Answered step by step

Verified Expert Solution

Question

1 Approved Answer

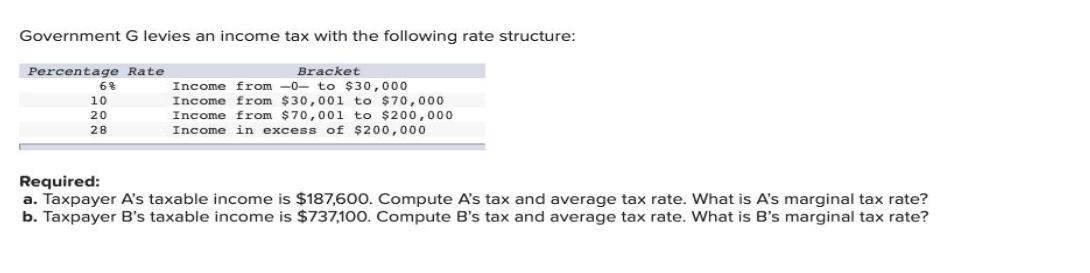

Government G levies an income tax with the following rate structure: Percentage Rate Bracket Income from -0- to $30,000 6% 10 20 Income from

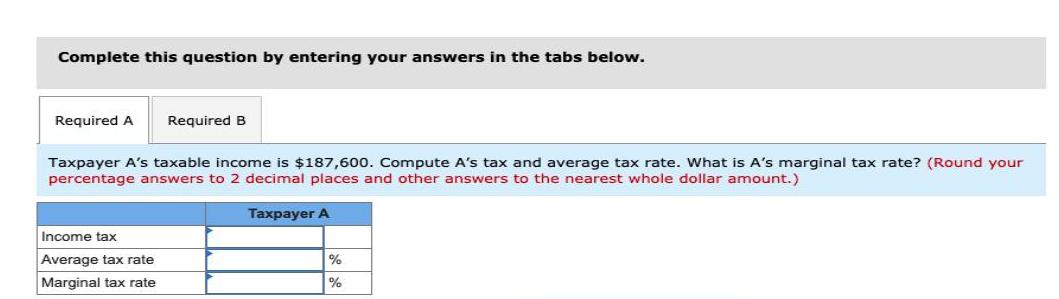

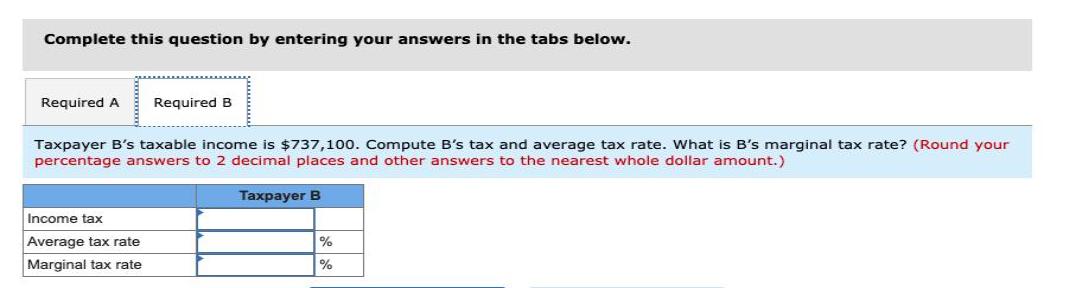

Government G levies an income tax with the following rate structure: Percentage Rate Bracket Income from -0- to $30,000 6% 10 20 Income from $30,001 to $70,000 Income from $70,001 to $200,000 Income in excess of $200,000 28 Required: a. Taxpayer A's taxable income is $187,600. Compute A's tax and average tax rate. What is A's marginal tax rate? b. Taxpayer B's taxable income is $737,100. Compute B's tax and average tax rate. What is B's marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Taxpayer A's taxable income is $187,600. Compute A's tax and average tax rate. What is A's marginal tax rate? (Round your percentage answers to 2 decimal places and other answers to the nearest whole dollar amount.) Taxpayer A Income tax Average tax rate Marginal tax rate % % Complete this question by entering your answers in the tabs below. Required A Required B Taxpayer B's taxable income is $737,100. Compute B's tax and average tax rate. What is B's marginal tax rate? (Round your percentage answers to 2 decimal places and other answers to the nearest whole dollar amount.) Taxpayer B Income tax Average tax rate Marginal tax rate % %

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution a In the given case Taxable Income of A 187600 tax rates slab wise given Average Tax Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started