Question

Baird Companys income statement information follows: Year 3 Year 2 Net sales $ 423,000 $ 266,000 Income before interest and taxes 111,000 85,000 Net income

Baird Companys income statement information follows:

| Year 3 | Year 2 | ||||||

| Net sales | $ | 423,000 | $ | 266,000 | |||

| Income before interest and taxes | 111,000 | 85,000 | |||||

| Net income after taxes | 55,560 | 63,800 | |||||

| Interest expense | 9,150 | 7,450 | |||||

| Stockholders equity, December 31 (Year 1: $199,000) | 299,000 | 241,000 | |||||

| Common stock, December 31 | 192,500 | 172,500 | |||||

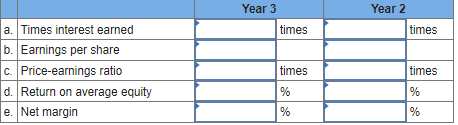

The average number of shares outstanding was 7,700 for Year 3 and 6,900 for Year 2. Required Compute the following ratios for Baird for Year 3 and Year 2. a. Number of times interest was earned. b. Earnings per share based on the average number of shares outstanding. c. Price-earnings ratio (market prices: Year 3, $66 per share; Year 2, $74 per share). d. Return on average equity. (Round your percentage answers to 2 decimal places. e. Net margin. (Round your percentage answers to 2 decimal places.

\begin{tabular}{|l|l|l|l|l|l|} \hline & \multicolumn{2}{|c|}{ Year 3 } & \multicolumn{2}{c|}{ Year 2 } \\ \hline a. & Times interest earned & & times & & times \\ \hline b. & Earnings per share & & & & \\ \hline c. & Price-earnings ratio & & times & & times \\ \hline d. & Return on average equity & & % & & % \\ \hline e. & Net margin & & % & & % \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & \multicolumn{2}{|c|}{ Year 3 } & \multicolumn{2}{c|}{ Year 2 } \\ \hline a. & Times interest earned & & times & & times \\ \hline b. & Earnings per share & & & & \\ \hline c. & Price-earnings ratio & & times & & times \\ \hline d. & Return on average equity & & % & & % \\ \hline e. & Net margin & & % & & % \\ \hline \end{tabular}

\begin{tabular}{|l|l|l|l|l|l|} \hline & \multicolumn{2}{|c|}{ Year 3 } & \multicolumn{2}{c|}{ Year 2 } \\ \hline a. & Times interest earned & & times & & times \\ \hline b. & Earnings per share & & & & \\ \hline c. & Price-earnings ratio & & times & & times \\ \hline d. & Return on average equity & & % & & % \\ \hline e. & Net margin & & % & & % \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & \multicolumn{2}{|c|}{ Year 3 } & \multicolumn{2}{c|}{ Year 2 } \\ \hline a. & Times interest earned & & times & & times \\ \hline b. & Earnings per share & & & & \\ \hline c. & Price-earnings ratio & & times & & times \\ \hline d. & Return on average equity & & % & & % \\ \hline e. & Net margin & & % & & % \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started