Question

Bad Debt Expense: Percentage of Credit Sales Method The Glass House, a glass and china store, sells nearly half its merchandise on credit. During the

Bad Debt Expense: Percentage of Credit Sales Method

The Glass House, a glass and china store, sells nearly half its merchandise on credit. During the past 4 years, the following data were developed for credit sales and losses from uncollectible accounts:

| Year of Sales | Credit Sales | Losses from Uncollectible Accounts* | ||||

| 2020 | $197,000 | $12,608 | ||||

| 2021 | 202,000 | 13,299 | ||||

| 2022 | 212,000 | 13,285 | ||||

| 2023 | 273,000 | 22,274 | ||||

| Total | $884,000 | $61,466 |

*Losses from uncollectible accounts are the actual losses related to sales of that year (rather than write-offs of that year).

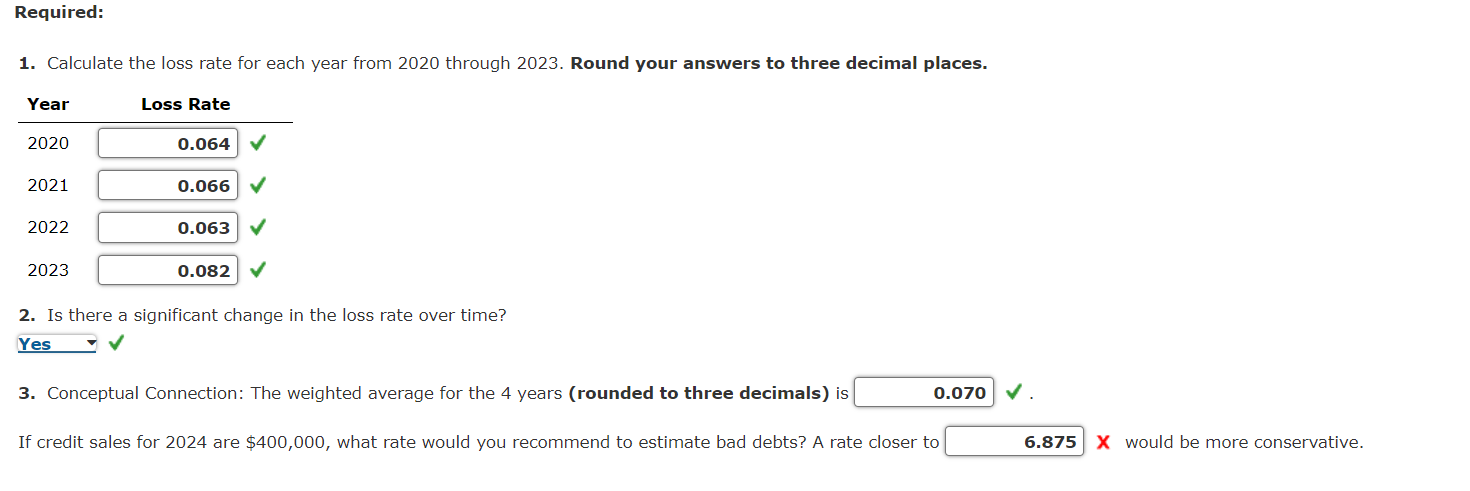

3. Conceptual Connection: The weighted average for the 4 years (rounded to three decimals) is 0.070

If credit sales for 2024 are $400,000, what rate would you recommend to estimate bad debts? A rate closer to (fill in the blank ) would be more conservative.

1. Calculate the loss rate for each year from 2020 through 2023. Round your answers to three decimal places. 2. Is there a significant change in the loss rate over time? 3. Conceptual Connection: The weighted average for the 4 years (rounded to three decimals) is If credit sales for 2024 are $400,000, what rate would you recommend to estimate bad debts? A rate closer to X would be more conservative. 1. Calculate the loss rate for each year from 2020 through 2023. Round your answers to three decimal places. 2. Is there a significant change in the loss rate over time? 3. Conceptual Connection: The weighted average for the 4 years (rounded to three decimals) is If credit sales for 2024 are $400,000, what rate would you recommend to estimate bad debts? A rate closer to X would be more conservative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started