufacturer $887,038 1475 Nov-13 A330-300 Lesee 1 Dec-25 $315,000 6015 Feb-14 A320-200 Lesee 2 Mar-26 $315,000 6034 Mar-14 A320-200 Lesee 3 Mar-26 $377,313 7659 May-29 Apr-17 A320-200 Lesee 4 9217 $403,158 Dec-19 A321-200 NEO Lesee 5 Dec-31 $215,147 Apr-24 33821 Apr-05 B737-800 Lesee 6 34902 $250,000 Jun-10 B737-800 Lesee 7 May-24 39322 $320,000 Oct-12 B737-800 Lesee 8 Nov-25 $320,000 39328 Nov-12 B737-800 Lesee 9 Nov-25 B737-800 $375,000 10 63701 Apr-17 Lesee 10 May-27 Total $3,777,655Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started