Answered step by step

Verified Expert Solution

Question

1 Approved Answer

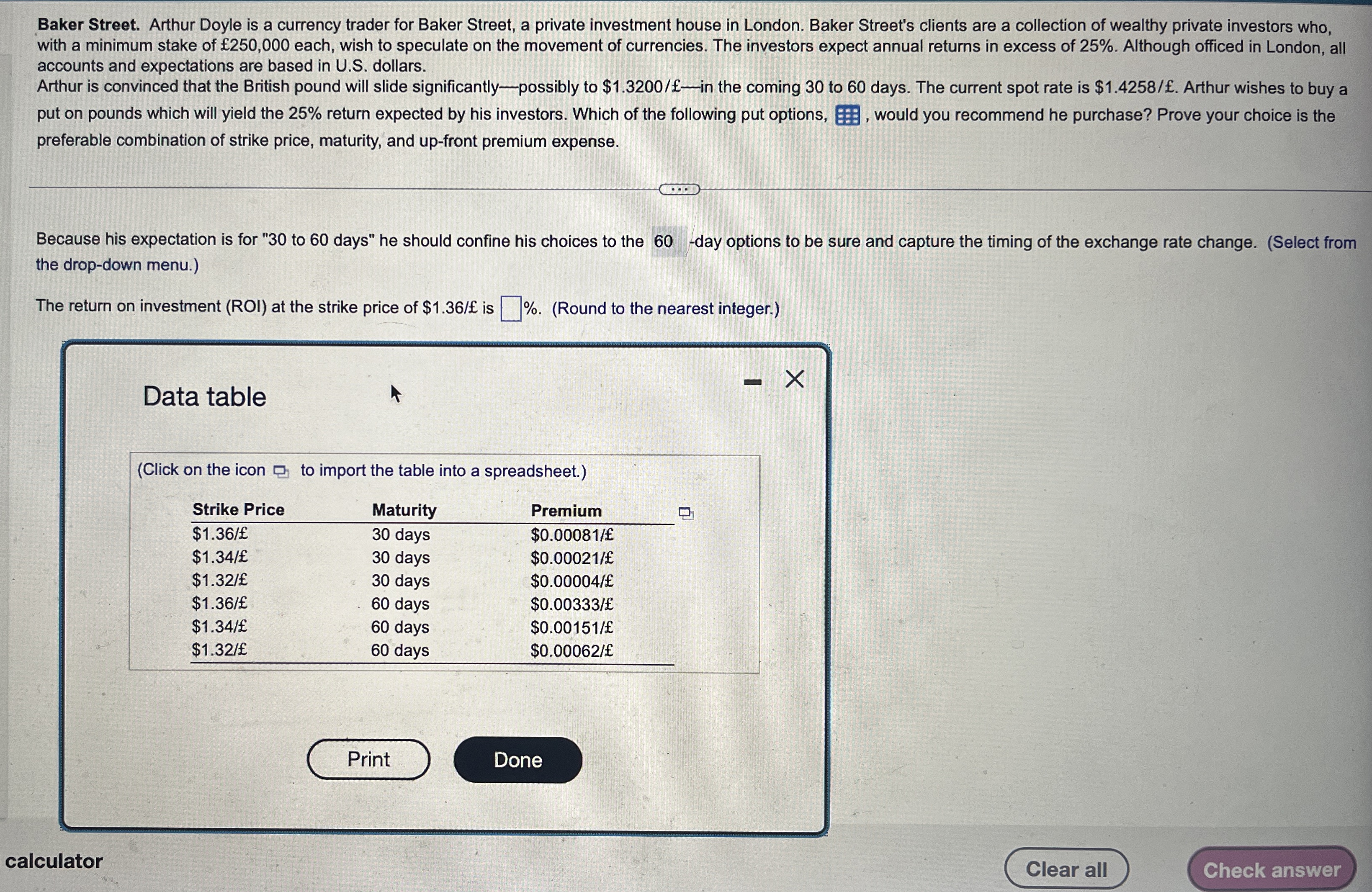

Baker Street. Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Street's clients are a collection of wealthy

Baker Street. Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Street's clients are a collection of wealthy private investors who, with a minimum stake of each, wish to speculate on the movement of currencies. The investors expect annual returns in excess of Although officed in London, all accounts and expectations are based in US dollars.

Arthur is convinced that the British pound will slide significantlypossibly to $in the coming to days. The current spot rate is $ Arthur wishes to buy a put on pounds which will yield the return expected by his investors. Which of the following put options, would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and upfront premium expense.

Because his expectation is for to days" he should confine his choices to the day options to be sure and capture the timing of the exchange rate change. Select from the dropdown menu.

The return on investment at the strike price of $ is

Round to the nearest integer.

Data table

Click on the icon to import the table into a spreadsheet.

tableStrike Price,Maturity,Premium$ days,$

Also need ROI on strike price of $ and $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started