Answered step by step

Verified Expert Solution

Question

1 Approved Answer

badly need this asap. thank you so much will give a thumbs up :)) Christy Company purchased a machine on January 2, 2012, for 500,000.

badly need this asap. thank you so much will give a thumbs up :))

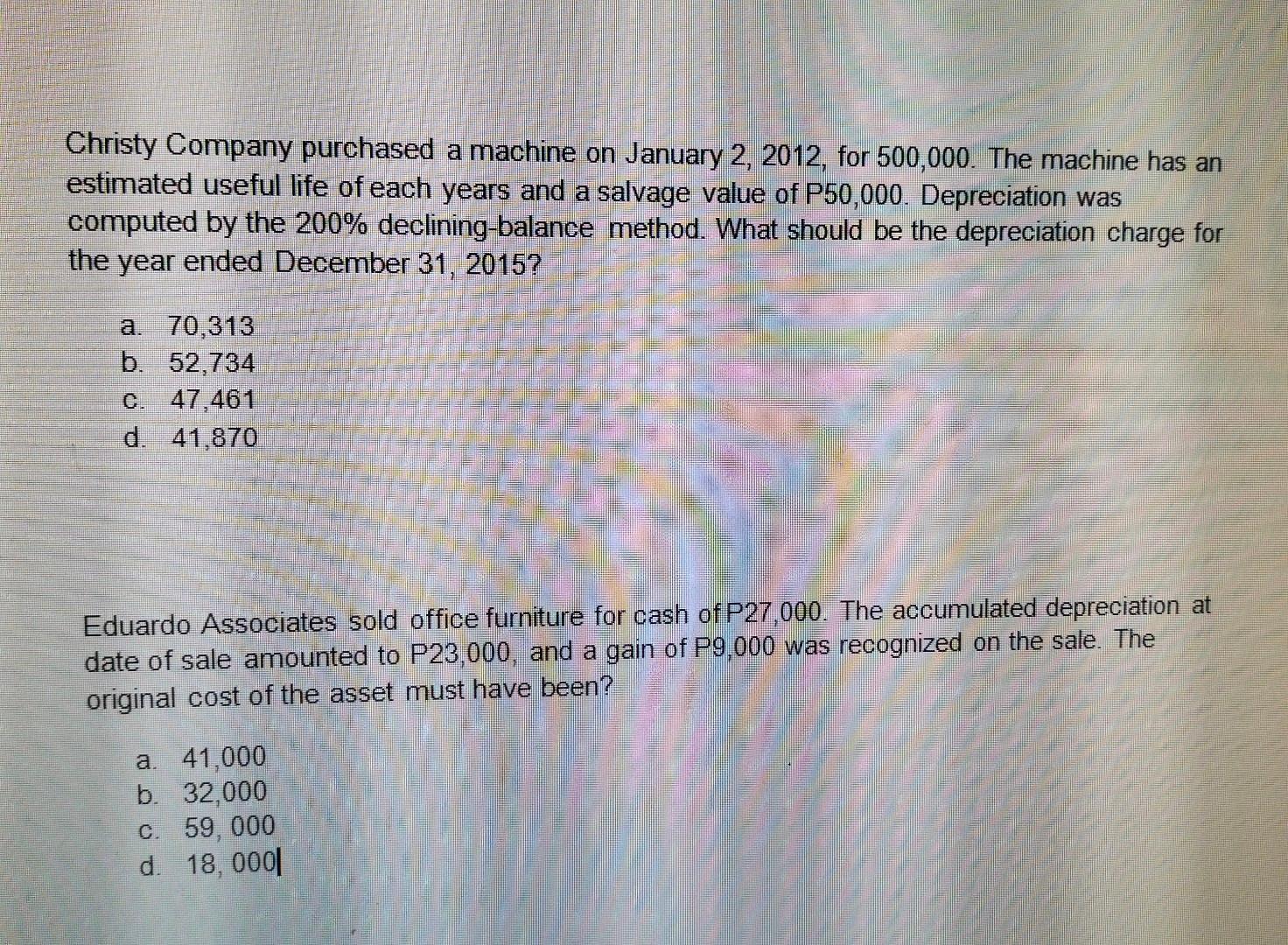

Christy Company purchased a machine on January 2, 2012, for 500,000. The machine has an estimated useful life of each years and a salvage value of P50,000. Depreciation was computed by the 200% declining-balance method. What should be the depreciation charge for the year ended December 31, 2015? a. 70,313 b. 52,734 c. 47,461 d. 41,870 Eduardo Associates sold office furniture for cash of P27,000. The accumulated depreciation at date of sale amounted to P23,000, and a gain of P9,000 was recognized on the sale. The original cost of the asset must have been? a. 41,000 b. 32,000 c. 59, 000 d. 18, 0001Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started