Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bailey's Manufacturing Company is looking at changing their method of reporting bad debts expense. In past years the company has been able to use the

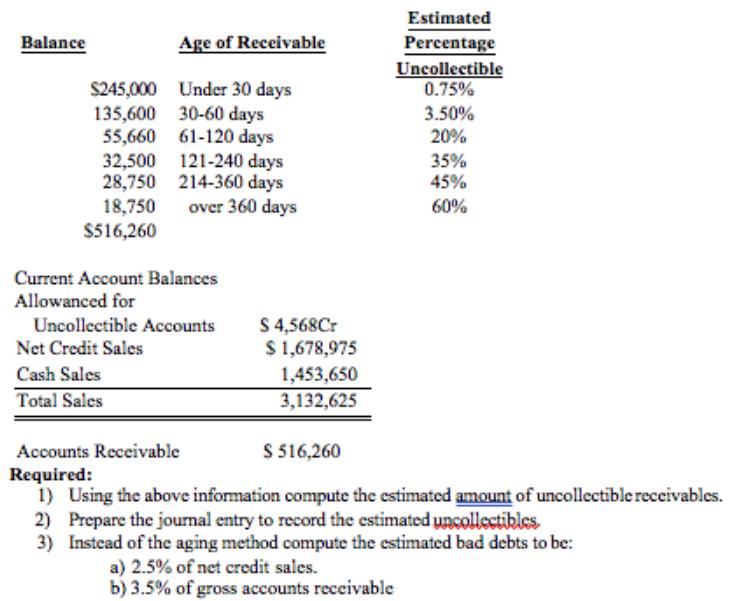

Bailey's Manufacturing Company is looking at changing their method of reporting bad debts expense. In past years the company has been able to use the direct write off method but have experienced significant growth in recent years. The accountants have prepared the following aging schedule based upon their current accounts receivable volume.

Estimated Percentage Uncollectible 0.75% Balance Age of Receivable S245,000 Under 30 days 135,600 30-60 days 55,660 61-120 days 32,500 121-240 days 28,750 214-360 days 18,750 $516,260 3.50% 20% 35% 45% over 360 days 60% Current Account Balances Allowanced for S 4,568Cr $ 1,678,975 Uncollectible Accounts Net Credit Sales Cash Sales 1,453,650 Total Sales 3,132,625 Accounts Receivable S 516,260 Required: 1) Using the above information compute the estimated amount of uncollectible receivables. 2) Prepare the journal entry to record the estimated uncollectibles 3) Instead of the aging method compute the estimated bad debts to be: a) 2.5% of net credit sales. b) 3.5% of gross accounts receivable

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started