Answered step by step

Verified Expert Solution

Question

1 Approved Answer

badly need this asap. will give a thumbs up thank youuu Bobby Corp. acquired a machine at a total cost of P5,200,000. The estimated life

badly need this asap. will give a thumbs up thank youuu

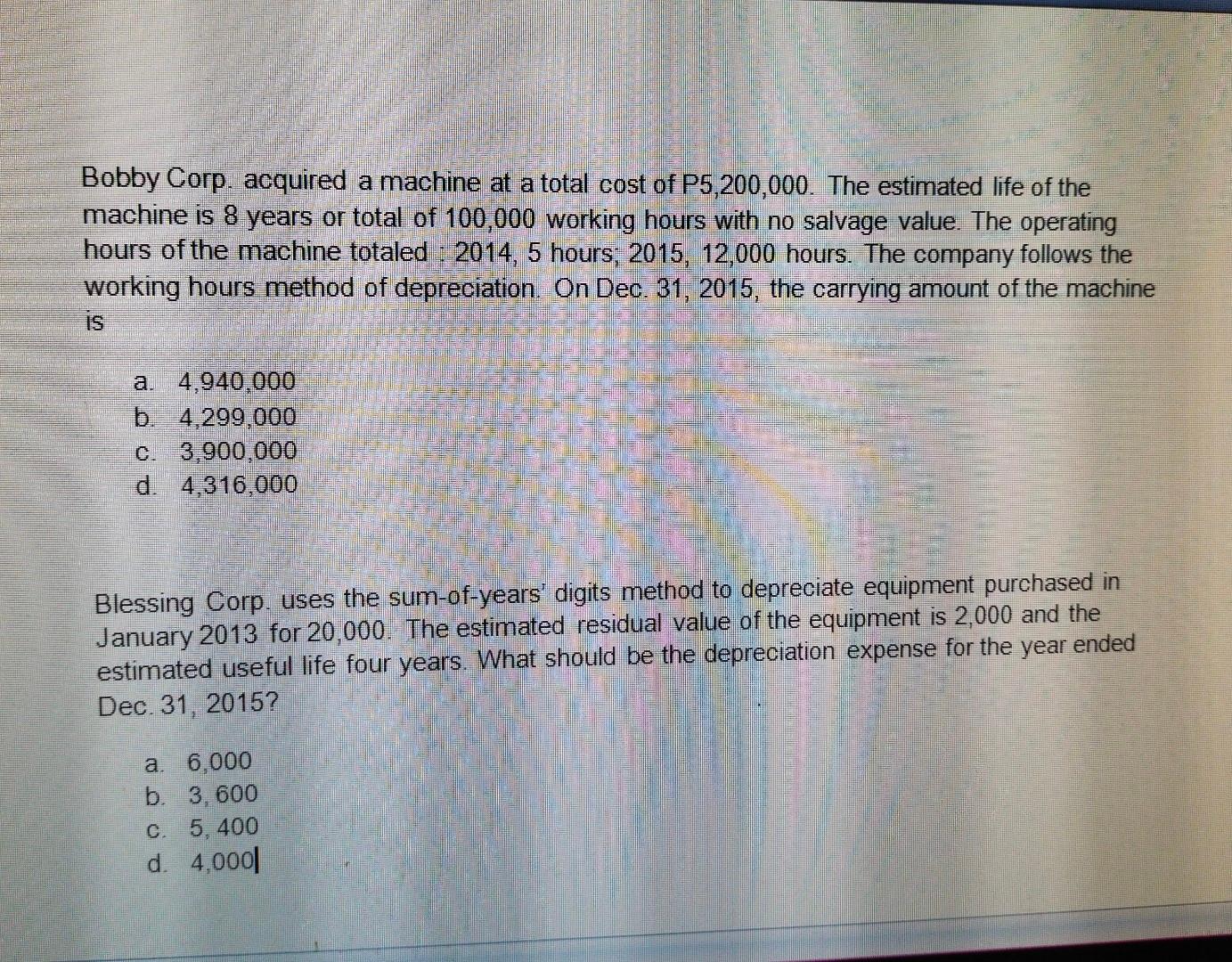

Bobby Corp. acquired a machine at a total cost of P5,200,000. The estimated life of the machine is 8 years or total of 100,000 working hours with no salvage value. The operating hours of the machine totaled : 2014, 5 hours, 2015, 12,000 hours. The company follows the working hours method of depreciation. On Dec 31, 2015, the carrying amount of the machine is a. 4,940,000 b. 4,299,000 c. 3,900,000 d. 4,316,000 Blessing Corp. uses the sum-of-years' digits method to depreciate equipment purchased in January 2013 for 20,000. The estimated residual value of the equipment is 2,000 and the estimated useful life four years. What should be the depreciation expense for the year ended Dec. 31, 2015? a. 6.000 b. 3, 600 c. 5,400 d. 4,0001Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started