Answered step by step

Verified Expert Solution

Question

1 Approved Answer

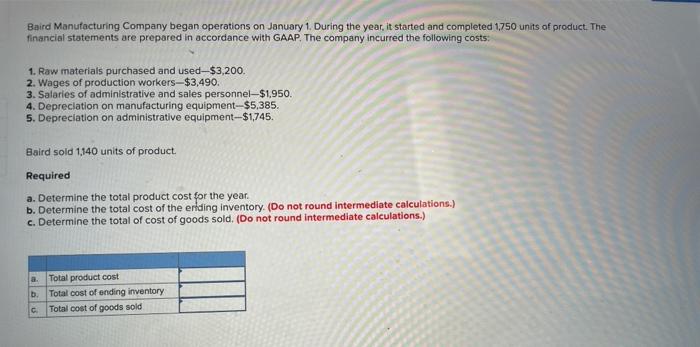

Baird Manufacturing Company began operations on January 1. During the year, it started and completed 1,750 units of product. The financial statements are prepared

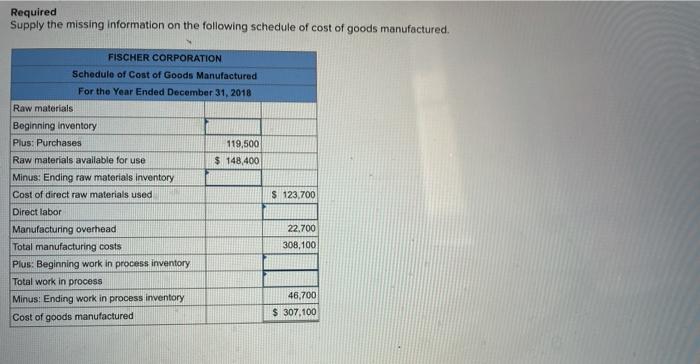

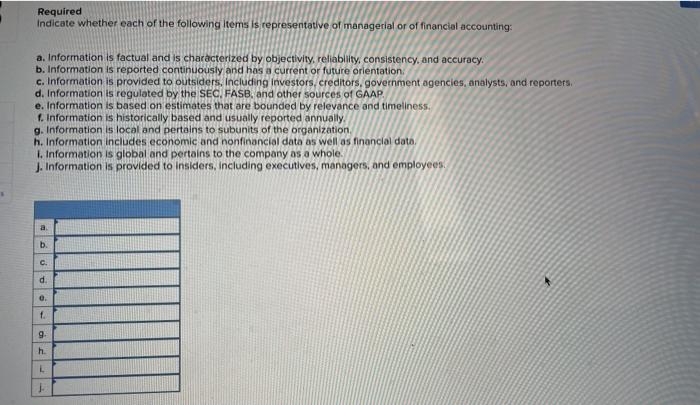

Baird Manufacturing Company began operations on January 1. During the year, it started and completed 1,750 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,200. 2. Wages of production workers-$3,490. 3. Salaries of administrative and sales personnel-$1,950. 4. Depreciation on manufacturing equipment-$5,385. 5. Depreciation on administrative equipment-$1,745. Baird sold 1,140 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the eriding inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory C. Total cost of goods sold Required Supply the missing information on the following schedule of cost of goods manufactured. FISCHER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2018 Raw materials Beginning inventory Plus: Purchases 119,500 $ 148,400 Raw materials available for use Minus: Ending raw materials inventory Cost of direct raw materials used Direct labor Manufacturing overhead. Total manufacturing costs Plus: Beginning work in process inventory Total work in process Minus: Ending work in process inventory Cost of goods manufactured $ 123,700 22,700 308,100 46,700 $ 307,100 Required Indicate whether each of the following items is representative of managerial or of financial accounting: a. Information is factual and is characterized by objectivity, reliability, consistency, and accuracy. b. Information is reported continuously and has a current or future orientation. c. Information is provided to outsiders, including investors, creditors, government agencies, analysts, and reporters. d. Information is regulated by the SEC, FASB, and other sources of GAAP e. Information is based on estimates that are bounded by relevance and timeliness. f. Information is historically based and usually reported annually. g. Information is local and pertains to subunits of the organization. h. Information includes economic and nonfinancial data as well as financial data. i. Information is global and pertains to the company as a whole. J. Information is provided to insiders, including executives, managers, and employees. a. b. C. d. 0. f. 9. h. L F Baird Manufacturing Company began operations on January 1. During the year, it started and completed 1,750 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,200. 2. Wages of production workers-$3,490. 3. Salaries of administrative and sales personnel-$1,950. 4. Depreciation on manufacturing equipment-$5,385. 5. Depreciation on administrative equipment-$1,745. Baird sold 1,140 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the eriding inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory C. Total cost of goods sold Required Supply the missing information on the following schedule of cost of goods manufactured. FISCHER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2018 Raw materials Beginning inventory Plus: Purchases 119,500 $ 148,400 Raw materials available for use Minus: Ending raw materials inventory Cost of direct raw materials used Direct labor Manufacturing overhead. Total manufacturing costs Plus: Beginning work in process inventory Total work in process Minus: Ending work in process inventory Cost of goods manufactured $ 123,700 22,700 308,100 46,700 $ 307,100 Required Indicate whether each of the following items is representative of managerial or of financial accounting: a. Information is factual and is characterized by objectivity, reliability, consistency, and accuracy. b. Information is reported continuously and has a current or future orientation. c. Information is provided to outsiders, including investors, creditors, government agencies, analysts, and reporters. d. Information is regulated by the SEC, FASB, and other sources of GAAP e. Information is based on estimates that are bounded by relevance and timeliness. f. Information is historically based and usually reported annually. g. Information is local and pertains to subunits of the organization. h. Information includes economic and nonfinancial data as well as financial data. i. Information is global and pertains to the company as a whole. J. Information is provided to insiders, including executives, managers, and employees. a. b. C. d. 0. f. 9. h. L F Baird Manufacturing Company began operations on January 1. During the year, it started and completed 1,750 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,200. 2. Wages of production workers-$3,490. 3. Salaries of administrative and sales personnel-$1,950. 4. Depreciation on manufacturing equipment-$5,385. 5. Depreciation on administrative equipment-$1,745. Baird sold 1,140 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the eriding inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory C. Total cost of goods sold Required Supply the missing information on the following schedule of cost of goods manufactured. FISCHER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2018 Raw materials Beginning inventory Plus: Purchases 119,500 $ 148,400 Raw materials available for use Minus: Ending raw materials inventory Cost of direct raw materials used Direct labor Manufacturing overhead. Total manufacturing costs Plus: Beginning work in process inventory Total work in process Minus: Ending work in process inventory Cost of goods manufactured $ 123,700 22,700 308,100 46,700 $ 307,100 Required Indicate whether each of the following items is representative of managerial or of financial accounting: a. Information is factual and is characterized by objectivity, reliability, consistency, and accuracy. b. Information is reported continuously and has a current or future orientation. c. Information is provided to outsiders, including investors, creditors, government agencies, analysts, and reporters. d. Information is regulated by the SEC, FASB, and other sources of GAAP e. Information is based on estimates that are bounded by relevance and timeliness. f. Information is historically based and usually reported annually. g. Information is local and pertains to subunits of the organization. h. Information includes economic and nonfinancial data as well as financial data. i. Information is global and pertains to the company as a whole. J. Information is provided to insiders, including executives, managers, and employees. a. b. C. d. 0. f. 9. h. L F

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part 3 a Financial accounting Objectivity reliability consistency and accuracy are the main characte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started