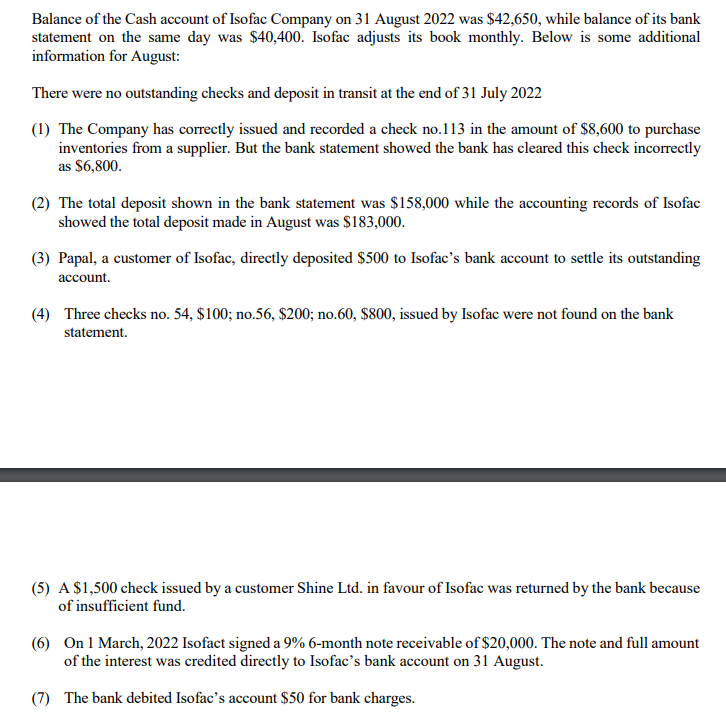

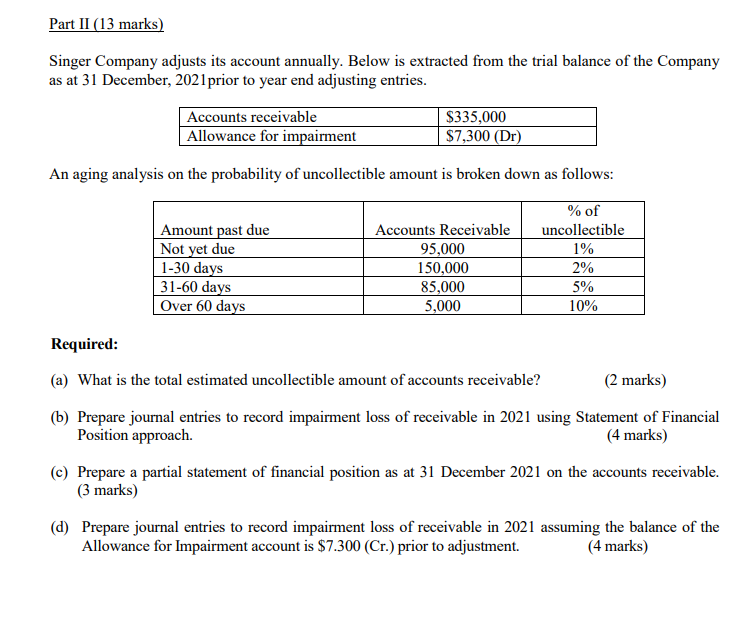

Balance of the Cash account of Isofac Company on 31 August 2022 was $42,650, while balance of its bank statement on the same day was $40,400. Isofac adjusts its book monthly. Below is some additional information for August: There were no outstanding checks and deposit in transit at the end of 31 July 2022 (1) The Company has correctly issued and recorded a check no.113 in the amount of $8,600 to purchase inventories from a supplier. But the bank statement showed the bank has cleared this check incorrectly as $6,800. (2) The total deposit shown in the bank statement was $158,000 while the accounting records of Isofac showed the total deposit made in August was $183,000. (3) Papal, a customer of Isofac, directly deposited $500 to Isofac's bank account to settle its outstanding account (4) Three checks no. 54, $100; no.56, $200; no.60, $800, issued by Isofac were not found on the bank statement. (5) A $1,500 check issued by a customer Shine Ltd. in favour of Isofac was returned by the bank because of insufficient fund. (6) On 1 March, 2022 Isofact signed a 9% 6-month note receivable of $20,000. The note and full amount of the interest was credited directly to Isofac's bank account on 31 August. (7) The bank debited Isofac's account $50 for bank charges. Part II (13 marks) Singer Company adjusts its account annually. Below is extracted from the trial balance of the Company as at 31 December, 2021 prior to year end adjusting entries. Accounts receivable Allowance for impairment $335,000 $7,300 (Dr) An aging analysis on the probability of uncollectible amount is broken down as follows: Amount past due Not yet due 1-30 days 31-60 days Over 60 days Accounts Receivable 95,000 150,000 85,000 5,000 % of uncollectible 1% 2% 5% 10% Required: (a) What is the total estimated uncollectible amount of accounts receivable? (2 marks) (b) Prepare journal entries to record impairment loss of receivable in 2021 using Statement of Financial Position approach. (4 marks) (c) Prepare a partial statement of financial position as at 31 December 2021 on the accounts receivable. (3 marks) (d) Prepare journal entries to record impairment loss of receivable in 2021 assuming the balance of the Allowance for Impairment account is $7.300 (Cr.) prior to adjustment. (4 marks)