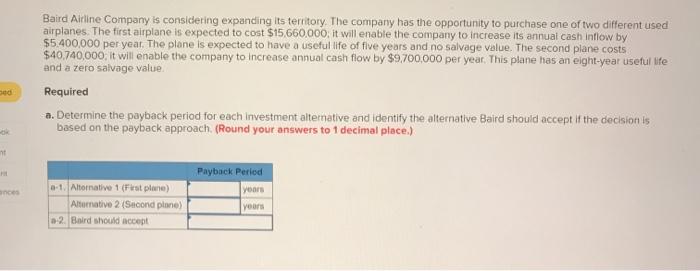

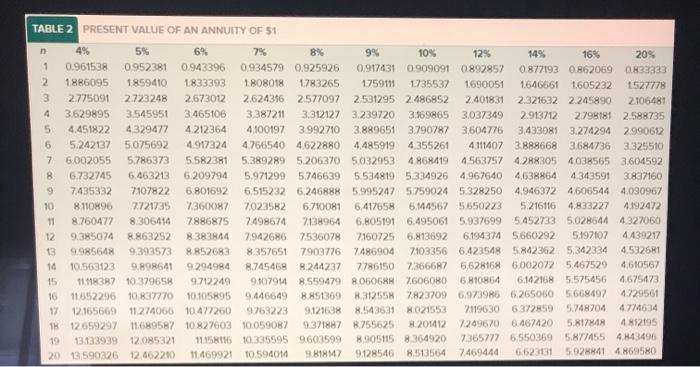

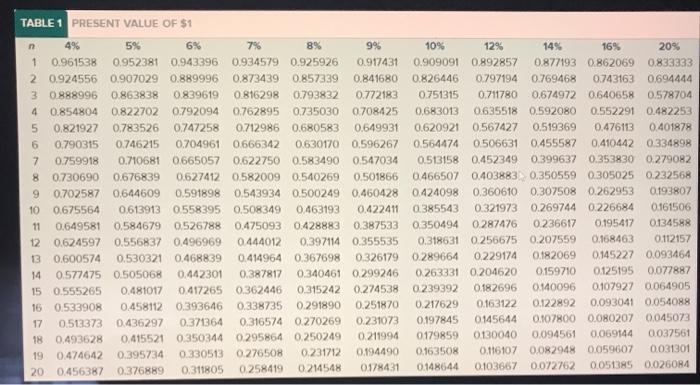

Baird Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $15,660.000, it will enable the company to increase its annual cash inflow by $5.400,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $40740,000 it will enable the company to increase annual cash flow by $9,700,000 per year . This plane has an eight-year useful life and a zero salvage value Required a. Determine the payback period for each Investment alternative and identify the alternative Baird should accept if the decision is based on the payback approach (Round your answers to 1 decimal place.) nt Payback Period yours ances 0-1 Altonative 1 (First plane) Alternative 2 (Second plone) 32 Baird should accept yoon TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 n 4% 5% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0952381 0.943396 0.934579 0.925926 0.917431 0.909091 0892857 0877193 0.862069 0.833333 2 1886095 1859410 1833393 1.808018 1783265 1759111 1735537 1690051 1.646661 1605232 1527778 3 2.775091 2.723248 2673012 2.624356 2577097 2531295 2.486852 2.401831 2.321632 2.245890 2106481 4 3629895 3545951 3.465106 3.387211 3.312127 3.239720 3.969865 3.037349 2.913712 2.798181 2.588735 5 4.451822 4329477 4.212364 4100197 3.992710 3.889651 3.7907873604776 3433081 3.274294 2.990612 6 5.242137 5.075692 4917324 4766540 4622880 4485919 4355261 4.111407 3.888668 3.684736 3.325510 7 6.002055 5786373 5.582381 5.3892895206370 5032953 4868419 4563757 4.2883054038565 3.604592 8 6.732745 6.463213 6.209794 5.971299 5746639 5.5348195334926 4.967640 4638864 4343591 3.837160 9 7435332 7.107822 6.801692 6.515232 6.246888 5.995247 5.759024 5328250 4.946372 4606544 4.030967 10 8110896 7721735 7.360087 7023582 6.710081 6.417658 5.144567 5650223 5.216116 4,833227 4.192472 11 8.760472 8.306414 7886875 7498574 7138964 6.805191 6.4950615.937699 5.452733 5.028644 4327060 12 9.385074 8.863252 8383844 7.942686 7536078 2160725 6.813692 6.194374 5660292 5.197107 4439217 13 998564 9.393573 8852683 8.357651 7903776 7486904 7103356 6.423548 5842362 5,342334 4.532681 14 10.563123 9.898641 9294984 8.745468 8.244237 7786150 2366687 6628168 6002072 5.467529 4.610567 15 11.118387 10.379658 9712249 9.107914 8559479 806068 7606080 6.810854 6.1421685.575456 4.675423 16 11652296 0837770 10.105895 9446649 8.851369 8.31255H 7823709 6.973986 6.2650505668497 4.729561 17 12.165669 11.274060 101427260 9753223 9121638 8.543631 021553 2119630 6372859 5.748704 4.774634 181265929711689587 10827603 10.059087 9.371887 8.755625 8.20112 7249670 6.467420 5.8178 4812195 13.133939 12 085321 11358116 10.335595 9603599 8.9051158364920 7365772 6.550369 5.877455 4.43496 20 13,590326 2.462200 11.46992: 10594014 9.8181791285468.513564 7.469440 6.623131 5.9288414869580 TABLE 1 PRESENT VALUE OF $1 n 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0743163 0.694444 30.8889960863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0,674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0,683013 0635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 6 0.790315 0.746215 0.704961 0666342 0.630170 0,596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 8 0.730690 0.676839 0.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0305025 0.232568 9 0.702587 0644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0193807 10 0.675564 0.613913 0558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0226684 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0.112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0263331 0.204620 0.159710 0125195 0,077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.163122 0.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0 145644 0.107800 0.080207 0.045073 18 0.493628 0.415521 0350344 0.295864 0.250249 0.211994 0179859 0130040 0,094561 0.069144 0.037561 19 0.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0059607 0.031301 20 0.456387 0.376889 0.311805 0.258419 0.214548 0178431 0.148644 0103667 0.072762 0.051385 0.026084