Answered step by step

Verified Expert Solution

Question

1 Approved Answer

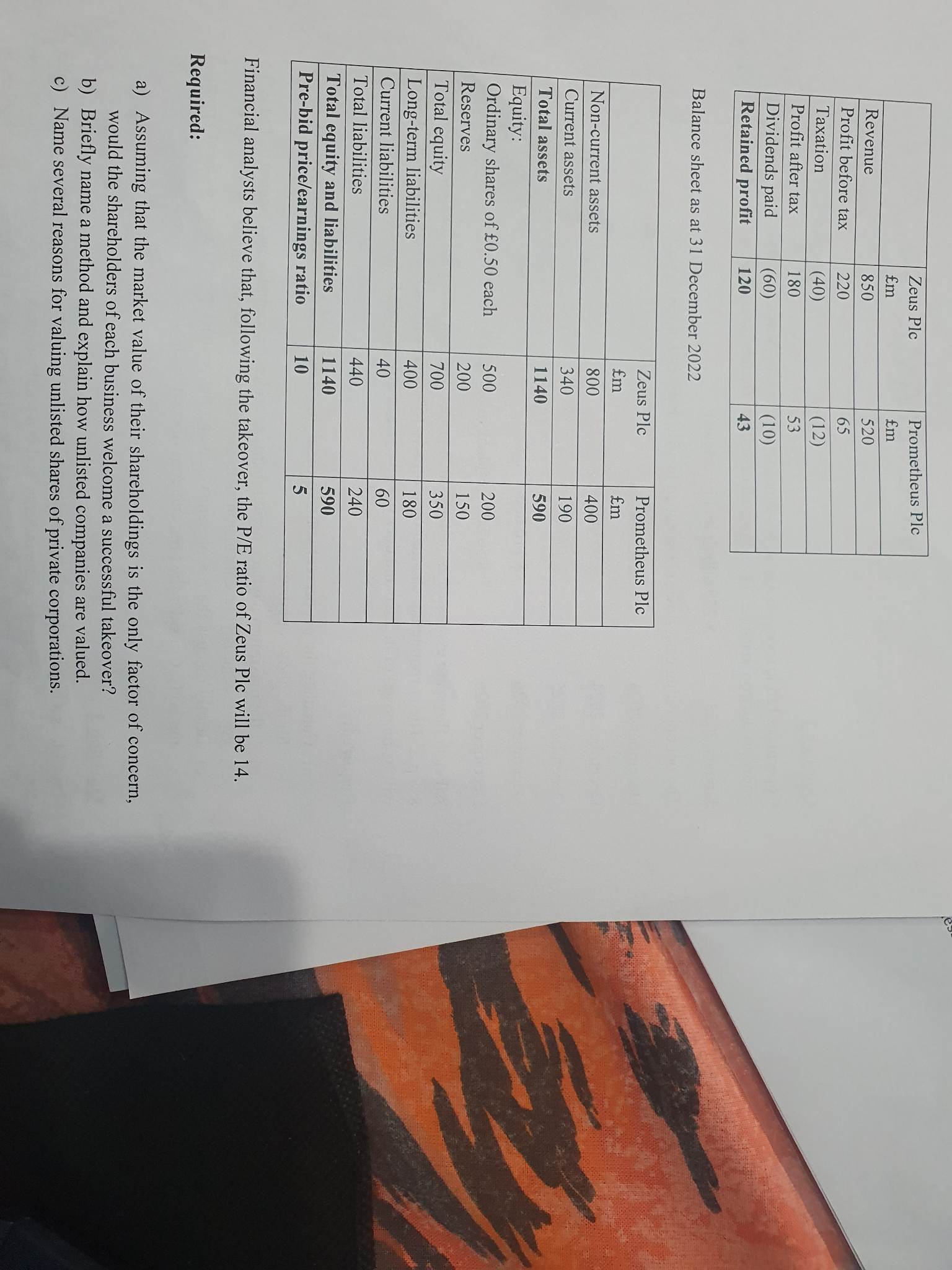

Balance sheet as at 31 December 2022 Financial analysts believe that, following the takeover, the P/E ratio of Zeus Plc will be 14. Required: a)

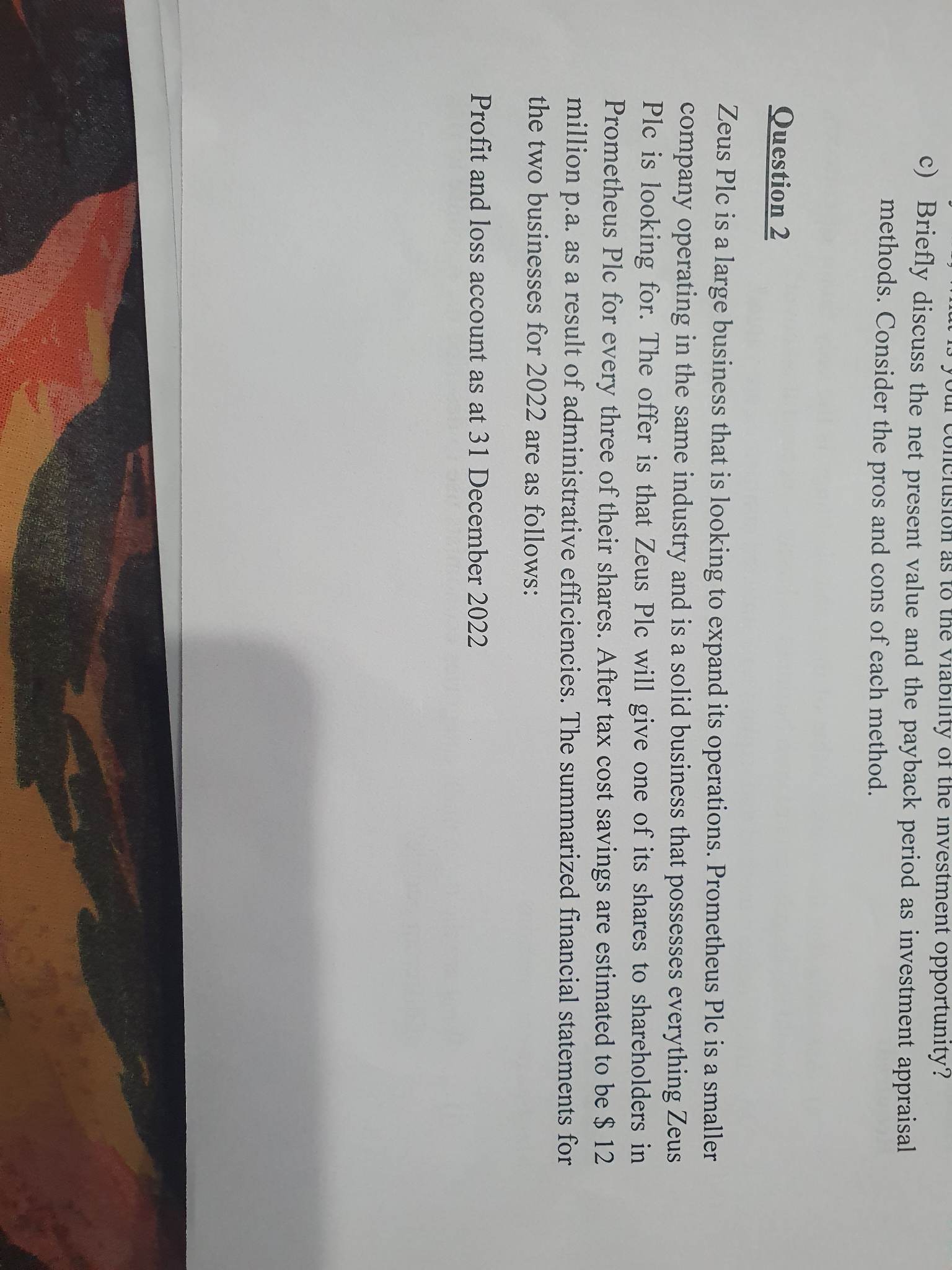

Balance sheet as at 31 December 2022 Financial analysts believe that, following the takeover, the P/E ratio of Zeus Plc will be 14. Required: a) Assuming that the market value of their shareholdings is the only factor of concern, would the shareholders of each business welcome a successful takeover? b) Briefly name a method and explain how unlisted companies are valued. c) Name several reasons for valuing unlisted shares of private corporations. c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method. Question 2 Zeus Plc is a large business that is looking to expand its operations. Prometheus Plc is a smaller company operating in the same industry and is a solid business that possesses everything Zeus Plc is looking for. The offer is that Zeus Plc will give one of its shares to shareholders in Prometheus Plc for every three of their shares. After tax cost savings are estimated to be $12 million p.a. as a result of administrative efficiencies. The summarized financial statements for the two businesses for 2022 are as follows: Profit and loss account as at 31 December 2022 Balance sheet as at 31 December 2022 Financial analysts believe that, following the takeover, the P/E ratio of Zeus Plc will be 14. Required: a) Assuming that the market value of their shareholdings is the only factor of concern, would the shareholders of each business welcome a successful takeover? b) Briefly name a method and explain how unlisted companies are valued. c) Name several reasons for valuing unlisted shares of private corporations. c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method. Question 2 Zeus Plc is a large business that is looking to expand its operations. Prometheus Plc is a smaller company operating in the same industry and is a solid business that possesses everything Zeus Plc is looking for. The offer is that Zeus Plc will give one of its shares to shareholders in Prometheus Plc for every three of their shares. After tax cost savings are estimated to be $12 million p.a. as a result of administrative efficiencies. The summarized financial statements for the two businesses for 2022 are as follows: Profit and loss account as at 31 December 2022

Balance sheet as at 31 December 2022 Financial analysts believe that, following the takeover, the P/E ratio of Zeus Plc will be 14. Required: a) Assuming that the market value of their shareholdings is the only factor of concern, would the shareholders of each business welcome a successful takeover? b) Briefly name a method and explain how unlisted companies are valued. c) Name several reasons for valuing unlisted shares of private corporations. c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method. Question 2 Zeus Plc is a large business that is looking to expand its operations. Prometheus Plc is a smaller company operating in the same industry and is a solid business that possesses everything Zeus Plc is looking for. The offer is that Zeus Plc will give one of its shares to shareholders in Prometheus Plc for every three of their shares. After tax cost savings are estimated to be $12 million p.a. as a result of administrative efficiencies. The summarized financial statements for the two businesses for 2022 are as follows: Profit and loss account as at 31 December 2022 Balance sheet as at 31 December 2022 Financial analysts believe that, following the takeover, the P/E ratio of Zeus Plc will be 14. Required: a) Assuming that the market value of their shareholdings is the only factor of concern, would the shareholders of each business welcome a successful takeover? b) Briefly name a method and explain how unlisted companies are valued. c) Name several reasons for valuing unlisted shares of private corporations. c) Briefly discuss the net present value and the payback period as investment appraisal methods. Consider the pros and cons of each method. Question 2 Zeus Plc is a large business that is looking to expand its operations. Prometheus Plc is a smaller company operating in the same industry and is a solid business that possesses everything Zeus Plc is looking for. The offer is that Zeus Plc will give one of its shares to shareholders in Prometheus Plc for every three of their shares. After tax cost savings are estimated to be $12 million p.a. as a result of administrative efficiencies. The summarized financial statements for the two businesses for 2022 are as follows: Profit and loss account as at 31 December 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started