Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Badang Trading accounts for its sales method. On January 1, 2020, its ledger accounts include the following balances. Instalments receivable, 2018 Instalments receivable, 2019

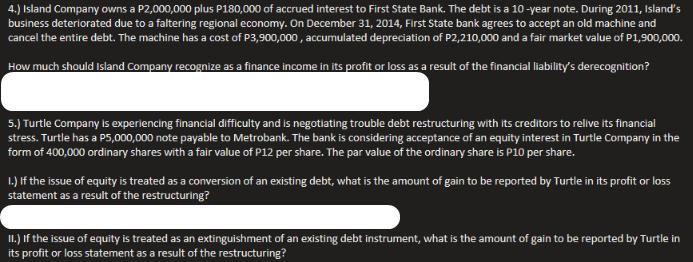

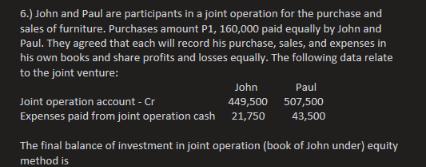

Badang Trading accounts for its sales method. On January 1, 2020, its ledger accounts include the following balances. Instalments receivable, 2018 Instalments receivable, 2019 Deferred gross profit, 2018. Deferred gross profit, 2019.. Instalment sales in 2020 were made at 42% gross profit rate. At December 31, 2020, account balances before adjustments were as follows: Installments receivable, 2018........... PO Instalments receivable, 2019 Instalments receivable, 2020.. Deferred gross profit, 2018... Deferred gross profit, 2019.. Deferred gross profit, 2020.. 1. The total realized gross profit for the year ended December 31,2020 was ..P24,640 .99,200 7,392 39,680 26,880 64,320 7,392 39,680 48,518.40 to Cyclops Company which began operations on January 5, 2019, appropriately uses the instalment method of revenue recognition. The following information pertains to the company's operations for 2019 and 2020. 2019 P192,000 2020 P288,000 64,000 0 Sales Collections from 2019 sales 2020 sales Accounts written off from 2019 sales 16,000 48,000 2020 sales 0 96,000 40% Gross profit rates 30% 2. What amount should Cyclops Company report as deferred gross profit in its December 31, 2020 balance sheets? 32,000 96,000 4.) Island Company owns a P2,000,000 plus P180,000 of accrued interest to First State Bank. The debt is a 10-year note. During 2011, Island's business deteriorated due to a faltering regional economy. On December 31, 2014, First State bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of P3,900,000, accumulated depreciation of P2,210,000 and a fair market value of P1,900,000. How much should Island Company recognize as a finance income in its profit or loss as a result of the financial liability's derecognition? 5.) Turtle Company is experiencing financial difficulty and is negotiating trouble debt restructuring with its creditors to relive its financial stress. Turtle has a P5,000,000 note payable to Metrobank. The bank is considering acceptance of an equity interest in Turtle Company in the form of 400,000 ordinary shares with a fair value of P12 per share. The par value of the ordinary share is P10 per share. 1.) If the issue of equity is treated as a conversion of an existing debt, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? II.) If the issue of equity is treated as an extinguishment of an existing debt instrument, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? 6.) John and Paul are participants in a joint operation for the purchase and sales of furniture. Purchases amount P1, 160,000 paid equally by John and Paul. They agreed that each will record his purchase, sales, and expenses in his own books and share profits and losses equally. The following data relate to the joint venture: John Paul Joint operation account - Cr 449,500 507,500 Expenses paid from joint operation cash 21,750 43,500 The final balance of investment in joint operation (book of John under) equity method is Badang Trading accounts for its sales method. On January 1, 2020, its ledger accounts include the following balances. Instalments receivable, 2018 Instalments receivable, 2019 Deferred gross profit, 2018. Deferred gross profit, 2019.. Instalment sales in 2020 were made at 42% gross profit rate. At December 31, 2020, account balances before adjustments were as follows: Installments receivable, 2018........... PO Instalments receivable, 2019 Instalments receivable, 2020.. Deferred gross profit, 2018... Deferred gross profit, 2019.. Deferred gross profit, 2020.. 1. The total realized gross profit for the year ended December 31,2020 was ..P24,640 .99,200 7,392 39,680 26,880 64,320 7,392 39,680 48,518.40 to Cyclops Company which began operations on January 5, 2019, appropriately uses the instalment method of revenue recognition. The following information pertains to the company's operations for 2019 and 2020. 2019 P192,000 2020 P288,000 Sales Collections from 2019 sales 2020 sales Accounts written off from 2019 sales 16,000 48,000 2020 sales 0 96,000 40% Gross profit rates 30% 2. What amount should Cyclops Company report as deferred gross profit in its December 31, 2020 balance sheets? 64,000 0 32,000 96,000 4.) Island Company owns a P2,000,000 plus P180,000 of accrued interest to First State Bank. The debt is a 10-year note. During 2011, Island's business deteriorated due to a faltering regional economy. On December 31, 2014, First State bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of P3,900,000, accumulated depreciation of P2,210,000 and a fair market value of P1,900,000. How much should Island Company recognize as a finance income in its profit or loss as a result of the financial liability's derecognition? 5.) Turtle Company is experiencing financial difficulty and is negotiating trouble debt restructuring with its creditors to relive its financial stress. Turtle has a P5,000,000 note payable to Metrobank. The bank is considering acceptance of an equity interest in Turtle Company in the form of 400,000 ordinary shares with a fair value of P12 per share. The par value of the ordinary share is P10 per share. 1.) If the issue of equity is treated as a conversion of an existing debt, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? II.) If the issue of equity is treated as an extinguishment of an existing debt instrument, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? 6.) John and Paul are participants in a joint operation for the purchase and sales of furniture. Purchases amount P1, 160,000 paid equally by John and Paul. They agreed that each will record his purchase, sales, and expenses in his own books and share profits and losses equally. The following data relate to the joint venture: John Paul Joint operation account - Cr 449,500 507,500 Expenses paid from joint operation cash 21,750 43,500 The final balance of investment in joint operation (book of John under) equity method is Badang Trading accounts for its sales method. On January 1, 2020, its ledger accounts include the following balances. Instalments receivable, 2018 Instalments receivable, 2019 Deferred gross profit, 2018. Deferred gross profit, 2019.. Instalment sales in 2020 were made at 42% gross profit rate. At December 31, 2020, account balances before adjustments were as follows: Installments receivable, 2018........... PO Instalments receivable, 2019 Instalments receivable, 2020.. Deferred gross profit, 2018... Deferred gross profit, 2019.. Deferred gross profit, 2020.. 1. The total realized gross profit for the year ended December 31,2020 was ..P24,640 .99,200 7,392 39,680 26,880 64,320 7,392 39,680 48,518.40 to Cyclops Company which began operations on January 5, 2019, appropriately uses the instalment method of revenue recognition. The following information pertains to the company's operations for 2019 and 2020. 2019 P192,000 2020 P288,000 Sales Collections from 2019 sales 2020 sales Accounts written off from 2019 sales 16,000 48,000 2020 sales 0 96,000 40% Gross profit rates 30% 2. What amount should Cyclops Company report as deferred gross profit in its December 31, 2020 balance sheets? 64,000 0 32,000 96,000 4.) Island Company owns a P2,000,000 plus P180,000 of accrued interest to First State Bank. The debt is a 10-year note. During 2011, Island's business deteriorated due to a faltering regional economy. On December 31, 2014, First State bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of P3,900,000, accumulated depreciation of P2,210,000 and a fair market value of P1,900,000. How much should Island Company recognize as a finance income in its profit or loss as a result of the financial liability's derecognition? 5.) Turtle Company is experiencing financial difficulty and is negotiating trouble debt restructuring with its creditors to relive its financial stress. Turtle has a P5,000,000 note payable to Metrobank. The bank is considering acceptance of an equity interest in Turtle Company in the form of 400,000 ordinary shares with a fair value of P12 per share. The par value of the ordinary share is P10 per share. 1.) If the issue of equity is treated as a conversion of an existing debt, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? II.) If the issue of equity is treated as an extinguishment of an existing debt instrument, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? 6.) John and Paul are participants in a joint operation for the purchase and sales of furniture. Purchases amount P1, 160,000 paid equally by John and Paul. They agreed that each will record his purchase, sales, and expenses in his own books and share profits and losses equally. The following data relate to the joint venture: John Paul Joint operation account - Cr 449,500 507,500 Expenses paid from joint operation cash 21,750 43,500 The final balance of investment in joint operation (book of John under) equity method is Badang Trading accounts for its sales method. On January 1, 2020, its ledger accounts include the following balances. Instalments receivable, 2018 Instalments receivable, 2019 Deferred gross profit, 2018. Deferred gross profit, 2019.. Instalment sales in 2020 were made at 42% gross profit rate. At December 31, 2020, account balances before adjustments were as follows: Installments receivable, 2018........... PO Instalments receivable, 2019 Instalments receivable, 2020.. Deferred gross profit, 2018... Deferred gross profit, 2019.. Deferred gross profit, 2020.. 1. The total realized gross profit for the year ended December 31,2020 was ..P24,640 .99,200 7,392 39,680 26,880 64,320 7,392 39,680 48,518.40 to Cyclops Company which began operations on January 5, 2019, appropriately uses the instalment method of revenue recognition. The following information pertains to the company's operations for 2019 and 2020. 2019 P192,000 2020 P288,000 Sales Collections from 2019 sales 2020 sales Accounts written off from 2019 sales 16,000 48,000 2020 sales 0 96,000 40% Gross profit rates 30% 2. What amount should Cyclops Company report as deferred gross profit in its December 31, 2020 balance sheets? 64,000 0 32,000 96,000 4.) Island Company owns a P2,000,000 plus P180,000 of accrued interest to First State Bank. The debt is a 10-year note. During 2011, Island's business deteriorated due to a faltering regional economy. On December 31, 2014, First State bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of P3,900,000, accumulated depreciation of P2,210,000 and a fair market value of P1,900,000. How much should Island Company recognize as a finance income in its profit or loss as a result of the financial liability's derecognition? 5.) Turtle Company is experiencing financial difficulty and is negotiating trouble debt restructuring with its creditors to relive its financial stress. Turtle has a P5,000,000 note payable to Metrobank. The bank is considering acceptance of an equity interest in Turtle Company in the form of 400,000 ordinary shares with a fair value of P12 per share. The par value of the ordinary share is P10 per share. 1.) If the issue of equity is treated as a conversion of an existing debt, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? II.) If the issue of equity is treated as an extinguishment of an existing debt instrument, what is the amount of gain to be reported by Turtle in its profit or loss statement as a result of the restructuring? 6.) John and Paul are participants in a joint operation for the purchase and sales of furniture. Purchases amount P1, 160,000 paid equally by John and Paul. They agreed that each will record his purchase, sales, and expenses in his own books and share profits and losses equally. The following data relate to the joint venture: John Paul Joint operation account - Cr 449,500 507,500 Expenses paid from joint operation cash 21,750 43,500 The final balance of investment in joint operation (book of John under) equity method is

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the total realized gross profit for the year ended December 31 2020 we need to determine the gross profit recognized on the installment sales made during the year The gross profit rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started